How Federal Reserve's 2025 Interest Rate Cuts Could Influence Bitcoin and Crypto Investments

In 2025, the Federal Reserve is expected to implement interest rate cuts, a move that often signals a shift toward more accommodative monetary policy. For investors, especially those in the crypto space, this could be a pivotal moment. Lower interest rates generally reduce the appeal of traditional interest-bearing assets and can push investors toward higher-risk, higher-reward assets such as Bitcoin and other cryptocurrencies.

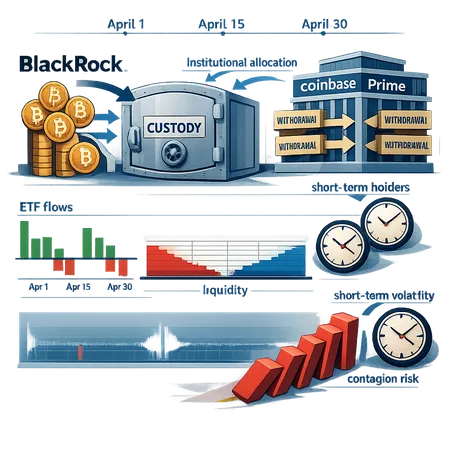

Bitcoin, often seen as a hedge against inflation and economic uncertainty, has historically responded positively during periods of lower interest rates. The anticipated cuts may lead to increased liquidity in the markets, making it easier and more attractive for investors to allocate funds into crypto assets.

For those looking to capitalize on this opportunity, platforms like Bitlet.app provide innovative solutions. Bitlet.app offers a unique Crypto Installment service that allows investors to purchase cryptocurrencies immediately but pay for their investments over time in monthly installments. This approach lowers the barrier to entry, enabling more people to participate in the crypto market without the need for full upfront capital.

In summary, the Federal Reserve's 2025 interest rate cuts could enhance the attractiveness of Bitcoin and other cryptocurrencies. Utilizing services like Bitlet.app's Crypto Installments may empower investors to make timely moves and benefit from the changing economic landscape.