Ethereum, Fusaka, and Institutionalization: A Roadmap for Asset Managers

Summary

Executive snapshot

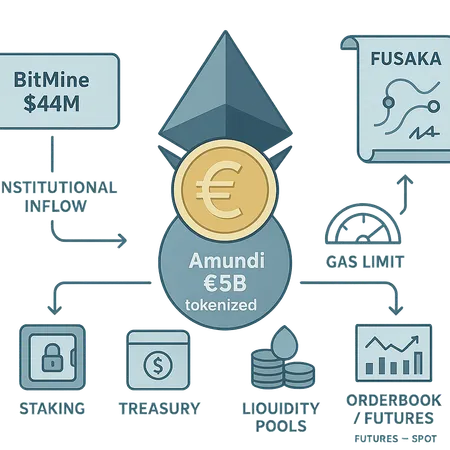

The narrative that Ethereum is primarily a retail playground is changing fast. Institutional actors are putting sizeable euro-denominated exposures and pooled money-market strategies onto the chain, while miners, validators and protocol teams tune parameters to reduce friction ahead of the Fusaka upgrade. For product teams this is not theoretical: tokenization at scale, concentrated buy-ins by crypto-native firms, and deliberate gas-limit adjustments mean the next 6–12 months will decide where liquidity lands and how competitive on-chain euro-money products will be.

What changed: institutional tokenization that looks different

Tokenization isn't new — proof-of-concept stablecoins and asset-wrapped tokens have existed for years. What recent moves signal is scale plus custody-grade design choices. A clear example is Amundi’s decision to put a flagship €5 billion money-market fund on Ethereum. Coverage of that project highlights not just the value tokenized but the integration model and regulatory framing that distinguish it from earlier pilots: this is productized fund exposure, not a boutique wrapped asset.

Several pieces put the move in context: AltcoinBuzz reports on Amundi’s tokenization on Ethereum and what that implies for institutional demand (Amundi tokenizes €5B fund on Ethereum). Blockonomi’s analysis further emphasises how this is Amundi’s biggest blockchain step yet and how retail and institutional access models differ from earlier attempts (Blockonomi on Amundi’s move).

Why does this matter? First, productization implies standardized interfaces for subscriptions/redemptions, compliance, and valuation — all the elements asset managers care about. Second, integrating a sizable fund onto Ethereum forces settlement, custody and liquidity partners to build robust order rails rather than ad hoc bridges.

Smart-money is positioning: on-chain and market evidence

Institutionalization is often preceded by smart-money accumulation and derivative repositioning. Two signals are worth noting right now.

The clearest public example: BitMine’s purchase of roughly $44 million in ETH, covered in the press as a concentrated accumulation ahead of network upgrades (BitMine snaps up $44M in ETH). Large, visible buys by miners or institutionally affiliated entities are historically correlated with confidence in protocol tailwinds and shorter-term supply squeezes.

At the same time, futures-to-spot dynamics (basis and funding rates) are shifting in ways that indicate professional desks are positioning for a tighter on-chain liquidity picture post-upgrade. Put simply: if funding rates are elevated and long-dated basis compresses, that suggests participants expect the on-chain usable supply to become more attractive or scarce — a common institutional signal ahead of major protocol changes.

Combine these flows with the Amundi-style tokenization pipeline and you get two interacting forces: demand for on-chain euro-denominated exposures, and speculative/professional demand for the underlying settlement asset (ETH).

Protocol-level readiness: timed changes for Fusaka

Protocol teams have not been idle. Recent consensus and execution-level changes appear timed to improve throughput and UX before Fusaka activation. One concrete change: Ethereum’s block gas-limit increase, which was publicly reported as a timely adjustment in expectation of the Fusaka roadmap (Ethereum raised gas limit ahead of Fusaka).

Why raise the gas limit now? A higher gas limit increases per-block execution capacity, which can reduce per-transaction fees when demand is constant and improves UX for high-frequency fund operations (e.g., redemptions, rebalancing). It also gives DeFi protocols breathing room to deploy more complex logic or batch operations without immediate fee storms.

Beyond parameters, there are roadmap items advocated in the ecosystem that align with institutional needs: better fee predictability, improved MEV mitigation strategies, and composability primitives that preserve settlement finality and audit trails. These are not just developer preferences — they directly lower operational risk for asset managers who need predictable costs and on-chain proof of position.

What this means for gas pricing, DeFi UX, staking and liquidity

The confluence of institutional tokenization and protocol tuning changes the microeconomics of on-chain activity.

Gas pricing: In the short term, a higher block gas limit can flatten fee spikes, improving predictability for batch transactions (large subscriptions/redemptions). But fee dynamics remain demand-driven — a sudden inflow into a tokenized fund or a flash rebalancing event could still push gas prices up. Teams should plan for both average-case lower volatility and tail-case surges.

DeFi UX: Expect smoother on-chain user flows for regulated products. Standardized fund token interfaces, combined with higher per-block throughput, will reduce failed transactions and lower the operational overhead of retry logic. That improves the experience for custody providers and automated market makers that support euro-denominated pools.

Staking and treasury flows: Institutional flows can shift where liquidity pools earn yield. If asset managers deposit ETH as backstop liquidity or use staking derivatives to monetize holdings, we will see more sophisticated treasury plays that balance staking yields with on-chain liquidity needs. This could concentrate liquidity in liquid staking derivatives and large AMMs that offer capital-efficient depth.

Liquidity landing post-upgrade: Liquidity will likely bifurcate. Short-term settlement and money-market operations will gravitate to regulated tokenized-fund rails and large, permissioned liquidity pools. Longer-term speculative liquidity and AMM depth will remain in open DeFi. Product architects should expect cross-layer interactions — for example, tokenized euro funds that route redemptions through both regulated custodial on‑ramps and public liquidity pools depending on size and speed requirements.

Practical takeaways for asset managers and DeFi teams

Below is a staged checklist for product managers and institutional investors planning to allocate or integrate tokenized euro-money exposures on Ethereum.

Custody and settlement architecture

- Choose custody that supports both on-chain settlement and regulatory reconciliation; consider a dual custody model (qualified custodian + hot-settlement signer) for operational resilience.

- Standardize subscription/redemption smart contracts and ensure they emit complete audit trails for compliance teams.

Liquidity provisioning and routing

- Design a staged LP strategy: seed broad public pools for market-making, but reserve a permissioned stability buffer for large institutional redemptions.

- Integrate dynamic routing that can pull liquidity from AMMs, order-book venues, or off-chain settlement partners depending on size and latency needs.

Gas optimization and batching

- Batch operations where possible (e.g., batched redemptions, netting of inflows) to take advantage of increased per-block gas capacity and minimize per-unit cost.

- Use gas oracles and fee caps in contracts to avoid failed executions during transient spikes.

Staking and treasury strategy

- Balance staking (or liquid-staking derivative exposure) vs. on-chain liquidity demands — excessive staking of backing reserves can create settlement risk for large redemptions.

- Consider hedging strategies (e.g., futures, options) to manage ETH-price exposure when tokenized funds hold ETH as part of collateral or settlement mechanics.

Compliance, reporting and integration

- Embed event logs and on-chain proofs into reporting pipelines for auditors and regulators.

- Ensure KYC/AML gates on fund subscription rails where regulatory requirements demand it.

Monitoring and ops readiness

- Implement real-time monitoring for gas, MEV events, and funding-rate anomalies. If BitMine-style accumulations happen, you want near-instant visibility into basis and on-chain inflows.

- Run tabletop exercises for large redemptions and unexpected fee storms.

These steps are practical and actionable, and they reflect the combined realities of protocol evolution (gas-limit changes and roadmap items), market flows, and institutional requirements.

Where to watch next

- Liquidity concentration in liquid-staking derivatives and large AMMs.

- Fee volatility around major fund net flows and protocol upgrade milestones.

- The cadence of tokenized product launches from incumbents beyond Amundi.

For product teams experimenting now, tools like Bitlet.app provide modular rails for installment, earn and exchange — useful for prototyping custody-to-market flows — but the broader technical and operational checklist above is the critical foundation.

Conclusion

Ethereum’s next phase is about institutional integration plus protocol readiness rather than pure speculative activity. Amundi’s €5B fund tokenization demonstrates that incumbents are willing to design products for on-chain settlement at scale, while visible buys like BitMine’s ETH accumulation and deliberate protocol parameter changes indicate smart-money and core developers are positioning the network for that demand. Asset managers and DeFi teams who prepare custody, liquidity routing, gas optimization and staking strategies now will be best placed to capture the efficiency and reach of on-chain euro-denominated products once Fusaka lands.

Sources

- https://www.altcoinbuzz.io/cryptocurrency-news/amundi-tokenizes-flagship-money-market-fund-on-ethereum/

- https://blockonomi.com/amundi-puts-e5b-fund-on-ethereum-in-its-biggest-blockchain-move-yet/

- https://www.cryptopolitan.com/bitmine-snaps-up-44m-in-eth/

- https://coinpaper.com/12722/ethereum-just-raised-its-gas-limit-and-it-s-perfectly-timed-for-the-fusaka-upgrade?utm_source=snapi