Bitwise’s 11 Altcoin ETF Filings: What AAVE, ZEC and TRX Mean for Institutional Access

Summary

Executive snapshot

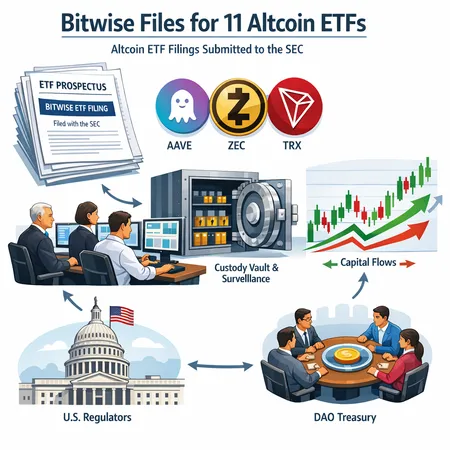

Bitwise’s recent filings for 11 new altcoin ETFs mark a potentially pivotal moment in U.S. institutional access to a broader set of crypto assets. The filings — and Bitwise’s proposed hybrid ETF structures — name tokens such as AAVE, ZEC and TRX, and outline a framework that blends spot exposure with regulated oversight. Reporting around the filings highlights both product innovation and the regulatory questions that will determine whether these vehicles deepen on‑chain liquidity or simply reroute capital into a new wrapper. For many traders, Bitcoin remains the primary bellwether, but the next phase of ETF development could put DeFi primitives and privacy coins on institutional radars in a material way.

What Bitwise filed — the nuts and bolts

Bitwise’s application set seeks approvals for eleven altcoin-focused ETF products beyond its Bitcoin and Ethereum offerings. Media coverage and the filing summaries indicate a list that includes AAVE, ZEC and TRX among the named tokens and describes a hybrid ETF design intended to reconcile spot exposure with regulatory surveillance and custody demands.

- The initial announcement of the 11 filings lays out Bitwise’s intent to expand altcoin ETF coverage and frames the move as the next logical step after Bitcoin and Ethereum product launches. See the filing overview for specifics. CoinPedia’s coverage summarizes the scope.

- Follow-up reporting dives into the proposed hybrid structures and explicitly lists tokens such as AAVE, ZEC and TRX as targets, providing context on how Bitwise expects to manage market integrity concerns. See the structure details in this piece. Crypto.News’s analysis is a useful explainer.

Taken together, the filings signal that Bitwise is attempting to couple product demand with design features aimed at satisfying regulators and custodians.

Why asset managers are targeting altcoins now

The timing reflects a few converging dynamics:

- Market maturation: Derivatives markets, on-chain liquidity pools and custody solutions for many altcoins have improved since earlier cycles. That infrastructure lowers the operational friction to offering institutional products.

- Demand from institutions and treasuries: Large buyers — including entities that publicly disclose allocations — are already accumulating non‑BTC assets. The Cypherpunk purchase of Zcash is a recent example showing appetite for privacy-coin exposure and the scale of potential inflows. Independent reports confirm a roughly $28–29M ZEC acquisition and quantify the share of supply acquired, underscoring real institutional appetite (CoinPaper, CoinDesk).

- Competitive product development: Managers that already run Bitcoin/ETH funds see runway in offering diversified crypto exposure. Broader ETF product sets can retain clients inside a firm’s ecosystem rather than losing them to niche funds.

Institutional access coupled with productized liquidity is the hook: regulated ETFs make it easier for pension funds, family offices and corporate treasuries — including DAO treasuries using platforms like Bitlet.app for operational needs — to gain exposure without direct custody of the underlying keys.

Structural questions: custody, surveillance and the hybrid design

The filings emphasize a hybrid approach — a repeated buzzword in recent filings — and for good reason. Hybrid here means blending direct crypto custody of spot tokens with surveillance mechanisms and potentially derivatives overlays to manage settlement and market integrity.

Custody: not one-size-fits-all

Custody for altcoins is materially more complex than for Bitcoin. Differences include token standards, staking mechanics, privacy features (in the case of ZEC), and network upgrade risk.

- Cold vs. hot custody tradeoffs: Providers must show robust cold storage with audited signoff while retaining hot-wallet rails for redemptions. For privacy coins, custody vendors also face compliance and monitoring challenges.

- Third-party custodians and insurance: Institutional custodians with fiduciary-grade controls and insurance will be favored. But insurance limits for less-liquid altcoins may be thin, meaning funds will need to disclose coverage gaps.

Market surveillance and compliance

Regulators will press for surveillance to prevent manipulation and to ensure accurate NAV calculations.

- Surveillance-sharing arrangements with exchanges and market makers will be essential to meet exchange-traded product standards.

- For privacy-focused protocols, surveillance is operationally thorny — proving provenance of supply and transaction histories without undermining on‑chain privacy requires novel attestations.

Hybrid ETF mechanics: why they matter

Bitwise’s hybrid proposal attempts to square spot fidelity with the practicalities of fund operations. Hybrids can:

- Use spot holdings for price exposure while employing derivatives to manage liquidity or tax/timing mismatches.

- Allow for baskets or representative sampling when direct spot acquisition is impractical for every share creation/redemption.

But hybrids introduce basis risk: if the fund relies on derivatives or representative baskets during stress, NAVs can diverge from on‑chain price discovery, which in turn can amplify arbitrage flows and short-term volatility.

Likely market impacts for listed tokens

If any of Bitwise’s altcoin ETFs are approved and launch at scale, expect a set of predictable—and some less predictable—market responses.

Flows and spot demand

ETF listings concentrate buy-side demand through a single, regulated vehicle. This can be a powerful liquidity pump, particularly for mid-cap altcoins whose order books are thinner.

- Initial inflows could produce outsized price moves, especially if product demand exceeds the depth of custodial acquisition windows.

- Tokens with concentrated supply or active treasury sales (or large single holders) could see sharper moves as funds accumulate.

The Cypherpunk ZEC purchases illustrate how a significant buyer can alter available free float; institutional accumulation at scale interacts with ETF flows in the same way, except ETFs enable a broader set of institutions to participate passively.

Volatility and price discovery

- Short term: expect heightened volatility around listings, conversion/redemption windows and regulatory news. Arbitrage desks will be active, but they are not omnipotent — liquidity gaps can cause slippage.

- Medium term: ETFs can improve price discovery by creating a consolidated reference price and funneling institutional arbitrage that tightens spreads across venues. A well‑capitalized ETF can make markets more efficient for AAVE, ZEC or TRX.

- Long term: repeated ETF inflows and the emergence of ETF-tracking benchmarks can anchor valuations and lower the effective cost of capital for projects with steady token economics.

Benchmark and index creation

ETFs often accompany the creation of benchmarks or index methodologies. Over time, these indices become reference points for treasury valuation, derivatives pricing and corporate reporting, which in turn feeds more institutional demand.

How traders, DAOs and projects should prepare

Whether you manage a DAO treasury, run an asset manager or provide market-making services, the ETF wave demands preparation.

For DAO treasuries and corporate treasuries

- Review custody arrangements and counterparty risk. If your treasury exposure may be reallocated into ETF-like products, ensure custodians can handle large inflows or programmatic rebalancing.

- Consider staggered selling/vesting plans to avoid unfavorable slippage if funds begin buying significant amounts of your token.

- Tighten reporting and audit readiness: institutional counterparties will want clean provenance and proof of reserves.

For asset managers and market makers

- Build surveillance and compliance playbooks. Pre‑approved surveillance arrangements and exchange connectivity will be competitive advantages.

- Model basis risk under hybrid constructs and stress-test redemption scenarios. Liquidity providers should size quotes for potential ETF-driven flow shocks.

For token projects

- Communicate roadmap and governance clarity: institutional investors prize predictability. Clear tokenomics reduce the premium demanded by risk‑averse capital.

- Improve on-chain analytics and transparency. Even privacy projects can provide off‑chain attestations or cryptographic proofs that satisfy custody/compliance while preserving user privacy.

Practical checklist (quick wins)

- Audit custodial relationships and insurance limits.

- Establish liquidity playbooks: tiered selling, negotiation with market makers, and preferred exchange lists.

- Prepare clear, auditable disclosures for institutional counter‑parties.

- Run stress tests: creation/redemption runs, severe price moves, and partial market closures.

Closing perspective

Bitwise’s altcoin ETF filings are less a single product launch than a signal: institutions want regulated, portfolio‑grade exposure to a broader digital-asset set. If regulators approve hybrid structures and custodians step up, we should expect accelerated capital flows into mid-cap tokens like AAVE, ZEC and TRX, faster benchmark formation, and a re‑pricing of liquidity premia.

That said, the process will be iterative. Technical custody, surveillance gaps — especially for privacy coins — and the mechanics of hybrid designs mean that ETFs could both stabilize market structure over time and amplify short-term volatility at launch. Active managers, DAOs and projects that tighten custody, improve transparency, and model ETF flow scenarios will be best positioned to capture long-term benefits while minimizing near-term disruption.

For further reading on the filings and Cypherpunk’s Zcash accumulation, see the sources below. If you're managing a treasury or running market-making operations, now is the time to review custody contracts and stress tests — the window to influence product mechanics and readiness is open.

Sources

- https://coinpedia.org/news/bitwise-files-for-11-new-altcoin-etfs-beyond-bitcoin-and-ethereum/

- https://crypto.news/bitwise-proposes-11-hybrid-structure-etfs-tracking-aave-zec-trx-among-others/

- https://coinpaper.com/13470/cypherpunk-doubles-down-on-zcash-with-29-m-treasury-buy?utm_source=snapi

- https://www.coindesk.com/business/2025/12/31/winklevoss-backed-cypherpunk-buys-usd28-million-of-zcash-now-owns-1-7-of-supply