TrebleSwap Integrates Orbs' Perpetual Hub Ultra to Launch Perpetual Futures on Base

Summary

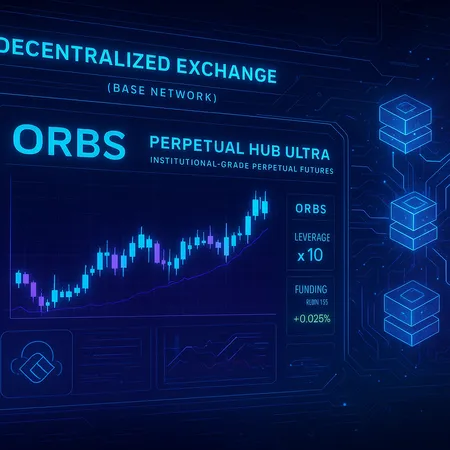

TrebleSwap and Orbs: Bringing Perpetuals to Base

TrebleSwap — a decentralized exchange built on the Base network — has integrated Perpetual Hub Ultra, Orbs’ new Layer‑3 infrastructure, to launch institutional‑grade perpetual futures. The upgrade is designed to reduce costs and latency for derivatives execution while keeping settlement anchored to Base. For traders seeking scalable leverage products, this represents a meaningful step: perpetuals historically required complex infrastructure that many L2s and rollups struggle to provide efficiently.

How Perpetual Hub Ultra works and why it matters

Perpetual Hub Ultra is a Layer‑3 solution that offloads order matching, margin calculations and cross‑margining to a specialized execution layer while leveraging Base for final settlement. By separating execution from settlement, Perpetual Hub Ultra can offer faster fills, lower gas exposure and more predictable fee structures — critical factors for high-frequency and institutional traders. The architecture also aims to preserve security assumptions by periodically committing state to Base, minimizing trust expansion beyond the L2.

Layer‑3 design benefits and technical tradeoffs

The Layer‑3 approach brings clear benefits: improved throughput, cheaper per‑trade costs, and the ability to run advanced risk engines (e.g., real‑time liquidation auctions, isolated vs cross margin). However, operators and users must monitor state‑finality cadence and oracle latency, as these affect funding rates and liquidation fairness. Orbs’ offering attempts to strike a middle ground: keep execution nimble while ensuring on‑chain settlement integrity.

Market impact: liquidity, market makers and ORBS

This integration could attract market makers who previously avoided Base for derivatives due to tooling limits. With Perpetual Hub Ultra, TrebleSwap may see deeper orderbooks and tighter spreads, improving trader experience and volume. The move also increases on‑chain utility for ORBS — the token underpinning Orbs’ ecosystem — as protocol fees, staking or governance hooks may be tied to the hub. That said, competition from other rollups and centralized venues remains a factor in how quickly liquidity materializes.

What traders, builders and platforms should watch

Traders should watch funding-rate behavior, initial margin requirements and the speed of liquidations as the product ramps. Builders and integrations — including consumer services like Bitlet.app that offer installment or earn products — will want to monitor composability with other DeFi primitives and how Perpetual Hub Ultra interoperates across the blockchain stack. Custody integrations, on‑chain risk oracles and insurance mechanisms will be key to institutional adoption.

Takeaways and next steps

TrebleSwap’s integration of Orbs’ Perpetual Hub Ultra marks a notable milestone for on‑chain derivatives on Base: it makes perpetual futures more practical on EVM‑compatible rollups by balancing speed and security. Expect incremental liquidity inflows as market makers test the new rails and as tooling (analytics, risk dashboards, custody) catches up. For traders and platforms, the immediate focus should be on metrics: fills, slippage, funding rates and oracle reliability — those will determine whether this Layer‑3 model becomes the blueprint for derivatives across DeFi.