Filecoin Onchain Cloud: Technical Deep Dive and Implications for Web3 Infrastructure

Summary

Executive overview

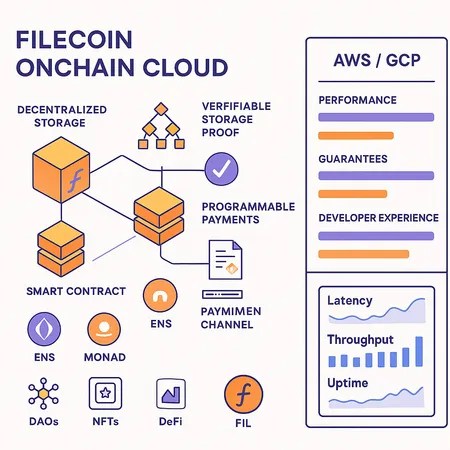

Filecoin's new Onchain Cloud reframes decentralized storage as a set of developer-facing cloud primitives: verifiable storage (cryptographic proofs that content was stored/served) and programmable payments that enable automated, onchain settlement for storage and retrieval. The product announcement and technical positioning are summarized in Filecoin’s release coverage and a deeper technical brief, which highlight features like verifiable storage, ENS integrations and programmable payment rails Filecoin unveiled Onchain Cloud and expanded the explanation of its verifiable storage, programmable payments and integrations with ENS and Monad in follow-up coverage Filecoin launches Onchain Cloud: decentralized infrastructure.

For many infrastructure leads and Web3 developers evaluating alternatives to AWS/GCP, this isn’t about matching every latency benchmark. It’s about replacing opaque object stores with audit-ready storage that composes naturally with onchain logic—and doing so without reinventing settlement and discovery layers.

What Onchain Cloud delivers

Onchain Cloud bundles several core capabilities that change how decentralized apps think about storage and payments:

Verifiable storage and content guarantees

At its core, Onchain Cloud exposes storage with cryptographic proofs. Instead of taking a provider’s word that data is stored and retrievable, clients can request and verify proofs (e.g., proofs of replication/space-time like Filecoin’s existing constructs) tied to specific content IDs. That gives applications a verifiable SLA: you can assert onchain that a dataset is archived as claimed and prove it later in a dispute or audit.

These proofs matter for provenance-sensitive flows—NFT metadata escrow, legal archives for DAOs, and any app where auditors or regulators may demand tamper-evidence. The product briefs emphasize verifiability as a product differentiator compared with a traditional S3 bucket.

Programmable payments and onchain settlement

Onchain Cloud also embeds programmable payment rails: storage and retrieval incentives can be expressed and enforced onchain so suppliers receive payments automatically when they meet agreed conditions. This removes manual reconciliation and opens new UX patterns—pay-on-delivery, conditional payment channels and automated renewal logic.

Programmable payments lower friction for cross-chain and cross-party workflows. For example, a marketplace could escrow FIL for metadata hosting and release funds only when cryptographic proofs of storage appear onchain, creating an auditable lifecycle from payment to proof.

Integrations: ENS, Monad and composability

Two integrations are worth attention for developers: ENS for discoverability and Monad for embedding compute logic into storage workflows.

ENS integration makes human-readable discovery and names a first-class part of storage resolution. Instead of shipping and managing raw CIDs, apps can resolve ENS names to Onchain Cloud resources—this improves UX for end users and simplifies routing in multi-provider setups.

Monad integration is more subtle but powerful. Monad enables onchain-executable logic that can orchestrate storage actions, verify proofs and trigger payments as composable program fragments. In practice, this means you can encode workflows like “when proof-of-storage X appears, mint token Y or release payment Z” directly into your onchain execution graph. That combination—verifiable storage + programmable compute/payment—turns storage from passive persistence into an active protocol primitive.

How it compares to centralized clouds (AWS/GCP)

When evaluating Onchain Cloud against an incumbent like AWS S3 or GCP Cloud Storage, think in terms of guarantees, developer ergonomics and cost model.

Guarantees: verifiability, censorship resistance, availability model

Centralized clouds offer high availability, predictable SLAs and strong global CDNs. They do not, however, give cryptographic guarantees about what was stored or make it easy to prove that a provider complied with retention rules. Onchain Cloud’s verifiable proofs are useful where evidence of storage matters.

Censorship resistance is another axis. Centralized providers can be compelled to alter or remove data. A decentralized storage fabric, combined with crypto-economic incentives, provides a higher bar against unilateral tampering—assuming sufficient network decentralization and healthy replication.

Performance and latency

AWS/GCP still win on raw latency, global edge reach and integrated CDN/processing. Onchain Cloud is likely to lag slightly in tail latency and single-request RTTs, especially for dynamic media serving. Where Onchain Cloud closes the gap is in predictable, provable behavior: you can verify content authenticity even if a particular node is slow.

For many Web3 workloads the latency trade-off is acceptable—metadata reads, archival retrievals, audit logs and batch content distribution are less latency-sensitive than interactive web content.

Developer experience and tooling

Developer experience is crucial. AWS/GCP deliver mature SDKs, console, IAM and debugging tools. Onchain Cloud must compete on ergonomics: SDKs in major languages, local emulation, monitoring for proof states, and clear failure modes.

Filecoin’s approach—human-readable ENS resolution, onchain-triggered payments via Monad, and straightforward APIs for requesting/validating proofs—is designed to reduce cognitive load. But expect a ramp: teams should budget integration time to adapt deployment pipelines and monitoring to a system with probabilistic availability and cryptographic verification.

Practical use cases

The most immediate and compelling applications are those that require auditability, composability and onchain-linked economics.

DAOs: auditable archives and trustless treasuries

DAOs managing grants, legal documents, or meeting archives can store records with verifiable proofs and tie releases of funds to proof issuance. This reduces trusting an offchain custodian and enables payout automation based on verifiable evidence.

NFT platforms: provenance, metadata escrow and on-demand minting

NFT marketplaces and provenance services can escrow metadata on Onchain Cloud with verifiable retention guarantees. Combined with ENS resolution, collectors can resolve readable names to immutable, verifiable metadata roots—closing an important trust gap in IP disputes and secondary issuance.

DeFi: verifiable oracles, state archives, and settlement layers

DeFi composers can use verifiable storage for archival of offchain state snapshots, dispute resolution, or as a settlement substrate for complex derivatives. Because programmable payments are native, you can build primitives that only execute when proofs validate—opening novel trust-minimized clearing models.

These use cases naturally intersect with existing Web3 stacks; for instance, archival snapshots used by indexers can be both stored verifiably and paid for via onchain payment channels.

Tokenomics and FIL utility impact

Onchain Cloud introduces clear demand-side levers for FIL, but the net tokenomics will depend on deployment details and market dynamics.

Demand drivers: verifiable storage usage, programmable payments denominated in FIL, and new classes of automation that require onchain settlement should increase demand for FIL as the canonical unit of payment. Higher recurring storage demand from DAOs, NFT platforms, and DeFi protocols directly translates to demand for FIL-denominated services.

Supply-side response: miner/node operator economics matter. If Onchain Cloud shifts storage demand to Filecoin’s network, storage providers will be incentivized to allocate capacity, potentially increasing blockspace and storage service supply. How that affects market prices depends on how rapidly supply adjusts and whether additional staking or bonding mechanisms are introduced.

Utility vs. speculative effects: short-term FIL price movement could be driven by speculative positioning around Onchain Cloud’s adoption. Long-term fundamentals, however, will be set by actual transaction volumes, recurring storage revenue and whether the product attracts enterprise-grade workloads.

Protocol-level implications: programmable payments might encourage more frequent onchain interactions (renewals, micropayments), increasing base-layer activity. Design choices—such as whether payments are escrowed, burned or redistributed—will influence token sink mechanics and inflationary pressure.

In short: Onchain Cloud creates rational therapy for FIL utility, but the strength of that effect depends on pricing competitiveness, developer adoption, and how much of the Web3 stack moves on-chain for settlement.

Migration and evaluation checklist for devs & infra leads

If you’re assessing Onchain Cloud as an alternative or complement to AWS/GCP, consider this practical checklist:

- Workload fit: Is your workload latency-sensitive (user-facing media) or audit-sensitive (archives, provenance, legal records)? Prioritize migration for the latter.

- Integration cost: Assess SDK maturity, CI/CD changes and monitoring implications. Set aside time for writing proof-verification tests and observability around proof life cycles.

- Pricing model: Compare total cost of ownership (storage + bandwidth + verification compute) versus S3, including potential benefits from composability with onchain payments.

- Failure modes: Model degraded performance scenarios and define fallback strategies (cache warmers, multi-backend reads, hybrid CDN setups).

- Security & compliance: Verify how retention, GDPR-style deletion workflows and legal holds are managed when data is stored in a decentralized fabric.

- Token exposure: Decide if your product will accept FIL natively or wrap payments behind a fiat or stablecoin layer via relayers. This impacts treasury management.

Final thoughts

Filecoin’s Onchain Cloud is a notable step toward making decentralized storage a usable cloud primitive for Web3 applications. The product’s emphasis on verifiable storage and programmable payments, plus integrations with ENS and Monad, directly addresses developer pain points around discovery, automation and settlement.

It won’t immediately replace AWS/GCP for every workload—those platforms still own low-latency global delivery and mature ops tooling. But for applications where auditability, composability and censorship resistance matter, Onchain Cloud offers a compelling alternative and a pathway to reduce trust assumptions.

If you’re building infrastructure or evaluating storage primitives, start with a small, high-value use case (audit logs, NFT metadata escrow or DAO archives), measure the operational differences, and expand once toolchains and SLAs are understood. And if you’re experimenting with hybrid approaches, services like Bitlet.app can help bridge fiat and crypto payment rails while you prototype FIL-denominated storage flows.

For a closer technical read on the Onchain Cloud launch and its deeper feature set, see the initial announcement and the expanded technical coverage linked earlier.