What the $5B Tokenized Commodities Milestone Means for DeFi, Custody and Institutions

Summary

Why the $5 billion marker matters

Coinpaper recently reported that tokenized commodities surpassed $5 billion in on-chain value, with Ethereum, Polygon and the XRP Ledger driving much of the rally. That milestone is more than a headline — it’s evidence that real-world assets (RWAs) on-chain are breaking out of pilot mode. For institutional allocators and custody providers, the number signals scale: liquidity is reaching thresholds where institutional-sized orders and market-making become feasible, and DeFi teams can meaningfully design protocols that assume deeper liquidity.

This development also reframes how analysts view on-chain exposure to traditional stores of value. While many still treat tokenized commodities as alternative liquidity, the $5B figure shows convergence between crypto market microstructure and legacy markets — and a path for tokenized ETFs and tokenized gold to sit alongside synthetic exposure, derivatives and spot allocations in institutional portfolios. For readers building DeFi product strategies, this is the moment to evaluate operational plumbing and legal wrappers rather than just theoretical yield.

Growth drivers: what's behind the surge

Liquidity and market-making

Liquidity begets liquidity. Market makers and dedicated LPs have started quoting tighter spreads for PAXG, XAUT and other commodity tokens, reducing frictions for larger trades. Once spreads are reliably narrow and depth exists on multiple venues, institutional desks can execute without significant market impact. That in turn attracts OTC desks and exchange-listed products to use on-chain tokens as settlement rails or collateral.

Tokenized ETFs and TradFi bridges

A significant growth vector is tokenized ETFs and regulated products that bridge traditional custodians to blockchains. Recent product launches — like Hang Seng’s Ethereum-based tokenized gold ETF — show how incumbents are comfortable putting ETF-like wrappers onto blockchains, creating a regulated on-ramp for institutional flows. See the Hang Seng announcement for a concrete example of a tradfi-to-chain path that materially expands addressable demand.

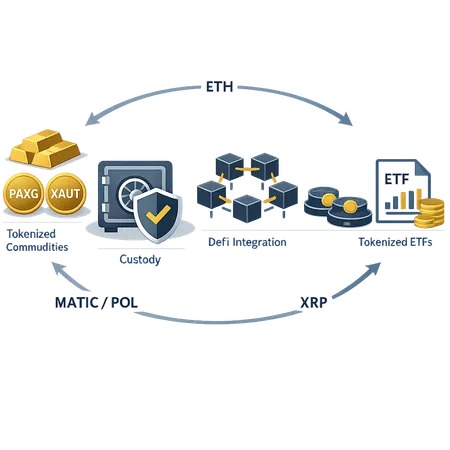

Chain choice, fees and UX (ETH, MATIC/POL, XRP)

Not all chains are the same. Cost of settlement, finality guarantees, and existing liquidity pools matter. Ethereum (ETH) remains the default for composability and visibility, but high gas can push settlement and active trading to lower-cost chains such as Polygon (MATIC/POL). The XRP Ledger offers ultra-fast settlement and low fees, which can be attractive for repeated custody reconciliations and exchange flows. Chain selection becomes a trade-off: composability vs cost vs available market makers.

Tokenized gold: ETFs vs on-chain asset tokens (PAXG, XAUT)

Tokenized gold comes in several legal and technical flavors. Understanding these differences is central for custody providers and institutional allocators.

Tokenized ETFs (on-chain): These are ETF structures that record ownership or share units on a blockchain while the underlying gold sits with regulated custodians off-chain. The Hang Seng Ethereum-based tokenized gold ETF is an example where the ETF wrapper is integrated with on-chain settlement, but redemptions and regulatory compliance follow ETF rules and custodial chains of title. This structure emphasizes regulatory clarity and investor protections, but can limit direct DeFi use because ETF shares often carry transfer restrictions.

On-chain asset tokens (PAXG, XAUT): Tokens like PAXG and XAUT represent a claim on physical gold with different operational models. PAXG is issued by a regulated issuer and is explicitly backed by allocated gold held in vaults; it is designed to be fungible, ERC-20 compatible, and readily composable in DeFi. XAUT similarly represents tokenized gold but has had notable custody and flow dynamics visible on exchanges and derivative venues.

A practical contrast: tokenized ETFs emphasize regulatory wrapper and fund-level protections, while PAXG/XAUT prioritize composability, instant transferability and direct on-chain redemption options (subject to issuer terms). The trade-offs are clear: ETFs offer a familiar compliance surface to institutions; pure tokens offer DeFi-native utility but require additional custody, proof-of-reserve and legal diligence.

Real activity underlines these differences. For example, a recent on-chain whale accumulation of nearly $7M in XAUT illustrated how concentrated flows and exchange custody movements can be — a transparency feature that also raises operational questions for large allocators and custodians handling inbound/outbound flows.

Custody, compliance and operational considerations for institutions

Institutions evaluate tokenized commodities through a custody-and-compliance lens first. Custody models fall on a spectrum:

- Traditional custodial trusts: Third-party custody with KYC/AML, audited vaults and legal title sitting with a trustee. This model aligns with legacy risk frameworks but can add reconciliation steps for on-chain settlement.

- Custodial crypto wallets with insured custody: Crypto-native custodians provide key management, insurance products and integrations that let institutions custody tokens like PAXG while maintaining on-chain access for settlement.

- Hybrid wrappers: Products that pair an off-chain legal claim (ETF share) with an on-chain representation — useful for institutions that need both regulatory comfort and some on-chain efficiency.

Key compliance requirements include: robust proof-of-reserves and auditability, clear redemption mechanics, segregation of client assets, and strong KYC/AML on fiat on-ramps. Institutions must also review issuer legal frameworks: who bears custody liability, what recourse exists in a bankruptcy, and how redemptions are enforced.

Operationally, institutions need playbooks for reconciliations, insured transfer channels and failover custody plans. Providers like Bitlet.app and established custodians will be asked to integrate such flows into existing treasury and settlement systems — but every integration should be tested in low-latency, high-volume scenarios before production trades.

DeFi integration and tokenized yield: opportunities and caveats

The promise of tokenized commodities in DeFi is immediate: gold or commodity tokens can serve as stable collateral, diversify lending pools, and create novel yield products that pay out in asset-backed tokens. For DeFi teams, tokenized assets unlock several primitives:

- Collateral diversification for credit protocols (reduce correlation to crypto-native collateral)

- Asset-backed liquidity pools that attract risk-averse LPs seeking yield without direct crypto volatility

- Synthetics and structured products that mix commodity exposure with crypto-native leverage

However, it’s not frictionless. Tokenized ETFs may have transfer restrictions or redeemability rules that complicate on-chain composability. Pure tokens like PAXG and XAUT are more composable, but that creates counterparty, custody and legal risks that must be surfaced to users. Smart-contract risk, oracle quality (pricing physical commodities accurately), and liquidity fragmentation across chains are real issues.

DeFi teams should design integrations with conservative capital assumptions: limit concentration of asset-backed tokens in a single pool, use multi-source price oracles, and require additional collateral buffers when accepting tokenized commodities as collateral. For institutional counterparties, these designs should be transparent and auditable — and custodians should support proof-of-reserve workflows that map vault holdings to on-chain balances.

Trading, arbitrage and cross-chain flows (ETH, Polygon, XRP Ledger)

As tokenized commodities scale, cross-venue and cross-chain arbitrage becomes a high-return area for sophisticated traders. Several structural dynamics create opportunities:

- Fragmented liquidity pockets: Markets on ETH, Polygon (MATIC/POL), and the XRP Ledger can show different spreads and depths for the same tokenized commodity. Spot arbitrage and on-chain swaps can capture price differentials, particularly when gas and bridge costs are low.

- Exchange custody flows: Large custodial movements — like the reported whale accumulation of XAUT via Bybit — create temporary dislocations between exchange order books and on-chain DEX pricing. Trading desks that monitor exchange flows and on-chain balances can arbitrage these gaps.

- Settlement and fee considerations: Practical arbitrage requires factoring in gas fees, bridge slippage, and custody transfer times. ETH offers deep liquidity and visibility but can be expensive for frequent settlement; Polygon provides cheaper rails, and the XRP Ledger supplies fast finality with minimal fees, making each chain preferable for different strategies.

Tactically, arbitrageurs will want real-time watches across centralized exchanges, DEX pools, and issuer redemption windows. Market makers can also provide two-sided quotes by borrowing tokenized gold on one chain and lending on another, capturing funding spreads — but that requires robust custody and cross-chain risk management.

A practical playbook for allocators, custody providers and DeFi teams

For institutional allocators: start with a small, governed program. Test redemptions and settlement cycles, validate proof-of-reserve reports, and prefer issuers with clear legal wrappers. Use insured custody for large positions and treat tokenized ETFs differently from pure tokens in risk models.

For custody providers: build standardized APIs for proof-of-reserve, implement multi-sig and hardware key separation, and offer on-chain settlement rails across ETH, Polygon and XRP Ledger. Work with audit firms to develop attestation routines that map vault holdings to circulating on-chain balances.

For DeFi teams: design protocols assuming fragmentary liquidity and potential transfer restrictions. Use multiple oracles, set conservative LTVs for asset-backed tokens, and provide transparent risk disclosures. Consider partnering with custodians and funds experimenting with tokenized ETFs to create regulated liquidity pools.

Conclusion

The $5B tokenized commodities milestone is both symbolic and practical: it confirms that market participants are willing to lock meaningful capital to access on-chain commodity exposure. Tokenized gold — whether via ETFs or tokens like PAXG and XAUT — offers compelling use cases for diversification, yield and settlement efficiency, but each architecture brings different custody, compliance and composability trade-offs.

For institutional allocators, custody providers and DeFi teams, the next phase is operational: integrate robust custody, legal clarity and cross-chain liquidity strategies. If you’re building products or portfolios around these assets, prioritize auditability, conservative risk parameters and real-world settlement tests. The market is maturing fast; those who move prudently will capture the structural advantages of tokenized commodities while avoiding avoidable operational shocks.

(References to on-chain flows and custody models in this article reflect observed market activity and public reporting; Bitlet.app teams are monitoring these developments as part of broader RWA product research.)

Sources

- https://coinpaper.com/14120/tokenized-commodities-smash-5-b-ethereum-polygon-and-xrp-ledger-steering-the-rally?utm_source=snapi

- https://www.coinspeaker.com/hang-seng-launches-ethereum-based-tokenized-gold-etf/

- https://www.cryptopolitan.com/whale-accumulated-nearly-7m-xaut-from-bybit/

For further reading on related on-chain primitives, see coverage of DeFi and broader market signals from Bitcoin.