December 2025: Terra (LUNA) Explosive Surge — Catalysts, Technicals, and Trade Scenarios

Summary

Quick framing: why this matters for active traders

LUNA's December 2025 surge was not a slow grind — it arrived as a concentrated burst of buying across spot and derivatives venues. That kind of move changes risk profiles for traders and risk managers: margin stacks get thinner, funding rates spike, and technical support/resistance levels shift in hours, not weeks. Below we unpack what triggered the rally, how fast it was, and what to watch next.

What happened — magnitude and speed

Between the announcement window for the protocol upgrade and subsequent headlines about Do Kwon’s sentencing, markets saw a concentrated inflow into LUNA that produced a multi-day rally. Market commentators and prior coverage of similar episodes noted moves on the order of a few hundred percent over short windows: for instance, FXEmpire documented a 250% move in a prior surge and parsed the role of upgrade optimism and legal‑news speculation, and BeinCrypto covered the immediate market reaction during rapid double-digit spikes.

On-chain and exchange snapshots from the December 2025 event showed:

- A very large percentage of daily volume concentrated in a 7–14 day window.

- Spike in net exchange inflows just before and during the first phase of the rally (consistent with accumulation and short-covering).

- Derivatives metrics (open interest and funding) heating up quickly, indicating large leveraged long exposure and a fragile positioning backdrop.

Quantifying these precisely requires exchange-level time-series, but traders should treat the move as an explosive, liquidity‑driven rally rather than a slow, organic reappraisal of fundamentals.

On-chain catalysts: what the upgrade changed (and why it mattered)

Developers announced a material network upgrade around the same time as the rally; release notes emphasized performance and staking-related improvements. Those upgrade signals produced several predictable on-chain responses:

- Increased staking interest and token allocation shifts from exchanges to staking addresses, tightening available spot liquidity.

- Anticipatory buying from validators, node operators, and some long-term holders who expected improved reward mechanisms or fee distribution changes.

- Higher on-chain activity that drew attention from algorithmic and opportunistic liquidity providers.

The key point for traders: upgrades can create genuine demand by changing token economics or UX (lower fees, better throughput, staking incentives), but they also create a narrative that speculative players can amplify. Past coverage and market reaction to similar upgrades demonstrates how quickly narratives can translate into price acceleration.

Off-chain catalysts: Do Kwon headlines and speculative flows

Legal news — in particular updates around Do Kwon’s sentencing — played an outsized role in amplifying speculative flows. Coverage and analysis of earlier LUNA rallies have highlighted the same pattern: legal or narrative events create fear-of-missing-out (FOMO) and force short covering, which in turn accelerates the move. FXEmpire's analysis connected a prior 250% move to both an upgrade and sentencing‑related speculation, and BeinCrypto discussed immediate market reactions during fast surges.

Mechanically, the off-chain cascade typically looks like this:

- News hits headlines (sentencing, appeal, or legal development).

- Retail and some institutional players jump in hoping to front-run a narrative-driven rally.

- Derivatives markets (high leverage longs + tight funding) create susceptibility to short-covering squeezes.

- Liquidity thins on the way up, increasing slippage and accelerating prices when buy pressure persists.

Understanding whether the conviction is fundamental (upgrade-driven) or speculative (headline-driven) is crucial for sizing positions.

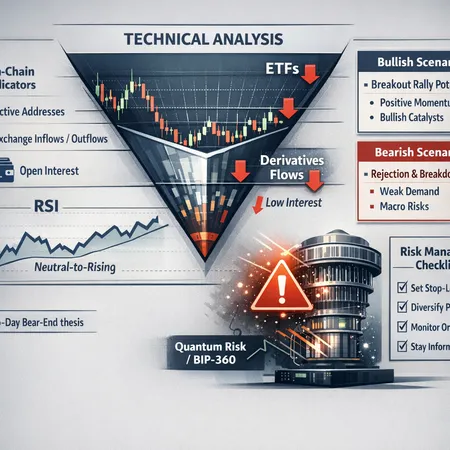

The technical picture: are we out of momentum?

From a technical-analysis perspective the December move had several familiar characteristics of an exhausted short-squeeze rally:

- Volume: large spike on breakout days followed by intermittent lower-volume advances — a sign of front-loaded buying.

- Momentum: common momentum indicators (e.g., RSI, Stochastics) were pushed into extreme ranges; that signals short-term overextension.

- Price structure: many exchanges showed price gaps and long wick candles — classic signs of impulse buying with limited liquidity.

That combination usually creates two practical near-term regimes:

- Short-term exhaustion: a meaningful retracement (mean reversion) of a portion of the rally, often towards pre-rally consolidation or key moving averages.

- Sustained recovery: price digests gains on lower-volume pullbacks, then resumes trend if on-chain inflows and spot demand remain robust.

Technically, traders often watch Fibonacci retracement bands from the rally low to high — a 38–50% retracement is a common first target on a healthy pullback, while a deeper 61.8% retrace suggests the move was more of a blow-off top than a sustainable structural shift. Likewise, a clean retest of the breakout level with shrinking volume followed by renewed volume on the next leg up is a bullish confirmation pattern.

Scenario A — Sustained recovery (what would need to happen)

Triggers and confirmations:

- Continued on-chain accumulation: sustained net outflows from exchanges into staking or cold wallets.

- Derivatives cooling: funding rates normalize without a dramatic drop in open interest (suggesting deleveraging rather than capitulation).

- Technical stability: successful retest of breakout level and supportive volume on pullbacks.

Trade idea (for disciplined players): scale into long positions on a 25–50% pullback off the local high, use smaller initial size, and add on confirmed support and normalization of funding. Place stops below the retest failure level and keep leverage conservative (low single digits). A layered profit-taking plan at logical resistance clusters preserves capital if news sentiment reverses.

Scenario B — Mean reversion (fade the move)

Triggers and confirmations:

- Legal headlines fail to materialize into lasting certainty, or new adverse legal developments hit the tape.

- Sharp drops in exchange outflows and a return of sellers to the market.

- Volatility expansion to the downside with heavy volume and a breakdown through short-term moving averages.

Trade idea: enter short (or hedge spot) once price breaks a defined support level with increasing volume and persistent high funding rates. Tight risk controls are essential: leverage magnifies the speed of losses in these environments. Consider protective stops above the breakdown candle and size positions to reflect a worst-case rapid rebound.

Risk checklist for leveraged traders (practical warnings)

- Funding rates and open interest: extremely high funding tells you long positions are crowded — a small selling wave can flip the market.

- Slippage and liquidity gaps: in fast rallies, fills can be poor on market orders; use limit orders and test small sizes on illiquid pairs.

- Position sizing: limit leverage to a level you can survive through a 30–50% intraday swing — for many traders that is 3x or less.

- Stop placement: widen stops in proportion to volatility; avoid tight stops that guarantee being shaken out during normal post-rally chopping.

- Legal risk: headline volatility tied to court outcomes is binary and can reverse sentiment instantly.

Prudent risk managers will also simulate margin calls and run stress tests for both spot and derivatives positions under outsized moves.

Practical trade checklist (short-term)

- Confirm whether on-chain exchange outflows are continuing or reversing.

- Watch funding rate and open interest dynamics on major derivatives venues.

- Identify the nearest logical support (previous consolidation high, moving average band, Fibonacci 38–50%) and resistances.

- Choose a cap on leverage (e.g., ≤3–5x) and set stop-loss and take-profit ladders before entering.

- Avoid all-in FOMO: scale entries and take partial profits on strength.

Final take: balance caution with opportunity

LUNA's December 2025 surge combined a legitimate protocol event (an upgrade) with an outsized speculative overlay tied to news about Do Kwon. That mix is a double‑edged sword: upgrades can create durable narrative buyers, but headline-driven speculative flows tend to be fragile. Traders and risk managers should watch the intersection of on-chain flows, derivatives positioning, and technical confirmations to decide whether this is the start of a sustainable recovery or another fast mean-reversion event.

For those monitoring correlated markets, remember that macro moves in Bitcoin and activity on DeFi rails often amplify crypto-specific narratives — keep an eye on cross-market flows and funding dynamics. Bitlet.app users and risk teams should incorporate both on-chain signals and conventional TA before sizing leveraged exposure.