Solana’s Institutional and Retail Plumbing Upgrade: Coinbase DEX, Sovereign TER, and On‑Chain Funds

Summary

Executive overview

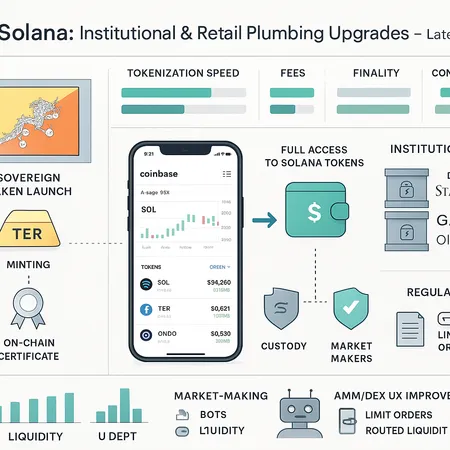

Late 2025 marked a meaningful inflection for Solana. Three complementary plumbing upgrades — Coinbase’s in‑app decentralized exchange that exposes any Solana token to app users, a sovereign token issuance (Bhutan’s gold‑backed TER), and a major institutional on‑chain fund commitment from State Street, Galaxy and Ondo — have together changed how liquidity, custody, regulatory risk, and user experience behave on the chain. Each development is significant on its own; combined, they materially accelerate the case for Solana as a primary rail for tokenized assets and on‑chain funds.

For product leaders and institutional allocators this is not just hypothetical: these are distribution and capital commitments that matter. Coinbase increases retail distribution and order flow; TER demonstrates sovereign provenance and asset‑backed token use cases; the State Street/Galaxy/Ondo initiative brings traditional institutional plumbing and compliance expectations on‑chain. Below we unpack technical effects, market structure implications, custody and compliance concerns, UX impacts, and how Solana stacks up versus EVM L2s for tokenization.

What changed: the three plumbing upgrades

Coinbase’s in‑app DEX: retail distribution meets Solana token breadth

Coinbase’s late‑2025 upgrade to its in‑app DEX lets users trade any Solana token directly inside the app, removing a significant discovery and onboarding barrier for tokens native to Solana. That change shifts retail order flow from isolated DEXs and niche wallets into one of the largest consumer venues in crypto. The upgrade effectively turns Coinbase into a major retail distribution channel for Solana tokens and reduces the friction between a user seeing a token and trading it onchain. See coverage of the upgrade for technical and product details.

Sovereign tokenization: Bhutan’s TER (gold‑backed)

Bhutan’s government launched TER — a gold‑backed digital token issued on Solana — demonstrating sovereign tokenization as a real, live use case. A government issuing an asset‑backed token provides a template for provenance, reserve mechanics, and redemption frameworks that other sovereigns or quasi‑sovereign issuers can reference. TER brings a distinct on‑chain narrative: not a purely speculative token but a token representing a commodity with an issuer who can be audited and engaged with offchain.

Institutional commitments: State Street, Galaxy and Ondo on‑chain fund plans

Institutional players are not just experimenting anymore. State Street, Galaxy, and Ondo’s plans to tokenize a private liquidity fund (an institutional liquidity vehicle) on Solana inject large, programmatic capital and conventional diligence practices into the ecosystem. The commitment signals that traditional custodians, asset managers, and market makers are building the rails necessary to support regulated, institutional product wrappers on‑chain.

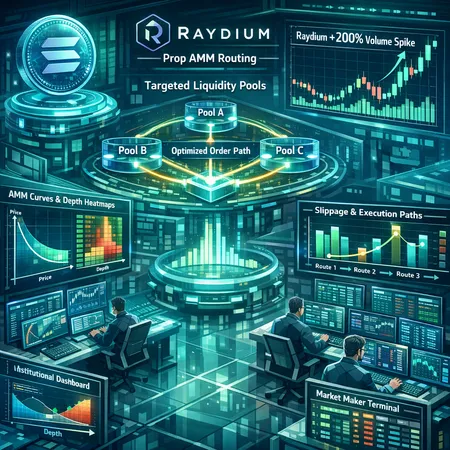

Liquidity: how order flow and market structure change

Coinbase’s in‑app DEX converts latent retail demand into actionable onchain liquidity. Historically, many Solana tokens sat behind wallet UX or small DEX UIs; now, a substantial portion of retail order flow can hit Solana token markets through Coinbase’s app. That helps in three ways:

- It increases available taker liquidity and reduces effective spreads for many tokens, particularly mid‑cap listings.

- It changes where liquidity is concentrated: more volume flows into venues and pools that have tight integration with Coinbase order rails, forcing market makers to adapt.

- It accelerates price discovery and can reduce fragmentation if liquidity providers route to highly visible pools.

At the same time, institutional on‑chain funds (ONDO‑style products) will deposit capital into yield strategies and private credit pools on Solana, creating programmatic supply and demand that’s stable and predictable relative to retail flows. The appearance of ONDO as a ticker and product design onchain gives liquidity providers (LPs) a clearer bid for longer‑dated exposures.

The net effect is less isolated illiquidity for tokenized instruments issued on Solana, but it also raises the technical bar for LPs and MM engines that must now operate across native AMMs, orderbook programs, and offchain execution venues.

Custody and institutional plumbing: custody models, settlement and auditability

Tokenized sovereign assets and institutional funds change custody requirements. Institutional allocators expect:

- Clear segregation of client assets and robust custody primitives (hardware security modules, MPC, or regulated custodial services),

- Auditable reserve and redemption processes for asset‑backed tokens like TER,

- Settlement finality guarantees that integrate with offchain compliance and accounting systems.

Solana’s account model and high throughput enable low‑latency settlement, which is attractive for fund settlement and NAV calculations. But custody providers and custodial workflows must adapt: operational tooling needs to support token standards used on Solana, reporting APIs, and onchain governance hooks. The State Street/Galaxy/Ondo initiative helps close that loop by building institutional‑grade custody and fund administration practices around on‑chain fund vehicles.

For product teams, the practical takeaway is simple: custody questions are no longer theoretical for Solana. Expect counterparties to request KYC/AML flows, audit reports for backing reserves (TER), and proof of custody for tokenized fund holdings. Bitlet.app and other product teams should ensure integration with regulated custodians and provide clear audit trails for institutional counterparts.

Regulatory questions and risk vectors

These plumbing upgrades bring regulatory scrutiny into sharper focus. Three risk vectors stand out:

- Securities classification: tokenized funds and yield products (including funds tokenized by ONDO‑like structures) may be treated as investment contracts in multiple jurisdictions. Issuers and platforms must design around exemptions or registration.

- Sovereign tokens: Bhutan’s TER reduces one type of risk (issuer credibility) but raises questions about cross‑border capital controls, reserve audits, and whether redemption rights are enforceable across jurisdictions.

- Exchange/operator compliance: Coinbase’s in‑app DEX sits between centralized custody and decentralized execution — operators will need to reconcile local DEX and exchange rules, KYC obligations, and on‑chain settlement rules.

Regulators will ask for transparency: proof of reserves for TER, audited fund structures for institutional on‑chain funds, and compliance frameworks for retail execution channels. For allocators, the prudent course is to require legal opinions, custody attestations, and chain‑level compliance checks before allocating significant capital.

DEX UX and product implications on Solana

Coinbase opening full access to Solana tokens inside a mainstream app changes UX expectations. Users expect:

- Discoverability: token search, curated lists, and warnings for risky tokens,

- Smooth gasless or low‑fee experiences: Solana’s fee profile supports this, but wallets and apps must mitigate failed transactions and slippage,

- Integrated custody: users will want custody options that feel as secure as centralized wallets while enabling onchain activity.

For product teams building DEX UX on Solana, the emphasis shifts from pure onchain innovation to orchestration: clear token metadata, liquidity signal displays, integrated best‑execution routing, and fallback mechanics if onchain pools lack depth. Coinbase’s model also highlights the competitive advantage of combining offchain UX polish with onchain settlement — a pattern product teams may wish to emulate.

Solana vs EVM L2s for tokenization: comparative assessment

Choosing a chain for tokenization is a tradeoff between throughput, tooling, liquidity, and regulatory clarity. Here’s how Solana compares with EVM L2s across key vectors:

- Throughput & cost: Solana’s architecture offers high throughput and consistently low fees, favoring high‑frequency settlement and micro‑payments. EVM L2s have improved, but fees and batching mechanisms still differ across rollups.

- Tooling & standards: EVM L2s benefit from mature ERC‑20/721 ecosystems, audited libraries, and composability across many protocols. Solana’s programming model (Rust programs) is performant but different; developers may face a steeper learning curve and fewer drop‑in integrations.

- Liquidity fabric: EVM L2s often inherit liquidity routing patterns from L1 and other L2s, but fragmentation is a problem. Solana’s recent retail and institutional flows (Coinbase DEX + on‑chain funds) materially reduce that fragmentation on a single chain.

- Custody & compliance: Traditional custodians and prime brokers have built more EVM tooling historically; however, institutional initiatives on Solana are closing the gap, bringing regulated custody and fund admin to the chain.

- Finality & risk: Solana’s fast finality is an advantage for settlement operations. But critics point to validator concentration and outage history as operational risks. EVM rollups trade off slightly slower finality for the security model and toolchain of Ethereum.

In short: Solana is now a viable primary chain for many tokenization projects, especially where high throughput, low latency settlement, and retail distribution (via Coinbase’s DEX) matter. EVM L2s remain compelling when developers need maximal composability with existing Ethereum tooling or when regulatory product wrappers expect EVM compatibility.

Practical checklist for product leaders and allocators

Use this checklist when assessing Solana for tokenized assets and on‑chain funds:

- Liquidity testing: run TWAP/back‑test scenarios using retail flow assumptions from Coinbase DEX and institutional order simulations from fund commitments (ONDO‑style). Monitor slippage curves for SOL, TER, and fund tokens.

- Custody & settlement: confirm custody providers support Solana native signing (MPC/HSM), reporting APIs, and third‑party attestations.

- Legal & compliance: obtain jurisdictional legal opinions on securities classification, AML/KYC obligations, and cross‑border redemption mechanics for asset‑backed tokens (TER use case).

- Counterparty due diligence: require audits, proof‑of‑reserves, and redemption guarantees for sovereign or commodity‑backed tokens.

- UX and execution strategy: design for discoverability, show depth and executed liquidity paths, and plan WM/market maker integrations to guarantee two‑sided markets.

- Interop & fallback: have a bridge or L2 fallbacks if you need EVM composability; maintain hedging strategies across chains.

Recommendations and where to focus next

If your firm is evaluating Solana as a primary chain for tokenization, prioritize these actions:

- Pilot small, regulated issuances with strong offchain governance and audited custody (a TER‑style instrument with clear redemption rules is ideal). Run the pilot with institutional counterparties and custodians active in the State Street/Galaxy/Ondo stack.

- Integrate retail distribution plans early. Work with platforms or DEX integrators that can route retail order flow — Coinbase’s in‑app DEX shows how powerful that can be for secondary market liquidity.

- Build operational resilience. Plan for monitoring validator health, outage mitigation, and reconciliation primitives so NAV and client reporting remain accurate.

- Keep legal and compliance teams involved from day one. Tokenized products interact with securities, commodities, and banking rules; early legal clarity reduces execution risk.

Conclusion

Late‑2025 plumbing upgrades on Solana — the Coinbase DEX rollout, Bhutan’s TER, and institutional commitments from State Street/Galaxy/Ondo — move the chain from a promising tech stack toward a practical market for tokenized assets. These developments knit together retail distribution, sovereign provenance, and institutional capital in a way that meaningfully improves liquidity and product viability. Tradeoffs remain: tooling and composability favor EVM L2s, while Solana offers settlement speed and retail reach.

For product leaders and institutional allocators, the moment calls for disciplined pilots, rigorous custody and legal frameworks, and thoughtful liquidity engineering. Solana should now be viewed as a first‑class candidate for tokenization strategies where speed, cost, and direct retail distribution matter.

For further system integration or product thinking about tokenized rails, keep an eye on how market makers, custodians, and exchanges adapt — and onchain ticks like SOL, TER, and ONDO for early market signals.

Sources

- Coinbase makes all Solana tokens accessible with new in‑app DEX upgrade

- Bhutan launches gold‑backed digital token on Solana blockchain (TER)

- State Street, Galaxy and Ondo onchain cash sweep / tokenized private liquidity fund on Solana

For context on Solana’s ecosystem and developer flows, see Solana and for broader market infrastructure trends consult DeFi. Bitlet.app teams evaluating integrations should ensure custodial and compliance requirements are embedded early in product design.