Cipher Mining's Strategic Pivot: Embracing AI Innovations During Crypto Market Challenges

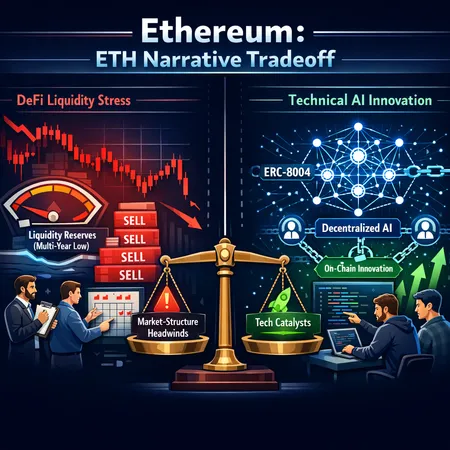

In response to ongoing challenges in the crypto market, Cipher Mining has announced a strategic pivot towards exploring artificial intelligence (AI) innovations. This shift signifies a proactive approach by the company to diversify and leverage emerging technologies beyond traditional crypto mining.

Cipher Mining's decision highlights how firms within the crypto space are adapting to fluctuating market conditions by incorporating AI advancements to create new opportunities. This move not only strengthens the company's future growth prospects but also reflects the broader trend of integrating AI technologies in the blockchain and crypto industry.

For individual investors interested in navigating the complexities of the crypto market, platforms like Bitlet.app offer innovative solutions such as Crypto Installment services. Bitlet.app allows users to buy cryptocurrencies now and pay monthly, providing flexibility especially valuable during volatile market periods.

Stay informed with Bitlet.ai, powered by Bitlet.app, for the latest updates and insightful analysis on the intersection of cryptocurrency and emerging technologies like AI.