Institutional Demand

CME Group has listed futures for Cardano (ADA) and Stellar (XLM), expanding regulated institutional exposure beyond existing Bitcoin, Ether, Solana and XRP products. The listings give asset managers and trading desks new hedging and price‑discovery tools on a cleared exchange.

Tokenized U.S. Treasuries have exceeded $10 billion in total value, driven by rising institutional interest alongside retail participation. The milestone highlights growing appetite for digital, tradable government debt and improved access to Treasury yields.

Cathie Wood says Bitcoin's traditional four‑year cycle may be breaking down as institutional demand rises and volatility falls. She views this as a structural shift that could alter timing and allocation strategies for investors.

Michael Saylor signaled that MicroStrategy may be preparing for its first Bitcoin purchase of 2026, a move that could reinforce institutional demand for BTC.

Canary's single-token spot XRP ETF opened on Nasdaq with stronger-than-expected institutional demand, putting it on track for a record-breaking debut. The fund cleared final regulatory hurdles this week and outperformed multiple expert projections on day one.

The Canary XRP ETF (XRPC) traded $55.5 million on its first day (Nov 13), moving 2.26 million shares with 11% intraday volatility. The debut matched this year’s top crypto ETF launch—Solana’s—and points to growing institutional interest in XRP.

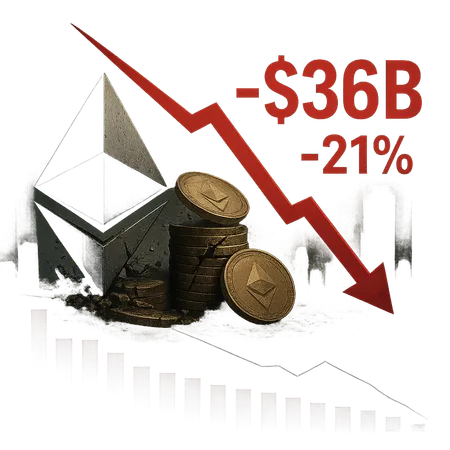

DeFi total value locked dropped by $36 billion (about 21%) from its October peak, raising fresh concerns about liquidity and Ethereum’s role as DeFi’s backbone. Declining ETH-denominated TVL since April, even while prices rose, and cooling institutional demand for ETH highlight a shifting market dynamic.

Bitcoin is trading tightly between $109,000 and $110,000 with critical resistance at $112,000. Institutional inflows from BlackRock and Fidelity, combined with shrinking market demand and low retail activity, set the stage for potential high volatility and breakout scenarios. Bitlet.app offers crypto installment services that let you get in on opportunities like this without paying full upfront costs.

Bitcoin and Ethereum prices slipped on August 20, 2025, impacted by U.S. tariffs, inflation worries, and increased liquidation risks. Overall crypto market cap stands at $3.82 trillion, with Bitcoin support levels closely watched.

In August 2024, the crypto market showed resilience despite volatility from Fed interest rate hikes. Bitcoin held strong above $50K, while Ethereum faced ETF outflows. Notable is the rise in stablecoin supply and growing crypto adoption by companies like Ferrari. Innovations like Visa crypto cards and EU regulation compliance mark a promising future. Explore buying crypto with ease on Bitlet.app, featuring flexible Crypto Installment plans.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility