How Memecoin ETFs Will Reshape DOGE & SHIB Markets — A Strategic Guide

Summary

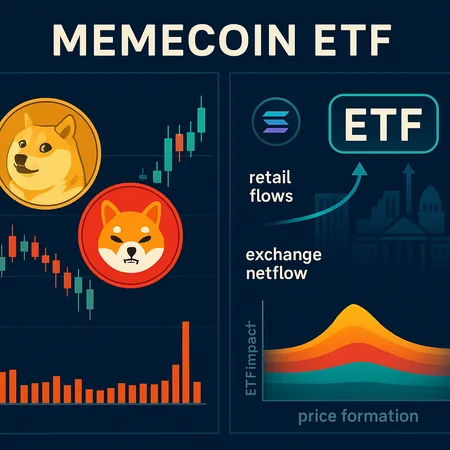

Why the memecoin ETF class matters now

Spot ETFs that hold tokens directly create a simple promise: investors can buy token exposure through a regulated wrapper without handling private keys. That changes distribution channels and — eventually — price mechanics. The market has already seen VanEck roll out a SOL-related product and the industry is preparing for a first U.S. spot memecoin ETF debut, signaling that issuers and intermediaries believe demand exists beyond fringe retail coverage and product notes. For traders, the immediate implication is structural: exposure can now flow through authorized participants, ETFs, and custodians rather than only through exchanges and wallets.

This matters because memecoins historically derive price action from concentrated retail flows, social narratives, and periodic liquidity vacuums. When an ETF starts buying or redeeming the underlying token to meet creation/redemption demand, it introduces a new, predictable participant in a market known for unpredictability. That reduces certain frictions — custody, on/off-ramp access — while introducing others: arbitrage windows, NAV-driven rebalancing, and regulatory oversight.

How ETF listings can change price formation and memecoin liquidity

The textbook ETF mechanics — creation/redemption, authorized participants (APs), and NAV arbitrage — create a tether between ETF price and the underlying token. For large-cap, liquid tokens that tether is tight; for memecoins, the tether will be noisier at first but still consequential.

Creation/redemption flows act as a buffer during net inflows or outflows. If a memecoin ETF attracts sustained dollars, custodians and APs will buy the token on exchanges or OTC desks, injecting liquidity. Conversely, redemptions can force sales into the market. That mechanism can amplify both rallies and declines depending on timing and execution.

Arbitrage behavior matters. Market makers will attempt to capture ETF discounts/premiums relative to NAV. For thin order books, arbitrage can be costly and lead to slippage — but it still provides incremental liquidity, especially near ETF rebalancing or heavy flows.

Institutional participation changes narrative drivers. Institutions tend to manage risk, size, and custody differently from retail: they may apply angle-lots, block trades, and OTC liquidity, which can smooth intraday volatility but increase correlation to macro risk appetite.

Custody and compliance can expand the investor base. Some allocators who avoided direct token custody may use ETFs as a regulated route; that could broaden demand but also link memecoin moves closer to equity-market style sell-offs in risk-off regimes.

All of this interacts with memecoin liquidity realities: shallow books, whale concentration, and fast retail cycles. An ETF does not solve low-latency order-book depth overnight, but it institutionalizes a repeatable buyer/seller and gives quant traders new signals to model — ETF flow, premium/discount, and creation unit size.

Short-term catalysts and the state of DOGE and SHIB

Memecoin ETFs introduce a medium-term structural change. Short term, markets are still driven by exchange flows, social chatter, and liquidity events.

DOGE: recent volume and momentum signals DOGE has registered a notable uptick in trading activity; one report flagged a roughly 43% jump in DOGE volume, which traders interpreted as a short-term rebound signal and a potential trigger for momentum-following systems (see the volume note here: DOGE volume jumps 43%). The narrative around Dogecoin often straddles a community-driven meme and broader retail enthusiasm — even comparisons to macro bellwethers like Bitcoin surface when traders ask whether DOGE is decoupling or simply piggybacking on risk appetite. That duality means surges in volume can quickly morph into directional squeezes, but also that moves may fail if they lack sustained flow (AP/ETF) support.

SHIB: selling pressure and netflow risk By contrast, SHIB’s supply dynamics make it vulnerable to concentrated selling. Analysts warned about a potential large SHIB selling wave driven by exchange netflow behavior and retail positioning, a structural headwind for rallies (see the SHIB exchange netflow analysis: selling wave alert). When large net inflows into exchanges occur, retail and automated sell algorithms can overwhelm limited buy-side depth. If a memecoin ETF starts sourcing SHIB in size, the initial buy pressure could lift price — but redemption events or AP-hedge sales could also accentuate downside.

Narrative friction: DOGE vs broader meme-story The Dogecoin story is different: it remains more price-resilient due to broader merchant/brand recognition and a larger market cap, and commentators continue to debate whether DOGE is a community asset or an elastic retail play (see discussion on Dogecoin vs Bitcoin narratives and presales in the marketplace: narrative dynamics). That ambiguity makes DOGE a more natural candidate for ETF inclusion from a marketability standpoint.

How to think about trades and allocations under ETF dynamics

Below are frameworks for retail and quant traders considering speculative meme exposure. These are not financial advice; treat them as tactical guardrails.

Practical allocation frameworks (retail-focused)

- Base size: keep memecoin ETF or spot memecoin exposure small relative to total portfolio. Suggested range: 0.25%–2% for conservative retail, 2%–5% for aggressive speculative allocations. Adjust downward if leverage or options are used.

- Position sizing by liquidity: scale not just by portfolio size but by the token’s 24h liquidity. For low-liquidity tokens, reduce size or use limit/OTC execution to avoid slippage.

- Staggered entries: buy in tranches tied to volume confirmation — e.g., 25% at signal, 50% on follow-through volume, 25% as a breakout leg. This helps against false breakouts common in meme markets.

- Stops and mental exits: set volatility-adjusted stop-losses (ATR-based) rather than static percentages; memecoin ATRs are large, so expect wider stops.

Quant and institutional-minded frameworks

- Signal construction: combine exchange netflow, 24h volume spikes, derivative open interest shifts, and ETF premium/discount signals. For example, a composite signal might require (1) >30% increase in spot volume, (2) ETF premium widening < 2% (to ensure arbitrageability), and (3) neutral-to-negative exchange netflow to avoid imminent sell waves.

- Volatility scaling: size = target_volatility / realized_volatility; cap allocations to limit on-chain liquidation curves. That keeps exposures manageable during explosive moves.

- Pair trades: consider ETF vs underlying arbitrage (when allowed) or long DOGE/short a correlated high-supply memecoin to isolate narrative-specific moves. Watch funding rates and basis in perpetual futures as additional signals.

- Execution: use block trades or OTC when building large positions to avoid front-running and slippage. Monitor creation/redemption schedules for ETFs — large timing mismatches create windows of illiquidity.

Tactical setups tied to ETF mechanics

- Monitor ETF premium/discount. A sustained premium suggests demand that may translate into spot buying by APs; a discount could indicate distribution risk. Quant systems can treat premium expansion as a buy signal if spot liquidity is sufficient to absorb expected AP buys.

- Watch creation unit inkouts. If ETF managers confirm large inflows and creation activity, that is a high-conviction sign of sustained demand; conversely, large redemptions warn of selling pressure.

- Hedging: maintain a hedge allocation — e.g., short a small amount of correlated risk (broad crypto or equity beta) during high euphoria phases. Options can offer defined-risk hedges if available.

Risk checklist and monitoring signals

- Exchange netflow: sustained net inflows to exchanges often precede selling; sustained withdrawals are a bullish signal for price support.

- Volume vs depth: spike in traded volume with no corresponding book depth increase screams fragility; treat such rallies as higher risk.

- ETF flows and creation/redemption notices: these are higher-quality signals for sustained directional moves than social metrics alone.

- Regulatory headlines: memecoin ETFs bring political attention. Any regulatory adverse rulings can change liquidity and listing dynamics fast.

Putting it together: a sample trade plan

- Thesis: buy DOGE via spot or ETF exposure after volume uptick confirms momentum. Signal: 43%+ volume spike + ETF premium narrowing <2%.

- Execution: enter in three tranches over 24–72 hours; use limit orders, or small OTC if >$250k notional.

- Sizing: cap to 1% of portfolio; volatility-scale to keep trade target 3% annualized risk.

- Hedge: set 25% of position notional in short broad crypto beta or buy OTM puts if available.

- Exit: trim half on 2x nominal expected return; use trailing ATR-based stop for the remainder.

Closing thoughts

Memecoin ETFs are not a panacea. They institutionalize a buyer and give quant traders new observables — ETF flows, premiums, and creation/redeption behavior — but the old rules still apply: memecoins are highly sensitive to retail flows, exchange netflows, and social momentum. Short-term catalysts for DOGE look constructive when volume confirms, while SHIB faces identifiable distribution risks unless exchange netflows and supply mechanics change.

For retail traders and quants, the best approach is disciplined sizing, systematic monitoring of ETF-related signals, and a willingness to use hedges. Keep an eye on SOL-related products like VanEck’s ETF developments as a precedent for how token ETFs behave under stress and demand (SOL context), and remember the macro bellwether role that Bitcoin can play in risk appetite cycles.

Finally, if you’re using consumer platforms to dollar-cost or layer exposure, ensure they support the trading and custody flows you expect — services like Bitlet.app are part of an ecosystem offering installment and on-ramp options for retail investors, but execution and cost differences matter. Stay humble, size small, and treat memecoin exposure as speculative satellite capital within a diversified playbook.