When Leverage Leaves the Room: How Falling Futures Open Interest and ETF Outflows Reshape Bitcoin Risk

Summary

Executive snapshot — what's changed and why it matters

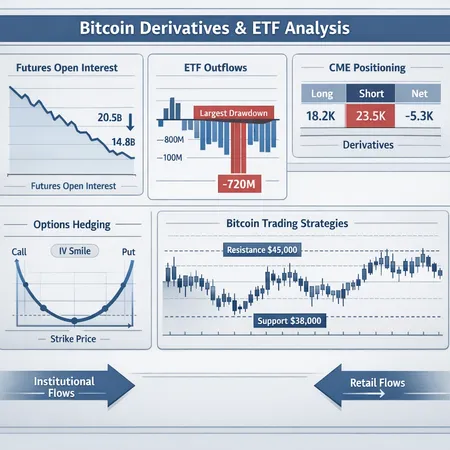

Over the past few weeks, market structure signals for BTC have shifted beyond simple price moves. Two interrelated dynamics stand out: a meaningful drop in futures open interest (OI) — a proxy for market leverage — and a multi-billion-dollar cumulative ETF drawdown that marks the largest outflow period since these products launched. Together these trends reduce mechanically available leverage, thin liquidity at key price levels, and increase the prevalence of range-bound action. For active traders and risk managers this demands a rethink of position sizing, hedge design, and how you harvest premium without taking unconstrained tail risk.

The data: open interest, ETFs and the new backdrop

Falling futures open interest — leverage is contracting

Exchange-level reports and market commentary point to a clear downtick in futures OI. Lower open interest means fewer outstanding leveraged bets (both long and short) that can force sharp moves through liquidations. In plain terms: the classic “levered blow-off” or cascade liquidation event becomes less likely when there’s simply less leverage stacked on the rails. Analysts are flagging this decline as a potential dampener on volatility and a reason for increased caution among leveraged participants (CoinTribune report).

ETF flows: the largest drawdown, but not a uniform retreat

Concurrently, cumulative flows into spot Bitcoin ETFs experienced their largest drawdown since launch, with billions in outflows over a compressed window. That’s an important liquidity and sentiment signal — passive institutional demand that had been a price anchor showed vulnerability under stress (U.Today analysis). Yet the picture is not binary: other trackers of institutional activity suggest steady accumulation at some desks and ongoing rebalancing by allocators, implying mixed behavior across market participants (Blockonomi perspective). Add in the longer-term framing from asset managers and strategists, and you get a market that's tactically fickle but structurally interested (Cointelegraph on Bitwise/CIO views).

What this combination implies for price mechanics

- Less open interest = lower forced volatility from liquidations. Price moves are likelier to be driven by net flows and order-book liquidity rather than violent deleveraging.

- ETF outflows can be persistent pain for price if sustained, but intraday volatility is often muted when leverage is low — creating choppy, range-bound trading.

- If institutional ETFs are still accumulating on dips (albeit more slowly), markets can exhibit asymmetric behavior: sharp local selling but slow, prolonged bids below.

This is a regime shift from highly levered momentum markets to a flow-and-liquidity dominated environment.

How CME positioning, retail behavior and derivatives interplay

CME and derivatives desks — concentration matters

CME order-books and block trades often reflect the somatic center of macro BTC positioning — large dealers, funds, and market makers. With declining OI, concentrated positions on CME desks can create localized depth pockets where price finds support or resistance. That concentration means that even modest institutional trades or rebalances can have outsized short-term market impact because fewer counterparties are carrying risk.

Retail disengagement and ‘retail giveaways’

Retail traders historically provide speculative demand and intraday flow. When retail participation fades — whether through sentiment, tax losses, or ETF-based substitution — short-term liquidity evaporates. The term retail giveaways describes episodes when retail sellers or overlevered shorts capitulate into a thin market and get poor execution. In a low-OI market, these giveaways are more common because there are fewer active liquidity takers to absorb flow.

The net effect: range-bound, occasionally spiky markets

Combine steady-but-slow institutional ETF accumulation, low futures OI, and reduced retail depth, and you get a market that moves slowly within a range but can still experience short-lived spikes when liquidity is crossed. That environment is hostile to size-aggressive directional bets funded with leverage, and more favorable to strategies that monetize subdued volatility or protect downside efficiently.

Trading implications: adapt your playbook

Below are practical adjustments and trade constructs for BTC traders and risk managers facing lower leverage and mixed ETF flows.

Position-sizing and margin discipline

- Reduce gross directional exposure relative to capital — lower notional positions by 20–40% versus high-OI regimes.

- Emphasize cross-margin and collateral optimization; in thin markets, margin shocks are more dangerous because replacement liquidity costs rise.

- Stress-test positions assuming slow-rolling flows rather than instant liquidity — model scenarios where liquidation is limited and price gaps are driven by one-way flow.

Options hedging and BTC trading strategies for low-OI markets

When futures OI is low, options markets often become the primary place to express volatility and tail risk views. Consider these constructs:

Protective collars: Buy a put and fund it by selling an out-of-the-money call. Collars limit downside while allowing for some participation on appreciation — useful when you expect range-bound action but need capital protection.

Vertical debit/credit spreads: Use bear call spreads or bull put spreads to define risk and reduce premium cost compared to naked options. In muted volatility regimes, credit spreads (selling premium) can be attractive but require tight risk management.

Iron condors / short-winged condors: Income strategies that sell premium in a defined range. These work when you believe BTC will stay in a band, but widen wings to account for occasional spikes; always size the short premium so a single adverse move doesn’t blow up P&L.

Calendar spreads and diagonal structures: Buy longer-dated options and sell shorter-dated options to harvest theta while preserving convexity. These are helpful when you expect low spot volatility but occasional term-structure shifts driven by ETFs or macro events.

Put spreads and tail hedges: For downside protection with controlled cost, use long put spreads (buy deeper put, sell cheaper lower strike) rather than naked puts. If you fear extreme tail risk, allocate a small percentage of AUM to out-of-the-money long-dated puts as insurance.

Gamma scalps with caution: In low-OI regimes, implied vol can be attractive for gamma selling strategies, but thinner spot liquidity means hedging costs can spike during stress. Be disciplined on rebalancing thresholds and use limit orders.

Basis and funding considerations

- Futures basis trades (cash-and-carry) rely on stable funding curves. With lower OI, basis can be more volatile; keep funding exposure modest and monitor term-structure changes.

- If basis compresses due to ETF arbitrage buying, basis trades may offer less pick-up — consider reallocating to options-based income.

Liquidity-aware execution

- Avoid large market orders. Use algorithmic execution or work with block desks for larger sizes.

- Stagger rebalances and hedge rotations to minimize signaling risk in concentrated CME liquidity pockets.

Risk management checklist for risk managers

- Recalculate worst-case liquidation scenarios assuming 30–50% lower available market depth.

- Run tail-event P&Ls with ETF outflow sweeps and localized CME rebalancings as shock events.

- Maintain convexity buffers: hold liquid options or spot collateral that can be monetized quickly in a stress window.

- Keep an eye on implied volatility vs realized vol; sudden divergence can identify mispricings for options hedges.

Tactical playbook: example trades

- Short-term income: Sell a 30–45 day iron condor sized to max loss = 1–2% of portfolio; widen wings during macro events or ETF distribution windows.

- Defensive hedge: Buy 3–6 month put spread at the 10–20% OTM range to protect against a rapid ETF-driven leg down, funded by selling a further OTM put or call (collar variation).

- Basis-lite carry: If basis is positive and term-structure stable, take modest cash-and-carry positions with close-outs set at tighter thresholds than in high-OI times.

Monitoring signals to watch daily

- Exchange open interest (futures OI) changes — sudden upticks signal a return of leverage and the potential for more violent moves.

- ETF net flows and AUM trends — large, persistent outflows can erode structural support.

- Funding rates and basis spreads — widening can reopen carry opportunities or signal risk-on/off shifts.

- Order-book depth around CME reference prices — thinning depth ahead of macro announcements raises execution risk.

Conclusion — trade differently, not less smartly

A market with declining leverage and mixed ETF flows is not necessarily low opportunity; it just rewards different skills. Income generation, disciplined options hedging, and tight risk controls outperform size-driven directional leverage. For traders and risk managers, that means smaller notional bets, better-defined risk via spreads and collars, and a heightened focus on liquidity and execution. Tools and desks — from block OTC to smart order routing — matter more now. Platforms such as Bitlet.app that mix custody, trading, and yield services can be useful parts of an operational toolkit, but the core is strategy: accept less enforced volatility, and design positions that profit from premium decay, controlled convexity, and thoughtful hedges.

Sources

- https://www.cointribune.com/en/derivatives-drop-triggers-caution-among-bitcoin-investors/?utm_source=snapi

- https://u.today/bitcoin-etfs-see-largest-drawdown-since-launch?utm_source=snapi

- https://blockonomi.com/bitcoin-price-consolidates-near-fair-value-amid-steady-institutional-bitcoin-etf-flows/

- https://cointelegraph.com/news/bitcoin-returns-strong-decade-analysts-2026-bitwise-matt-hougan?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

For many traders, Bitcoin remains the primary market bellwether; for those exploring cross-asset liquidity plays, consider how flows from DeFi venues and ETF mechanics interact with derivatives desks when building hedges.