Bitcoin's Recent All-Time High: Strategies for Navigating Market Volatility

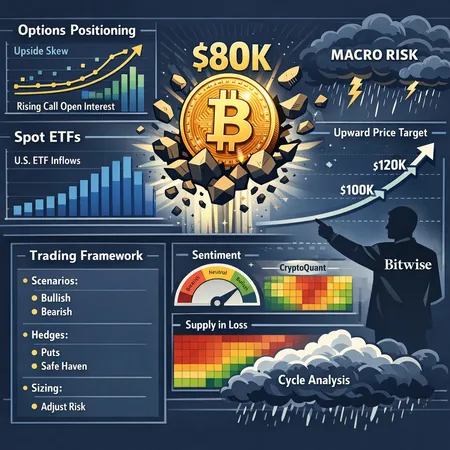

Bitcoin has recently achieved a new all-time high, sparking excitement and uncertainty among investors. As the cryptocurrency market continues to evolve, navigating through volatility becomes vital for both seasoned and new investors. Here are some key strategies to help investors manage their portfolios during these turbulent times:

Stay Informed: Keeping up with market news, trends, and regulatory changes is crucial. Awareness enables investors to make informed decisions and react promptly to market shifts.

Diversification: Avoid putting all funds into a single asset. Diversifying your investment portfolio can help mitigate risks associated with market fluctuations.

Set Clear Goals: Define short-term and long-term investment objectives. Knowing your target helps guide your trading strategies and when to exit positions.

Risk Management: Implementing stop-loss orders can protect your investments from unforeseen downturns. Additionally, only invest what you can afford to lose.

Dollar-Cost Averaging (DCA): This strategy involves buying a fixed dollar amount of Bitcoin at regular intervals, regardless of its price. DCA helps lessen the impact of volatility by averaging purchase costs.

Utilize Crypto Installment Services: Investing in Bitcoin doesn’t have to mean paying the total amount upfront. With Bitlet.app, investors can take advantage of its Crypto Installment services, allowing you to buy your desired amount of Bitcoin now and pay monthly. This approach makes investing easier and more manageable in a volatile environment.

By employing these strategies, investors can better navigate the ups and downs of Bitcoin's market. As always, conduct thorough research and consider professional advice tailored to your financial situation. Happy investing!