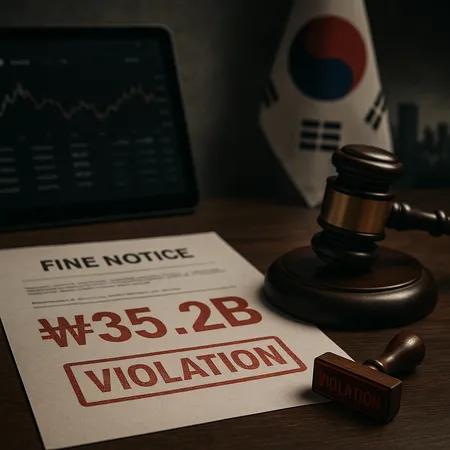

South Korea Fines Upbit Operator Dunamu $24M for AML and KYC Failures

Overview

South Korean financial authorities have fined Dunamu, the operator of the popular cryptocurrency exchange Upbit, 35.2 billion won (over US$24 million) for violations of anti-money laundering (AML) and customer verification (KYC) rules. The decision underscores intensifying regulatory scrutiny on centralized exchanges and the compliance gap that still exists in parts of the industry.

What regulators found

Authorities concluded Dunamu failed to meet required standards for verifying customer identities and monitoring suspicious transactions. While regulators did not order a shutdown, the fine signals that South Korea is enforcing stricter controls on crypto platforms to curb illicit finance and protect retail users.

Key takeaway: the penalty is financial and reputational — regulators are showing they will use meaningful fines to compel better compliance.

Why this matters for users and markets

Even if the fine is not crippling for a large exchange, it has several implications:

- Customer trust: KYC and AML lapses erode trust, which can reduce user retention and deter new sign-ups. Users may re-evaluate where they keep larger positions.

- Operational changes: expect Dunamu/Upbit to accelerate compliance upgrades, which could temporarily increase onboarding friction (longer verification times, more documentation requests).

- Market flows: short-term liquidity shifts are possible if traders move funds to other venues; this could affect altcoins, memecoins and secondary markets for NFTs and tokens.

Broader regulatory context

Regulators worldwide have been raising the bar for exchanges: higher KYC standards, transaction monitoring, and more transparent reporting. South Korea’s action follows a global trend where authorities prioritize preventing money laundering and terrorist financing in digital asset markets. This also affects areas interacting with centralized platforms like DeFi protocols and custody services built on the blockchain ecosystem.

Impact on Dunamu and Upbit

Dunamu will likely respond by increasing compliance headcount, investing in monitoring tools, and tightening customer onboarding. While the fine amount represents a material hit, the larger cost is reputational and operational: rebuilding trust and demonstrating robust controls take time and visible proof of change.

What exchanges should learn

Regulators are sending a clear message: lax KYC/AML practices are no longer tolerable. Exchanges should take these steps proactively:

- Implement continuous transaction monitoring and suspicious-activity reporting.

- Automate KYC checks while preserving manual review for edge cases.

- Publish transparent compliance roadmaps and cooperate with supervisors.

Platforms and services that combine user-friendly interfaces with strong compliance frameworks — including product ecosystems like Bitlet.app — will likely attract users seeking both convenience and regulatory safety.

Takeaways for users

If you use Upbit or any centralized exchange:

- Re-check your verification status and be prepared for stricter documentation requests.

- Keep an eye on official announcements from Dunamu about policy and process changes.

- Consider diversification of custody and follow best practices for risk management.

Conclusion

The fine against Dunamu is another milestone in the maturing of crypto regulation: enforcement is active, and operators must meet high AML/KYC standards or face significant penalties. For the industry, this is a push toward more robust compliance — a necessary step if crypto is to achieve broader institutional and retail acceptance.