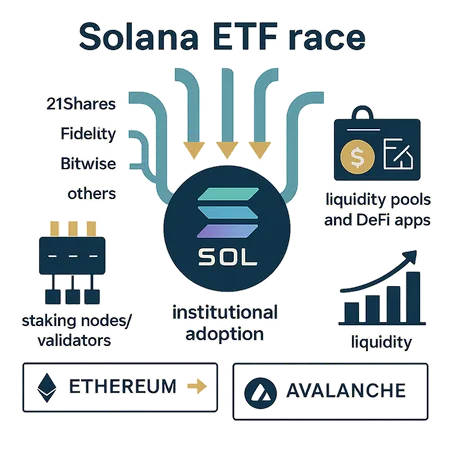

How the Solana ETF Race Will Reshape SOL Flows, Staking and Layer‑1 Competition

Summary

Executive snapshot: why the Solana ETF race matters now

Institutional interest in liquid, regulated crypto exposure is no longer theoretical — it’s an allocation problem. With firms such as 21Shares publicly joining the Solana ETF race and heavyweights like Fidelity expanding their regulated crypto offerings to include SOL, the market is about to get a new conduit for institutional capital. TheBlock reported that 21Shares joins the Solana ETF race, while coverage of Fidelity’s Solana offering highlights how incumbent asset managers are now treating SOL as an investable, regulated asset. For allocators, the question is not whether demand exists, but how these products will reshape on‑ and off‑chain dynamics for SOL and the Layer‑1 competitive landscape.

What these new Solana spot ETFs are — and are not

Spot Solana ETFs are regulated fund wrappers that hold physical SOL to provide price exposure to investors. Contrast that with: (a) ETH products where staking and liquid staking tokens (LSTs) complicate the economics; and (b) multi‑asset crypto ETFs that blend BTC/ETH/SOL and dilute pure SOL beta.

A pure Solana spot ETF is straightforward price exposure: the fund holds SOL in custody and issues shares reflecting that holding. If issuers follow the typical ETF playbook, funds will custody SOL with regulated custodians and settle creation/redemption via authorized participants. This is different from many ETH products that either lean on staking or LST derivatives to capture yield. The practical outcome: SOL ETFs give concentrated, regulated SOL exposure without immediately implying on‑chain staking or derivative overlays. For context, many market participants are referencing the new entrants against other Layer‑1 plays such as Solana and established DeFi ecosystems like DeFi.

That said, issuers vary. Some funds might pursue staking strategies later, or launch companion products (e.g., staking yield ETFs). Right now, most spot ETF filings focus on custody and price replication rather than active on‑chain staking.

Immediate capital‑flow mechanics: supply, custody and liquidity

When a spot ETF launches, the mechanical flow is simple: authorized participants buy SOL in the open market and deliver into fund custody to create ETF shares. Two important, sometimes conflicting, effects follow.

First, ETF creation can pull SOL off exchanges and into custody, which reduces the liquid, tradable supply and often tightens spot liquidity, narrowing spreads. That can be bullish for the price and reduce exchange sell pressure. Second, large centralized custodians and APs can concentrate holdings — raising centralization risk if a handful of entities control meaningful on‑chain stake or trading inventory. Concentration also affects slippage and large block execution costs for institutional traders.

Liquidity effects are nuanced. Short‑term, order book depth on regulated venues should improve as authorized participants arbitrage ETF NAV, but on‑chain DeFi liquidity may lag unless the ETF or its sponsors deploy capital into AMMs, lending pools, or OTC desks. For portfolio managers who need quick liquidity, ETFs offer regulated redemption channels; for DeFi users, the net effect depends on whether custodial holdings ever return to on‑chain markets.

How ETFs likely alter staking, validator economics and decentralization

Staking on Solana is a distinct economic layer: delegators lock SOL to validators in return for rewards. How ETFs interact with staking matters more for Solana than it might initially seem.

Most spot ETFs are unlikely to stake the SOL they hold at launch. That means custodied SOL sits idle from a staking perspective, reducing the share of tokens contributing to network security — unless custodians actively delegate or launch staking ETFs. A decline in staked supply could temporarily increase effective staking yields for active on‑chain delegators (rewards distributed across fewer stakers), but it also can weaken economic security if large custodians concentrate large unstaked balances.

Validator economics face a two‑fold pressure: if ETF inflows never convert to staking, validators lose potential uptime‑based revenue from new delegators. Conversely, if ETF holders or sponsors choose to stake on their behalf, validators could see sizable stake increases, raising their share of voting power. That dynamic poses a centralization risk: large custodians may prefer a small set of managed validators, which concentrates consensus power and could alter governance dynamics.

Operationally, higher trading volume and more frequent rebalancing of fund inventories also increase demand for validator infrastructure (RPC capacity, block propagation, etc.) and may reveal stress points in Solana’s historically bursty throughput environment. Expect validator uptime SLAs and infra spend to rise as institutional flows deepen.

DeFi impacts: liquidity, TVL and composability

Institutional SOL via ETFs can be a tailwind for Solana DeFi — but only if capital is recycled on‑chain. There are three plausible channels:

ETF cash flows back to DeFi: if ETF market makers or authorized participants use DeFi for hedging (e.g., lending SOL, liquidity provision) we could see direct TVL inflows. This is less common initially because custodial, regulated entities often avoid on‑chain counterparty risk.

Price and volatility effects: ETF demand that raises SOL price typically attracts retail and yield‑seeking activity into DEXs and lending markets, boosting DeFi volume indirectly.

Derivative and prime‑broker strategies: institutional players may combine physical ETF exposure with OTC derivatives and on‑chain hedges — for example, borrowing SOL on a lending market to short hedge exposures. That creates two‑way capital flows between regulated venues and DeFi.

Net: the most immediate DeFi impact will be improved price discovery and deeper AMM liquidity for SOL trading pairs. Deeper on‑chain derivatives and structured products may follow, but institutional comfort with on‑chain custody and counterparty risk will control the timing.

Comparative analysis: SOL vs ETH and Avalanche for institutional flows

How will institutional allocations to SOL via ETFs compare with flows into ETH or Avalanche exposure?

Ethereum (ETH): ETH benefits from the deepest derivatives markets, mature custody, and a well‑developed staking ecosystem. Institutional allocations to ETH often combine spot, staked ETH exposures, and derivatives. Because ETH underpins most DeFi and L2 activity, institutions view it as a foundational allocation — lower beta, higher liquidity, and a clearer regulatory pedigree for some firms. SOL, by contrast, is higher beta: issuers and allocators see it as growth‑oriented Layer‑1 exposure with potential for outsized returns or volatility.

Avalanche (AVAX): Avalanche competes with SOL on performance and lower fees, but its institutional narrative is weaker than ETH’s and somewhat comparable to SOL’s: application‑driven growth with episodic spikes in activity. ETFs that focus on a single Layer‑1 tend to attract allocators who want targeted beta rather than the broad market exposure an ETH/BTC multi‑asset ETF offers.

Institutional flows historically follow three drivers: (1) liquidity and execution ease, (2) regulatory comfort, and (3) narrative fit within macro portfolios. ETH remains the safe “platform” bet; SOL (via single‑asset ETFs) offers high beta access for allocators wanting growth exposure inside a regulated wrapper. Avalanche may win niche allocations where its ecosystem specifics matter.

Tactical guidance for portfolio managers and allocators

If you’re evaluating SOL allocations via the coming ETFs, consider a structured checklist rather than a gut call.

Decide your exposure objective: Are you buying pure SOL price beta, yield‑seeking exposure (staking), or application‑specific risk (DeFi/NFT activity)? ETFs, at launch, are best for price beta. For staking yield, examine whether the issuer offers a staking vehicle or how staking integrates with custody.

Size thoughtfully: Given SOL’s higher realized volatility relative to ETH, cap position sizes and use volatility‑aware sizing (e.g., volatility parity or scaled position limits). Consider staging exposure via DCA into ETF shares during initial listing and volatile price discovery.

Understand custody and concentration risk: Request transparency on who the custodians are, whether the ETF stakes, and any validator relationships. Concentration of holdings at a handful of custodians or validators adds counterparty and governance risk.

Liquidity and execution planning: ETFs ease entry and exit, but APs and block liquidity matter for large tickets. Use pre‑trade analytics to estimate market impact and have limit/algos ready. For very large allocations, coordinate with prime brokers and AP desks for creation/redemption blocks.

Hedging strategy: Combine spot ETF exposure with futures or options to control downside. Derivative liquidity for SOL will likely expand after ETF launches; plan to use cross‑venue hedges to reduce index tracking error.

On‑chain considerations: If you plan to translate ETF positions to on‑chain activity (e.g., staking or DeFi deployment), anticipate timing lags and tax/custody frictions. Consider hybrid approaches: allocate a smaller, managed pool to on‑chain strategies while using ETF shares for broad exposure.

Risks and open questions

The ETF wave introduces both predictable and uncertain risks:

- Centralization: custody concentration and possible validator centralization could have governance and security implications for SOL.

- Staking mismatch: ETFs that sit in custody unstaked may reduce the staked share of supply, altering reward dynamics and potentially increasing volatility in validator economics.

- Market structure changes: liquidity could migrate from spot exchanges and DEX order books to ETF wrappers and regulated venues, changing price discovery mechanics.

- Regulatory shifts: ongoing regulatory scrutiny of crypto products can change permitted behaviors (e.g., staking by custodians), which would materially change ETF economics.

Portfolio managers should treat these as active risks and build contingency plans with custodians, APs, and legal teams.

Looking forward: a pragmatic institutional playbook

The arrival of multiple Solana ETF issuers — from established players like Fidelity to niche specialists like 21Shares and asset managers such as Bitwise — signals a maturing investor path to SOL. That maturation will rewire how capital flows into Layer‑1s, increasing on‑ and off‑chain interdependence.

For allocators: prioritize clarity of exposure, execution plans, and counterparty assessments. For strategists: monitor staking ratios, custody concentration metrics, and DeFi TVL/flows as leading indicators of how ETF demand translates into on‑chain activity. And for product teams: consider whether a companion staking ETF or an institutional custody + staking product could capture incremental demand while addressing decentralization concerns.

Institutional capital is directional — it follows clear channels. The Solana ETF race will build those channels for SOL. Watch flows, custody behavior, and validator economics closely; the first months after launch will shape long‑term dynamics across Solana and competing Layer‑1s. For allocators seeking additional execution tools or alternative custody options, platforms such as Bitlet.app are part of the expanding ecosystem that connects regulated exposure with on‑chain strategy integration.

Further reading and monitoring

Track issuer filings and authorized participant activity, and follow market‑impact studies as ETFs list. For early coverage of the entrants, see The Block’s report on 21Shares and industry reaction as well as coverage of Fidelity’s market move into SOL. Keep these dynamics under continuous review — institutional flows can change rate‑of‑return expectations across the whole Layer‑1 landscape in short order.