Ethereum's 2025 Growth Drivers: Stablecoins, Regulations, and Institutional Investments

Ethereum is set for significant growth in 2025, driven by several key factors shaping the crypto landscape. One major catalyst is the advancement of stablecoin technology on the Ethereum blockchain. Stablecoins provide a more stable medium of exchange and have expanded Ethereum’s usability in decentralized finance (DeFi), remittances, and payment systems.

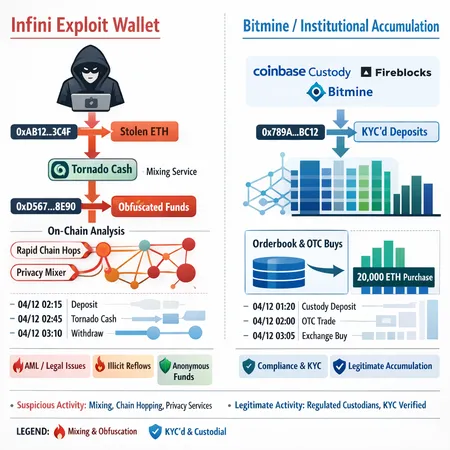

Alongside technological progress, regulatory changes around the world are creating a more defined framework for cryptocurrencies. Clearer regulations can foster greater trust and attract more institutional investors into Ethereum, pushing its adoption further into mainstream finance.

Institutional interest is another powerful force behind Ethereum’s growth. With big corporations, hedge funds, and financial institutions increasing their crypto exposure, Ethereum stands out due to its smart contract capabilities and broad developer ecosystem.

For retail investors looking to capitalize on Ethereum’s growth, Bitlet.app offers an innovative solution. Bitlet.app provides a Crypto Installment service, allowing users to buy Ethereum now and pay monthly instead of paying the full amount upfront. This lowers the barrier to entry and makes investing in Ethereum more accessible to a broader audience.

In summary, Ethereum’s growth in 2025 will be propelled by stablecoin innovations, evolving regulatory clarity, and rising institutional interest. Leveraging platforms like Bitlet.app can help investors tap into these opportunities with flexible payment options, making Ethereum investment easier and more affordable.