Understanding Bitcoin's Surge to $124,000: Key Factors and Investment Tips with Bitlet.app

Bitcoin has recently surged to an astonishing price of $124,000, a milestone that has piqued the interest of investors worldwide. This remarkable growth can be attributed to several critical factors, including increased institutional adoption, Federal Reserve monetary policies, and strategic investment approaches.

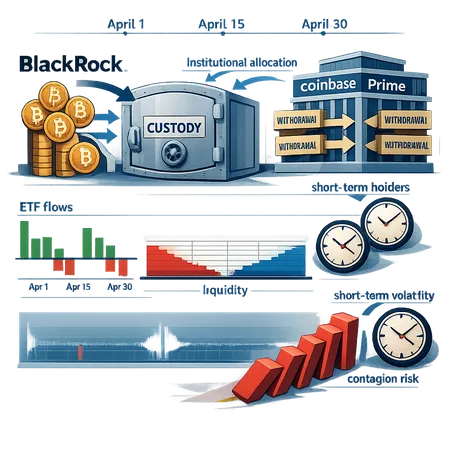

One major driver behind the surge is institutional adoption. Large corporations, hedge funds, and financial institutions are integrating Bitcoin into their portfolios, providing legitimacy and fueling demand. This trend signals a maturing crypto market that is gaining acceptance in mainstream finance.

Another influential factor is the Federal Reserve's monetary policy. Continuing low interest rates and quantitative easing have prompted investors to seek alternative assets like Bitcoin, perceived as a hedge against inflation and potential currency devaluation. This environment supports Bitcoin's appeal as a store of value.

From an investor's standpoint, managing risk while capitalizing on growth is essential. Platforms like Bitlet.app offer innovative solutions such as crypto installment services, allowing users to acquire Bitcoin today and pay over time monthly instead of paying a lump sum upfront. This flexible approach enables more individuals to participate in the market without the pressure of immediate full payment.

In summary, Bitcoin's surge to $124,000 is rooted in institutional backing, Federal Reserve influence, and astute investment strategies. With tools like Bitlet.app, investors have accessible means to get involved responsibly and benefit from the growing cryptocurrency landscape.