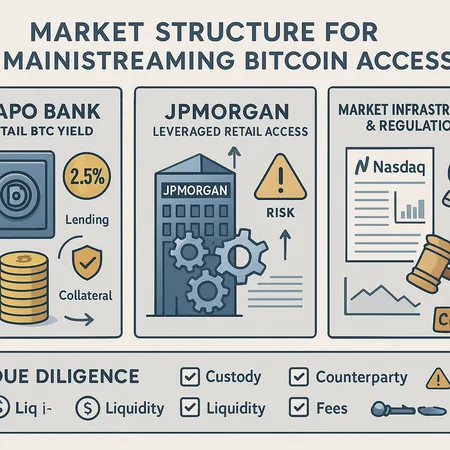

Mainstreaming Bitcoin Access and Yield: Xapo Bank, JPMorgan, and the Options Infrastructure Shift

Summary

Why mainstreamed Bitcoin access matters now

The last 24 months have accelerated a move from ad-hoc retail custody toward packaged, bank-grade Bitcoin exposure: products that promise yield, structured payoffs, or retail-friendly leverage. This shift matters because it rewrites the trade-off between convenience and the classic Bitcoin custody mantra — "not your keys, not your coins." More investors now expect institutional rails, clearer disclosure, and familiar product wrappers; that demand is prompting banks and exchanges to build offerings that look and feel like traditional retail financial products.

For many advisors the central question is simple: how is the yield created, who takes which risks, and what happens when markets stress? Below we compare three recent examples that illustrate the mechanics, the market infrastructure push, and the regulatory tensions at play.

Product mechanics: Xapo Bank’s retail Bitcoin yield product

Xapo Bank recently announced a Bitcoin yield product open to its customers. Broadly, bank-style yield products on BTC generate returns not from any protocol-level staking (Bitcoin is proof-of-work) but from off-chain economic activity — lending BTC to institutional counterparties, repo-style financing, market-making and occasionally overlaying options or other derivatives to extract premia.

Mechanics and typical flows

- Customer deposits BTC (or USD-equivalents) with the bank and receives a promise of periodic yield. The bank then places that BTC into revenue-generating activities.

- Revenue sources commonly include lending BTC to hedge funds/market makers, providing liquidity in OTC desks, or entering into swap agreements where the bank receives a fee or financing spread.

- Custody is usually held by the bank or a regulated custodian; the bank’s balance sheet and counterparty network are key to how yield is sourced and how fast customers can redeem.

Key risks

- Counterparty risk: If the bank or its borrowers default, customers are creditors — not direct owners of on-chain BTC — unless the product explicitly segregates and guarantees asset ownership.

- Liquidity & withdrawal limits: Banks can impose lockups, notice periods, or redemption gates during stress. Yield products that rely on rehypothecation or multi-day settlement can become illiquid in a fast sell-off.

- Operational and custody risk: Custody providers, key management practices and insurance cover important tail risks. A headline-grabbing custody failure can impair the product even if the underlying asset is intact.

Xapo’s move is a major example of mainstream retail access to Bitcoin yield because it packages these backend complexities into a retail experience. Read the bank’s announcement for context to the product structure and retail availability here.

JPMorgan’s leveraged retail access: structure and contradictions

JPMorgan has been moving to offer structured or leveraged access to BTC for advisors and retail clients while simultaneously navigating reputational and regulatory headwinds tied to crypto-related account closures. The bank’s offering reflects a different product design — one that emphasizes leverage and price exposure rather than pure yield.

How leveraged access typically works

- Firms like JPMorgan can offer leveraged exposure via structured notes, margin accounts, or derivatives that synthetically replicate leveraged BTC returns. These products may use options, futures, or swaps on the backend and often carry daily or path-dependent funding costs.

- For retail distribution, banks usually wrap the derivative exposure into a note or fund-like vehicle with broker-friendly documentation and clearing.

Trade-offs and risks

- Issuer credit and structural complexity: Structured notes depend on the issuer’s solvency and the embedded derivative's counterparty hedges. If the issuer or hedging counterparty fails, noteholders may suffer principal loss.

- Debanking & operational friction: As reported, the same institutions offering these products can still close accounts tied to crypto actors — an ongoing source of distrust for crypto-native clients and a sign that retail access does not eliminate operational risk (CryptoSlate coverage).

The paradox is worth stressing: mainstream banks are enabling sophisticated forms of BTC exposure even as they show limited tolerance for certain crypto-related clients. That duality is a reminder that institutional rails reduce some risks (custody, compliance, reporting) but introduce others (credit exposure to traditional banks, balance-sheet risk).

Market infrastructure: options limits and deeper liquidity (Nasdaq ISE and BlackRock)

Institutional-scale retail products often require deeper derivatives markets behind them. The Nasdaq ISE filing to increase limits for BlackRock Bitcoin options is an example of infrastructure adapting to demand for larger notional trades and more sophisticated hedging. Higher options limits allow market makers and institutional issuers to underwrite bigger positions without fragmenting liquidity; that, in turn, permits banks and issuers to offer larger or more efficient structured products.

Why options limits matter

- Options are a primary tool for producing yield (selling covered calls), creating leveraged exposure (buying calls or call spreads), and managing delta/gamma risk in structured notes. Larger exchange limits reduce the need for bilateral OTC hedges, lowering counterparty concentration.

- Improved on-exchange capacity tends to compress hedging costs and reduce execution risk. Nasdaq’s proposal around BlackRock-related options is a concrete sign of market plumbing scaling to support growing retail demand source.

Regulatory and debanking headwinds: why trust still matters

Debanking episodes and regulatory scrutiny remain a practical risk for retail Bitcoin products — not always through direct regulatory action against the products themselves, but via operational fallout when banks choose to limit services. The JPMorgan example highlights two points:

- Banks can close or restrict accounts linked to crypto activity even while distributing crypto products, creating unpredictable user experience for certain clients.

- Regulatory and compliance teams are still adapting; products that rely on bank balance sheets face policy and reputational risks distinct from on-chain custody models.

Advisors need to factor in these non-market risks. A bank offering yield may be solvent today and compliant tomorrow — yet still subject to sudden operational constraints or limits imposed by regulators or correspondent banks.

How these products change retail access to BTC exposure

- Lowered friction: Retail clients gain familiar interfaces, single-account reporting, and nominal protection via regulated custody and insurance backstops. That reduces the technical barrier for many investors.

- Shift in risk profile: From bearer assets on-chain to creditor relationships off-chain. Investors trade self-custody counterparty risk for institutional and regulatory risk.

- Access to yield and structured payoffs: Investors who previously could not access options, repo markets, or repo-financed lending now can through bank-supplied wrappers.

- Leverage and complexity for retail: Easier access to leveraged BTC exposure amplifies tail risk. Advisors must ensure clients truly understand path dependency, margining, and daily rebalancing mechanics.

Internal market dynamics are also changing. For many traders, Bitcoin remains the bellwether, but these products link BTC more tightly to traditional finance dynamics — funding rates, interest rate policy, and counterparty credit spreads.

Investment-grade due diligence checklist for advisors

Below is a practical checklist advisors can use when evaluating bank-style Bitcoin yield products, structured notes, or leveraged wrappers.

- Product legal docs: Read the prospectus/term sheet. Who is the issuer? Is the product a deposit, a note, or an investment fund?

- Custody & segregation: Are assets held in separate customer accounts with a regulated custodian or commingled on the issuer’s balance sheet? Is there proof-of-reserves or regular attestation?

- Counterparty and issuer credit: What are the credit ratings and liquidity profiles of the issuer, custodian, and any hedging counterparties? What happens on issuer default?

- Yield mechanics: Precisely how is yield generated — lending, options writing, repo? Are the returns from recurring operational income or one-off premia?

- Collateral treatment: If assets are rehypothecated or used as collateral, what are the rehypothecation terms and prioritization in bankruptcy?

- Liquidity & redemption terms: Are there lockups, notice periods, cap on redemptions, or gates during stress? What are typical settlement times?

- Fees and transparency: Total expense ratio, explicit vs. hidden fees (e.g., lending spreads, performance fees). How frequently are fees charged?

- Tax treatment & reporting: Is income characterized as interest, capital gain, or something else? Will the issuer provide clear tax documents?

- Stress testing: Ask for modeled outcomes in 30%, 50%, and 80% drawdowns. How are margin calls and option hedges handled?

- Insurance & operational risk: Does custody come with third-party insurance? What are exclusions? How are keys managed and what are disaster recovery plans?

- Regulatory status & disclosures: Is the product registered with local regulators? Are there consumer protection frameworks in place?

- Conflicts & revenue sharing: Does the issuer transact with related parties (proprietary desks, affiliates)? Are there written policies about best execution?

For structured notes specifically: verify embedded option payoff, barrier conditions, early redemption triggers, and whether the product is principal-protected or exposed to issuer default.

Practical scenarios to test with clients

- Redemption shock: Model a scenario where 20% of customers request redemptions within 5 days. How is liquidity met? Are there lines of credit or market-maker agreements?

- Counterparty failure: If a hedging counterparty defaults, can the issuer replace hedges quickly or will it crystallize losses?

- Regulatory freeze: If the issuer faces an enforcement action, what happens to client assets and reporting timelines?

Running through these scenarios with issuers and custodians will surface operational assumptions that are often buried in legal fine print.

Final takeaways

The mainstreaming of Bitcoin yield, structured notes and retail leverage is an important and largely positive evolution for investor access — it lowers friction and brings richer tools to a broader client base. But these products do not eliminate risk; they transform it. Advisors should treat bank-provided BTC yield as a hybrid product: part crypto exposure, part traditional credit and structured-product risk.

As market infrastructure improves — exemplified by exchange-level changes to options limits — the back-end economics of these products should become cheaper and more efficient, but they will still require active governance and careful due diligence. Use the checklist above, insist on transparency around how yield is produced, and remember: easier retail access can mask complex counterparty and liquidity exposures.

If you’re building client allocations, platforms such as Bitlet.app make it easier to compare custody and fee structures across offerings, but nothing replaces a disciplined review of the product mechanics and legal terms.

Sources

- Xapo Bank offers Bitcoin yield product announcement: https://www.crowdfundinsider.com/2025/11/255957-xapo-bank-offers-bitcoin-yield-product/

- JPMorgan opens leveraged bitcoin access while closing crypto CEO accounts: https://cryptoslate.com/jpmorgan-opens-leveraged-bitcoin-access-to-retail-while-closing-crypto-ceos-account/

- Nasdaq ISE eyes bigger limits for BlackRock Bitcoin options: https://www.thecryptoupdates.com/nasdaq-ise-eyes-bigger-limits-for-blackrock-bitcoin-options/