Did Solana Really Out-Earn Ethereum? Assessing Chain-Level Revenue and Developer Economics

Summary

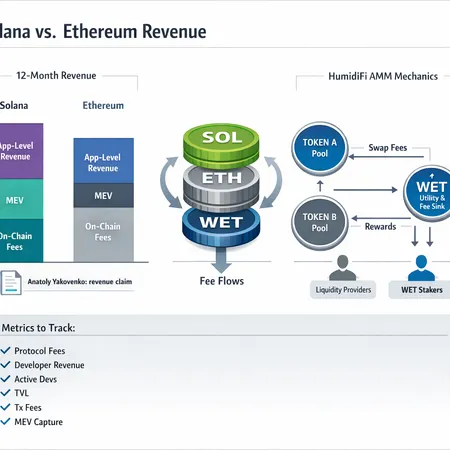

Executive snapshot

Anatoly Yakovenko — Solana’s co-founder — recently staked a bold claim that Solana out-earned Ethereum on a yearly revenue basis. That headline is compelling for on-chain investors and product teams deciding where to allocate developer time and liquidity. But revenue comparisons across chains are rarely apples-to-apples: differences in fee architecture, who captures fees, the role of MEV, and the amount of app-level value capture all matter. This piece breaks down the claim, inspects underlying drivers, profiles a Solana AMM as a working example, and lays out the concrete metrics investors should monitor.

What Anatoly Yakovenko actually said (and how credible it is)

Yakovenko’s claim is summarized in reports such as the U.Today piece that highlights his contention that Solana’s yearly on-chain revenue outpaced Ethereum’s. Read the original coverage here: Solana to surpass Ethereum in yearly revenue.

There are two immediate credibility checks:

- Definition: Revenue can mean total fees paid by users, fees retained by validators, or value accruing to protocols and token holders. Yakovenko’s framing appears to emphasize nominal on-chain fee receipts rather than a single canonical, standardized metric.

- Source transparency: public block explorers and analytics firms can surface gross fee totals, but attributing who ultimately keeps or burns those fees requires careful accounting (burns under EIP-1559, protocol treasuries, validator payout splits, and third-party relayers).

So, the claim is plausible at an aggregate-fee level — Solana’s extremely high transaction throughput and volume can produce large nominal fee pools — but the deeper question is who benefits from those fees compared with Ethereum’s economic architecture.

How chain-level revenue is generated: three buckets

Chain revenue and ecosystem economics stem from at least three distinct sources: on-chain fees, MEV capture, and app-level revenue (protocol fees, tokenomics). Each bucket behaves differently across Solana and Ethereum.

On-chain fees (gross fees, burns, and who keeps what)

Ethereum: Post-EIP-1559, the base fee is burned, reducing the supply of ETH and shifting the protocol-level arithmetic: higher fees can mean greater economic value to holders via deflationary pressure, but less direct cash flow to validators. Validators still earn the priority (tip) and block rewards; L2s and rollups add another layer of fee capture that often accrues to sequencers or L2 token economies.

Solana: Fees are low on a per-transaction basis, but very high throughput multiplies total fee volume. Solana’s fee structure does not have a base-fee burn mechanic analogous to EIP-1559; instead, nominal fees are distributed to validators and network participants. That means a larger slice of gross fee volume can be directly monetized by validators and node operators rather than being burned.

The headline effect: Solana can produce large nominal fee totals while Ethereum’s fee dynamics may look smaller at a glance because a significant share gets burned or allocated differently.

MEV (miner/validator extractor value)

MEV — value extracted by reordering, front-running, or sandwiching transactions — is a major revenue stream. The structure of MEV markets differs by chain: on Ethereum, a complex stack of searchers, builders, relayers, and validators exist (and L2s are building their own MEV ecosystems). Solana’s faster block times and different mempool dynamics change how searchers operate and how much value they capture.

MEV capture protocols and marketplaces (block builders, sequencer auctions) can systematically redirect profits to different stakeholders. A chain that makes it easier for validators or sequencers to extract MEV without sharing with the protocol or tokenholders will show higher on-chain revenue but not necessarily a healthier long-term economic model.

App-level revenue and tokenomics

This is the most important long-term variable. Protocol fees (e.g., swap fees in AMMs), lending interest spreads, NFT royalties, and token sinks (staking, buybacks) are how application-layer activity translates into sustained value for protocols and tokenholders. A chain with many apps that successfully capture value at the application level will produce more durable economic benefits than one with transient fee spikes.

Case study — HumidiFi and the WET token: an example of capture on Solana

HumidiFi is a Solana-built AMM focused on liquidity optimization with a native utility token, WET. The project’s token and fee mechanics showcase how app-level design can internalize value on Solana even when base fees are low. See a profile here: HumidiFi price prediction & profile.

HumidiFi captures value in several ways: protocol-level fees on swaps, token incentives that align liquidity providers with the protocol (staking, rewards denominated in WET), and secondary utility such as governance or fee discounts. Those flows directly reward WET holders or protocol treasuries rather than being absorbed solely by validators.

Why this matters: even if Solana’s per-transaction fees remain tiny, a vibrant set of applications that keep a share of tradable revenue is a reliable path to durable economic value for tokenholders and developers. In short: app-level capture can be more important than chain-level fee totals.

Ethereum’s pivot to security and the developer economics trade-off

Ethereum’s stated shift toward prioritizing security — with a 2026 emphasis on safe upgrades and rigorous protocol hardening — is more than a PR line. Coverage of the change in focus is summarized here: Ethereum shifts focus from speed to security with new 2026 deadline.

Practical effects for developers and investors:

- Slower cadence for risky, fast-moving feature rollouts. That raises time-to-market and auditing costs for developers.

- Higher assurance for capital and institutional actors who demand robust security, potentially attracting a different cohort of dapps and liquidity.

- A shift could re-balance where incremental revenue accrues: improved predictability might push more high-value financial applications to Ethereum despite higher short-term gas costs.

From a developer-economics standpoint, teams weigh faster iteration and lower per-op costs (a Solana advantage) against security guarantees and composability (still a strong Ethereum advantage). That trade-off will shape where teams put engineering effort and where liquidity pools aggregate over quarters and years.

What metrics should investors and product leaders track?

To judge whether Solana’s revenue lead is durable, follow a multi-dimensional dashboard rather than a single headline:

- Gross on-chain fees (monthly/yearly) and fee-per-transaction (to normalize for volume).

- Fee capture split: proportion burned vs. paid to validators vs. captured by protocols.

- MEV flows: estimated MEV revenue, and who receives it (validators, builders, apps).

- App-level revenue: protocol fee income for major dapps (AMMs, lending, NFT marketplaces). Track projects like HumidiFi to see if WET-style capture scales.

- Developer activity: new repo commits, deployments, smart contract audits, and grant distributions.

- Composability metrics: number of cross-protocol integrations, TVL composition by protocol type, and active wallets interacting with smart contracts.

- Retention and revenue per active user (RPAU): how much fee or protocol revenue each active user produces over 30/90/365 days.

- Liquidity and capital efficiency: DEX spreads, slippage metrics, and concentrated liquidity adoption.

Benchmarks: watch whether app-level revenues on Solana continue to grow as a share of total fees and whether validator/treasury capture remains stable. If Solana’s gross fee advantage narrows while app-level capture remains low, the leadership may be superficial.

A reasoned verdict: transient spike or durable shift?

Short answer: the claim that Solana surpassed Ethereum in yearly revenue may be accurate in gross terms, but it does not alone prove a lasting shift in chain-level monetization or developer economics.

Why:

- Solana’s throughput can generate large nominal fee pools, especially in periods of concentrated activity. But without mechanisms that systematically funnel fees into token-holder or protocol treasuries, that revenue can be ephemeral or accrue to infrastructure operators.

- Application-level capture (examples like HumidiFi/WET) are the best indicators of durability: if many dapps on Solana replicate sustainable token-aligned revenue capture, the ecosystem’s economics will deepen.

- Ethereum’s security-first posture may slow developer velocity but could enhance long-term capital inflows from risk-averse institutions and protocols that prioritize composability and secure money legibility.

In practice, both chains can co-exist with different niches: Solana as a high-throughput, low-cost execution layer that fosters fast product iteration and certain classes of AMMs, and Ethereum as a high-assurance settlement and composability hub. Product leaders should pick based on the trade-offs their product demands — and investors should watch the multi-metric dashboard outlined above.

Practical guidance for investors and product teams

- Don’t treat headline fee totals as the single truth. Break down who captures fees and whether revenue is recurring.

- Prioritize app-level revenue capture when evaluating protocol tokens (WET-style mechanics are a useful signal). Monitor several dapps, not just one flagship.

- If you’re allocating developer resources, map expected time-to-market and audit costs against target user LTV and revenue per user.

- Follow MEV market structures on each chain — changes there can rapidly re-route who earns what.

- Use tools and analytics providers to track fee splits, TVL composition, and active wallet metrics. Platforms like Bitlet.app can help teams think through liquidity allocation and installation economics in a multi-chain world.

Conclusion

Yakovenko’s claim is a useful provocation that forces a deeper look at how we measure blockchain revenue. But the real question for investors and product leaders isn’t which chain prints the largest gross fee number this year — it’s which stack enables sustainable value capture for protocols, tokenholders, and developers over multiple cycles. Watch fee capture, MEV dynamics, and app-level revenue closely; those are the strongest early indicators of durable chain-level monetization.

Sources

- Solana to surpass Ethereum in yearly revenue (Anatoly Yakovenko claim): https://u.today/solana-to-surpass-ethereum-in-yearly-revenue?utm_source=snapi

- HumidiFi profile and WET mechanics: https://crypto-economy.com/humidifi-price-prediction/

- Ethereum security shift and 2026 focus: https://cryptonews.com/news/ethereum-shifts-focus-from-speed-to-security-with-new-2026-deadline/

For further reading on protocol-level revenue mechanics and MEV, consult analytics from major on-chain data providers and protocol docs. Also see community discussions around Solana, Ethereum, and DeFi for on-the-ground sentiment and developer signals.