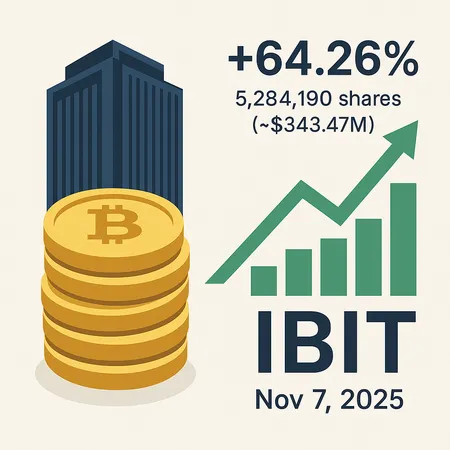

JPMorgan Increases Bitcoin ETF Holdings by 64%, Now Holding $343M in IBIT

Institutional Confidence: JPMorgan Raises IBIT Exposure

JPMorgan Chase & Co (JPM) disclosed on November 7, 2025, that it increased its position in the iShares Bitcoin Trust ETF (IBIT) by 64.26%, bringing its total to 5,284,190 shares — roughly $343.47 million as of September. The sizable uptick is a notable signal in a market where institutional flows often set the tone for broader investor sentiment.

What the Numbers Tell Us

This isn't a subtle rebalancing. Moving the needle by more than 64% in a single reported period shows active allocation toward Bitcoin exposure rather than passive maintenance. For context:

- Shares owned: 5,284,190

- Estimated value (Sept): $343.47 million

- Reported increase: 64.26%

These figures indicate that major financial institutions are increasingly comfortable using ETF wrappers to gain Bitcoin exposure, avoiding direct custody complexities while still participating in price dynamics.

Why JPMorgan Might Be Increasing ETF Holdings

Several factors likely influenced JPMorgan's decision:

Macro and Regulatory Clarity

As regulatory frameworks around spot Bitcoin ETFs and crypto custody evolve, ETFs have become an attractive, compliant vehicle for large financial firms. Greater clarity reduces operational risk and makes ETF allocations easier to justify to boards and clients.

Portfolio Diversification and Client Demand

Institutions seeking regulated Bitcoin exposure often prefer ETFs to buying spot BTC. ETFs simplify accounting and custody while meeting compliance requirements for many fiduciaries and wealth managers.

Market Structure and Liquidity

ETFs like IBIT provide a liquid, tradable instrument that reflects Bitcoin’s price but trades on exchanges familiar to institutional traders. That liquidity makes it simpler to scale positions up or down without directly impacting underlying spot markets.

Market Implications and Broader Significance

JPMorgan’s move is more than a firm-level allocation — it signals broader acceptance. When a major bank significantly increases exposure, it can:

- Boost confidence among other institutional investors and wealth managers.

- Encourage similar allocations by peers seeking parity in client offerings.

- Support ETF flows that may indirectly affect spot liquidity and price discovery.

This development sits within the larger context of ongoing institutional adoption across the [crypto market](/en/posts/news?filter=crypto market) and the maturing role of digital assets in diversified portfolios.

What This Means for Bitcoin Price Action

While a single institutional move doesn’t guarantee a price surge, consistent and growing ETF allocations can reduce volatility over time and create a tailwind for demand. Market participants should watch ETF inflows, regulatory updates, and spot market liquidity as immediate indicators of momentum.

Takeaways for Traders and Retail Investors

- Institutional endorsement matters: Large, regulated players increasing ETF allocations typically reflects reduced operational and regulatory friction.

- ETFs as access points: For retail and smaller institutional investors who prefer not to self-custody, ETFs remain a practical entry to Bitcoin exposure.

- Stay informed: Monitor filings and periodic reports to track allocation trends — they often precede broader flows.

Platforms like Bitlet.app that offer accessible crypto services can benefit from clearer institutional signals by tailoring products for users who want regulated exposure alongside direct crypto services.

Conclusion

JPMorgan’s 64.26% increase in IBIT holdings to about $343.47 million is a clear sign of growing institutional comfort with ETF-based Bitcoin exposure. While not a silver bullet for price direction, this trend underscores the continued normalization of Bitcoin within mainstream financial portfolios and highlights the ETF channel as a preferred mechanism for large-scale allocations.

For investors, the headline is less about a single bank and more about a structural shift: ETFs are becoming a primary bridge between traditional finance and digital assets as the ecosystem and regulatory landscape mature. Keep an eye on quarterly filings and ETF flow data — they often tell the story before price charts do.