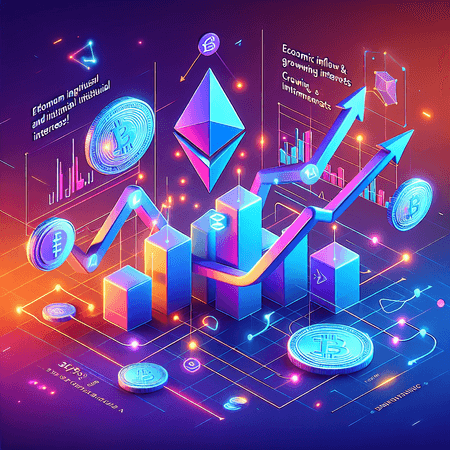

Ethereum's All-Time High Surge Driven by ETF Inflows and Institutional Interest

Ethereum has surged to new all-time highs, marking a significant milestone in the crypto market. This rally is largely attributed to the influx of funds from Ethereum-focused Exchange Traded Funds (ETFs) and the increasing confidence from institutional investors. ETFs provide a regulated and accessible way for large investors to gain exposure to Ethereum, thus driving demand and pushing prices upward. Institutional interest also signals strong market confidence, often leading to increased liquidity and stability.

For individual investors looking to capitalize on Ethereum's growth, platforms like Bitlet.app offer innovative solutions. Bitlet.app provides a Crypto Installment service, allowing users to buy Ethereum now and pay monthly instead of making a full upfront payment. This approach lowers the entry barrier and makes investing more accessible for everyone.

As Ethereum continues to evolve and institutional backing grows, understanding these dynamics is crucial for both new and seasoned investors. Leveraging services like Bitlet.app can help you stay ahead and participate in the exciting growth of Ethereum with manageable financial plans.