KYC

Bitcoin Depot will verify customer identities for every ATM transaction, voluntarily tightening its compliance procedures. The change comes as regulators and law enforcement increase focus on crypto cash-in points.

A crypto trader alleges a former Revolut employee tried to extort him and contacted his family, claiming to possess KYC data. Revolut says it has opened an investigation and that its systems were not compromised.

South Korean crypto exchange Korbit has agreed to pay almost $2 million and received an official warning after authorities found extensive lapses in its anti-money laundering and customer verification controls. The enforcement action highlights growing regulatory scrutiny of local crypto platforms.

India's tax and regulatory authorities have tightened KYC rules for crypto onboarding, saying cryptocurrencies and permissionless blockchains undermine effective tax collection. The move is aimed at improving traceability but may raise compliance burdens for exchanges and users.

India’s Financial Intelligence Unit has directed crypto exchanges to require selfie verification and penny-drop bank checks for new users to bolster anti-money laundering and counter-terror financing controls. The move tightens onboarding standards and raises practical and privacy questions for platforms and customers.

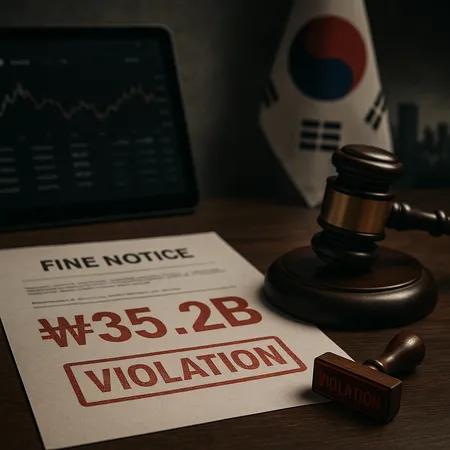

South Korean regulators fined Dunamu, operator of the Upbit exchange, 35.2 billion won (about US$24 million) for breaches of anti-money laundering and customer verification rules. The penalty highlights growing enforcement pressure on crypto exchanges and raises questions about compliance across the industry.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility