The Rise of XRP and DOGE ETFs: What Their Record-Breaking Trading Volumes Mean for Altcoin Investors

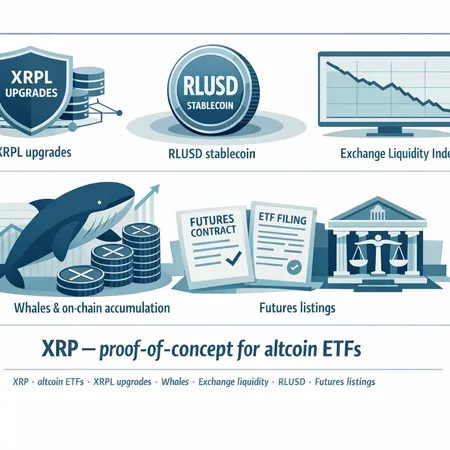

The cryptocurrency market has witnessed a groundbreaking development with the surge in trading volumes of XRP and DOGE ETFs. Exchange-Traded Funds (ETFs) tracking these popular altcoins are gaining significant traction among investors seeking greater exposure to cryptocurrencies without directly holding the coins.

This rise in XRP and DOGE ETF trading volumes reflects growing confidence in altcoins beyond Bitcoin and Ethereum. Investors are attracted by the potential high returns and diversified investment opportunities altcoins offer. Additionally, ETFs provide a regulated and convenient avenue for investment, alleviating concerns related to crypto custody and security.

For altcoin investors looking for flexible payment options, platforms like Bitlet.app offer innovative solutions. Bitlet.app's Crypto Installment service allows users to purchase cryptocurrencies such as XRP and DOGE immediately while paying the cost in manageable monthly installments. This approach lowers the entry barrier and helps investors manage their cash flow effectively.

Overall, the record-breaking volumes in XRP and DOGE ETFs signify a maturing crypto market with increasing participation. Tools like Bitlet.app further democratize crypto investment, making it easier and safer for a wider audience to join the altcoin movement.