XAUT

Institutionalizing Tokenized Gold: Wintermute, PAXG/XAUT and the OTC Playbook

Wintermute’s launch of institutional OTC trading for PAXG and XAUT accelerates tokenized gold’s move from retail curiosity to professional market utility. This article dissects OTC structure, custody and settlement mechanics, TAM considerations, regulatory frictions, and practical steps for treasury and asset managers.

Published at 2026-02-17 16:01:45

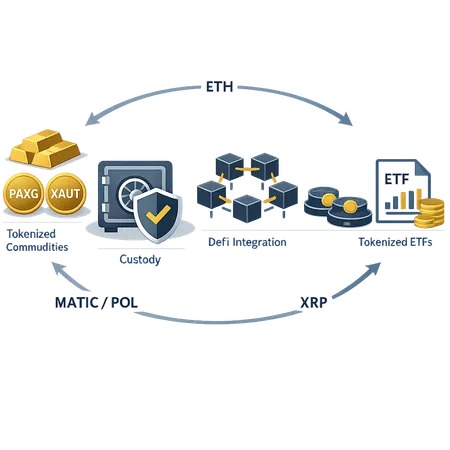

What the $5B Tokenized Commodities Milestone Means for DeFi, Custody and Institutions

Tokenized commodities topping $5 billion marks a structural shift: on-chain commodity exposure is moving from niche experiments to an institutional-sized market. This article breaks down growth drivers, differences between tokenized gold products (PAXG vs XAUT vs tokenized ETFs), custody and compliance trade-offs, and trading/arbitrage opportunities across ETH, Polygon and the XRP Ledger.

Published at 2026-01-29 17:18:38