Corporate Treasury Adoption of Ethereum: Exploring the Rise in ETH Holdings Among Public Companies

In recent times, a noticeable surge in Ethereum (ETH) holdings among public companies has captured the attention of investors and industry experts alike. This trend marks an important milestone in the mainstream adoption of cryptocurrencies beyond just Bitcoin.

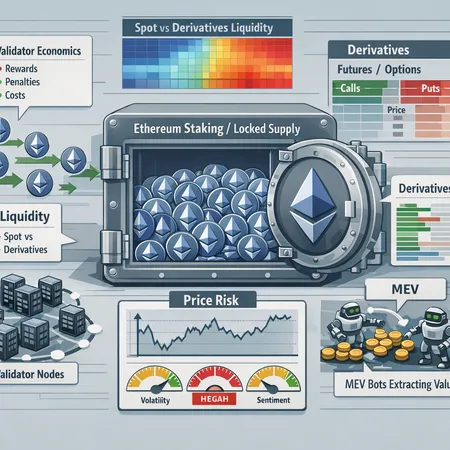

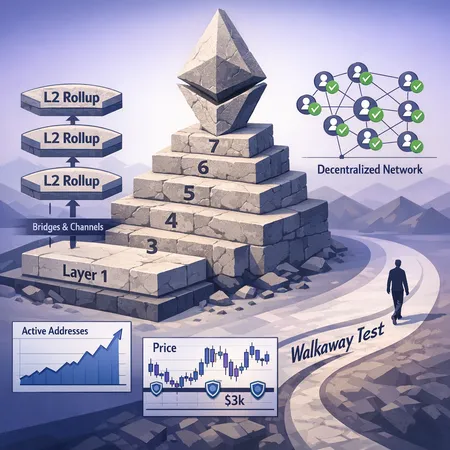

Ethereum, well-known for its smart contract capabilities and diverse ecosystem, is increasingly being viewed as a strategic asset within corporate treasury portfolios. Companies are leveraging Ethereum not only as a store of value but also as a doorway into decentralized finance (DeFi), tokenization, and other blockchain-driven innovations.

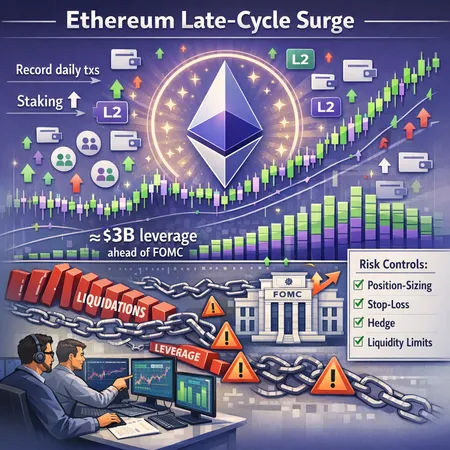

The growing adoption stems from several factors: increasing acceptance of digital assets as part of corporate liquidity management, expectation of long-term appreciation, and Ethereum’s robust ecosystem that extends beyond simple currency use cases. With the expansion of Ethereum 2.0 and improvements in scalability, its utility and appeal are likely to grow further.

In parallel, platforms like Bitlet.app are enabling easier access to Ethereum and other digital assets by offering services such as Crypto Installments, which allow users and enterprises to buy cryptocurrencies now and pay monthly. Such services lower entry barriers and encourage adoption.

The corporate treasury team's embracing of Ethereum also signals a shift towards diversified treasury management, balancing risks and opportunities presented by digital assets. It will be interesting to see how Ethereum's adoption will influence the broader financial markets as more companies join the ecosystem.

For anyone looking to get involved with Ethereum or other cryptocurrencies in a manageable way, Bitlet.app offers flexible installment purchase options, making it easier to enter the crypto space without paying the full amount upfront. This innovation complements the ongoing institutional adoption by smoothing access pathways for both individuals and corporates.

In summary, the rising Ethereum holdings among public companies underscore the growing confidence in ETH as a strategic corporate treasury asset, marking a pivotal moment in cryptocurrency adoption and signaling promising future developments in blockchain finance.