CFTC Leadership Changes: Navigating the New Regulatory Landscape for Cryptocurrency

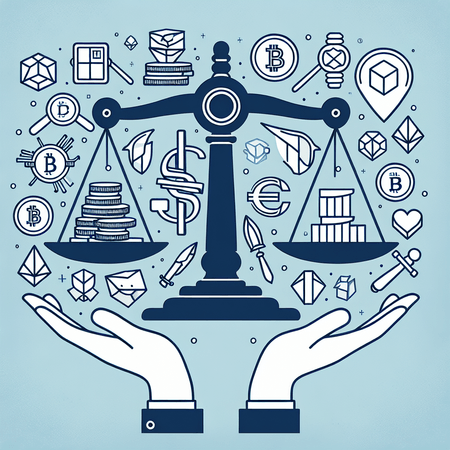

The Commodity Futures Trading Commission (CFTC) has announced significant leadership changes that mark a pivotal moment in the regulation of cryptocurrencies. As the landscape shifts, industry stakeholders must navigate a new regulatory environment that could greatly impact innovation and growth in the crypto space.

With the emergence of new leaders, there is anticipation regarding how policies will adapt to balance consumer protection with the need to foster technological advancement. This change presents both challenges and opportunities. For instance, clearer regulations might encourage more institutional participation, enhancing market stability. At the same time, overregulation could stifle innovative projects that are crucial for the growth of the industry.

For those looking to invest amidst this evolving landscape, platforms like Bitlet.app provide unique services to ease the process of acquiring cryptocurrencies. With its Crypto Installment service, Bitlet.app allows users to buy cryptocurrencies now and pay in monthly installments, making it more accessible for new and seasoned investors alike. As the regulatory environment develops, it will be important for investors to stay informed and consider how such services fit into their investment strategies.

The implications of the CFTC's leadership changes will not be fully realized for some time, but one thing is clear: the cryptocurrency space is evolving, and so too must the strategies of those involved.