How President Trump's Strategic Bitcoin Reserve Could Reshape Government Cryptocurrency Holdings

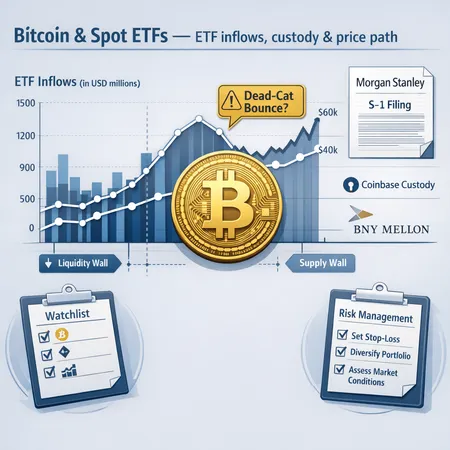

In recent discussions within the crypto and political domains, a notable proposal has gained attention: President Trump's concept of a strategic Bitcoin reserve for the government. This innovative idea suggests that national governments could diversify their reserves by incorporating Bitcoin, potentially reshaping how digital assets are perceived and managed on a governmental level.

The implications of such a reserve are profound. Firstly, it signals governmental endorsement of cryptocurrencies, possibly accelerating mainstream adoption. It also introduces a novel layer of financial strategy concerning liquidity, inflation hedging, and future-proofing economies against traditional currency devaluation.

For individual investors and enthusiasts looking to explore cryptocurrency investments, platforms like Bitlet.app offer unique advantages. Bitlet.app provides a Crypto Installment service, enabling users to buy cryptos now and pay monthly, making the entry into digital assets more accessible and manageable.

As governments contemplate Bitcoin reserves, the ripple effect on the market could unlock new investment paradigms. Staying informed and leveraging tools such as Bitlet.app can empower individuals to navigate this evolving landscape effectively.