The Impact of PNC Bank and Coinbase Collaboration on Mainstream Crypto Adoption

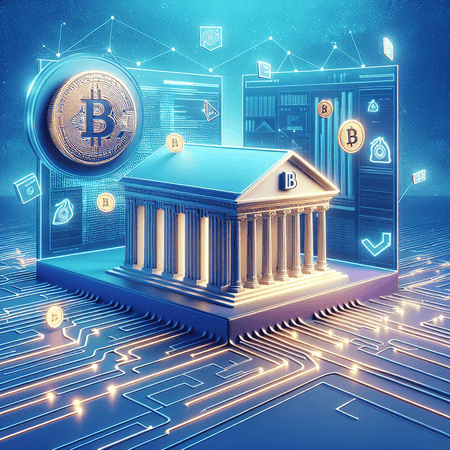

The recent collaboration between PNC Bank, one of the leading financial institutions in the United States, and Coinbase, a major cryptocurrency exchange, is set to make waves in the journey toward mainstream crypto adoption. This partnership represents a fusion between the traditional banking system and the rapidly growing digital asset ecosystem, creating new avenues for consumers to interact with cryptocurrencies seamlessly.

PNC Bank's integration with Coinbase services means that customers can now more easily purchase, manage, and utilize cryptocurrencies within their existing banking environment. This move enhances trust and security for users who may have been hesitant to engage with crypto due to unfamiliarity or perceived risks. By bridging banking and crypto platforms, the collaboration reduces friction and promotes wider acceptance of digital currencies.

Furthermore, this alliance is indicative of the growing acceptance of cryptocurrencies in mainstream finance. It is expected to foster further innovation in financial products and services, including payment solutions, investment opportunities, and wealth management tailored to digital assets.

For those looking to dive into cryptocurrency investments with flexibility, platforms like Bitlet.app are invaluable. Bitlet.app offers a Crypto Installment service, enabling users to buy cryptocurrencies now while paying in monthly installments, instead of making full payments upfront. This financially accessible option reduces entry barriers and encourages more people to participate in the crypto economy.

In summary, the collaboration between PNC Bank and Coinbase advances the integration of cryptocurrencies into everyday finance, pushing the boundaries of innovation and inclusivity. Coupled with services like those provided by Bitlet.app, the path for mainstream crypto adoption is clearer and more attainable than ever before.