Analyzing the September 2025 Crypto Market Correction: Causes and What Lies Ahead

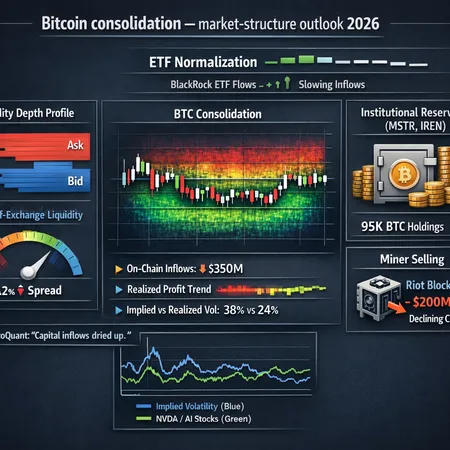

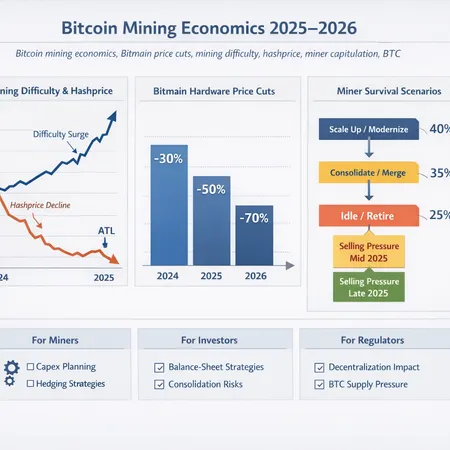

The cryptocurrency market experienced a notable correction in September 2025, leaving many investors concerned about the near-term outlook. Several factors contributed to this downturn, including regulatory pressures, shifting macroeconomic indicators, and profit-taking by large holders.

One primary cause was increased regulatory scrutiny across major markets. Governments introduced stricter frameworks targeting crypto exchanges and decentralized finance (DeFi) platforms, which momentarily reduced market confidence. Additionally, inflation concerns and interest rate fluctuations worldwide affected investor appetite for higher-risk assets like cryptocurrencies.

Despite these challenges, analysts believe this correction could pave the way for a healthier market in the long run by eliminating weaker projects and encouraging stronger innovation. Investors should approach the market with a well-thought-out strategy, considering both risks and opportunities.

For those looking to manage their crypto investments more prudently, platforms like Bitlet.app provide innovative solutions. Bitlet.app's Crypto Installment service allows users to buy cryptocurrencies now and pay over time in monthly installments. This approach can help smooth out exposure during volatile periods, making it easier to accumulate crypto assets without committing large sums upfront.

In conclusion, while the September 2025 correction may have caused short-term setbacks, the evolving regulatory landscape and market fundamentals still support long-term growth in the crypto space. Utilizing flexible purchasing options like those provided by Bitlet.app can be a smart move for investors aiming to build their portfolios steadily over time.