How 1inch’s Aqua and Aave App Rework DeFi Usability and Capital Efficiency

Summary

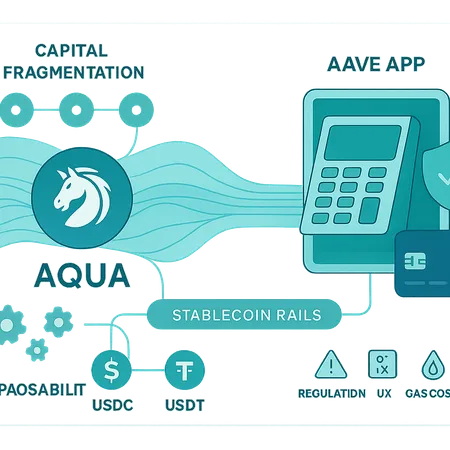

Why usability and capital efficiency are the core DeFi problems right now

Two recurring complaints among advanced DeFi users and product teams: capital fragmentation and poor retail on‑ramps. Capital fragmentation means liquidity is spread across many AMMs, chains, and strategies, lowering effective depth and raising slippage for large trades. Meanwhile, retail users still face confusing fiat rails, slow on‑ramps, and UX gaps that prevent broad adoption.

These problems are technical and product-led at once. Reducing fragmentation requires protocol-level primitives that let liquidity be pooled or reused, while better retail rails require compliant, low-friction interfaces that hand off funds to on‑chain contracts reliably. New offerings from 1inch and Aave tackle both sides: one optimizes where liquidity lives, the other optimizes how users get funds into DeFi.

1inch Aqua: a liquidity layer for reducing capital fragmentation

1inch’s Aqua proposes a dedicated liquidity layer designed to aggregate capital and make it reusable across AMMs and strategies. Instead of liquidity being locked into dozens of isolated pools, Aqua aims to act as a neutral substrate that AMMs and aggregators can tap into.

At a conceptual level, Aqua is trying to decouple liquidity provisioning from price discovery/AMM logic. That separation matters. When capital is pooled at a layer below AMMs, you get two immediate benefits: greater effective depth (because multiple AMMs can draw from the same deposits) and simpler routing (fewer fragmented pools to hop through). For traders, that means lower slippage; for LPs, it can mean more efficient utilization of capital and fewer capital-inefficient duplicate pools.

1inch’s announcement frames Aqua as enabling new strategies that were previously impractical when liquidity was siloed. For example, a single concentrated-liquidity vault could feed several AMM frontends with different pricing curves, or an optimizer could dynamically split LP positions across strategies without redeploying on each AMM. See the 1inch coverage for details on the protocol’s goals and architecture: 1inch unveils Aqua, a liquidity layer to optimize capital across DeFi and enable new strategies.

Practical AMM strategies unlocked by Aqua

- Shared concentrated liquidity: Liquidity providers deposit into a consolidated vault that multiple AMMs reference. This reduces duplicate capital allocations and allows LPs to express a single position that powers different markets.

- Routerless internalization: Aggregators can internalize swaps against the same liquidity pool without hitting external pools repeatedly, saving gas and reducing MEV surface if designed carefully.

- Dynamic risk layering: A liquidity layer can partition capital by risk (e.g., insured vs uninsured tranches) and expose those slices to AMMs or credit protocols selectively.

These ideas are powerful, but they come with engineering complexity: precise accounting, price-oracle design, and careful MEV/settlement handling. Aqua’s model raises questions about governance and incentives too — who pays for impermanent loss protection, and how are fee splits determined when multiple frontends use the same capital?

Aave App: retail rails, insured deposits, and stablecoin flow

Aave Labs’ consumer-facing move — an App with bank and debit-card rails plus insurance-backed protection — tackles the other half of the equation: how fiat and retail capital enter DeFi. The Aave App launch (high-yield savings accounts with bank/debit support and protection for deposits) reframes Aave not just as a permissionless protocol but as an accessible on‑ramp that looks and feels familiar to mainstream users. Read more about the features here: Aave App launches high-yield savings with bank/debit card support and unlimited stablecoin transfers.

For DeFi product leads, the significance is three-fold:

- Stablecoin rails: Direct fiat-to-stablecoin rails dramatically reduce friction in initial on‑ramps. If users can deposit fiat via debit card and receive USDC/USDT inside a wallet-like app, the conversion step that often scares newcomers disappears.

- Insurance-backed protection: Offering an insured floor (explicitly marketed) changes risk perception. Retail users are more willing to leave capital on-chain if there's a backstop for certain failure modes — assuming the insurance is credible and transparently funded.

- UX parity with banking: Integrating bank rails and debit cards means familiar flows (ACH, cards) and instant gratification, which lowers activation cost for use cases like recurring savings or payroll.

Aave App effectively blurs the line between off-chain rails and on-chain liquidity. Stablecoins minted or received via the App can be used immediately in DeFi strategies, supplied to liquidity layers like Aqua, or lent into protocols like Aave. That directness matters: moving from bank-to-stablecoin-to-AMM becomes a one-click experience rather than a multi-step technical undertaking.

Composability: what happens when liquidity layers meet retail rails?

The interesting bit for builders is composability. Imagine these flows:

- Retail user onboards via Aave App’s bank rail, receives insured USDC, and opts to allocate a percentage of deposits into a managed LP strategy that supplies liquidity to an Aqua vault. The vault then serves multiple AMMs, improving overall depth and collecting fees distributed back to the user.

- A yield-optimizing smart contract takes insured deposits from Aave App, routes them into low-slippage liquidity buckets in Aqua, and rebalances across L2s depending on gas and arbitrage windows.

This is not just theorizing. In practice, cross‑protocol composability depends on shared assumptions about token standards, account models, and risk. For example, trust assumptions change when custodial rails (Aave App UX) hand over fiat-converted stablecoins to noncustodial vaults (Aqua). Product teams will need clear UX flows and legal guardrails so users understand custody and insurance boundaries.

From a protocol design perspective, composability implies new primitives:

- Standardized deposit receipts or position tokens that represent a share of pooled liquidity and are easily transferrable across apps.

- Fee-and-incentive hooks so that frontends and vault providers can share revenue with on‑ramp partners (e.g., referral fees for deposits routed from an app into Aqua-backed LPs).

- Permissioned oracles and attestation layers to help custodial apps verify on‑chain state (balances, accrued yields) without forcing users to manage keys themselves.

Note also the operational perspective: Bitlet.app and others in the ecosystem can act as UX layers that integrate these primitives, enabling product teams to prototype cross‑rail experiences quickly.

Adoption obstacles: regulation, UX, gas, and trust

Even if the primitives exist, several adoption hurdles are real and non-trivial.

- Regulation and compliance: Apps that integrate bank rails and debit cards will face KYC/AML obligations. This can limit composability with truly permissionless primitives and complicate liquidity flows across jurisdictions.

- UX and mental models: Users must understand custody and insurance differences. An insured deposit inside an app is not always the same as on‑chain insurance for an LP position; product teams must avoid confusing users about counterparty risk.

- Gas and multi‑chain costs: Tapping a shared liquidity layer across multiple L1s or L2s increases cross-chain messaging and bridging. Without efficient abstractions (meta‑transactions, gasless UX, native L2 integrations), gas costs can erode gains from improved capital efficiency.

- MEV and front-running risks: Aggregating liquidity increases the surface for sophisticated searchers unless settlement designs and MEV-aware mechanisms are adopted.

- Trust in insurance and custodians: Retail adoption is sensitive to credible, well‑capitalized protection schemes. Insurers must be transparent and independent to move the needle on trust.

These obstacles suggest a phased adoption path: start with closed or semi‑permissioned experiments (insurance-backed vaults, single-chain integrations) and expand as tooling for user experience and regulatory compliance matures.

Recommendations for developers and product leads

- Experiment with vault abstractions and position receipts: build clear tokenized representations of pooled liquidity that can be moved between apps and L2s.

- Design UX that surfaces custody and insurance explicitly: show users where their funds live, what protections exist, and what risks remain.

- Optimize for gas early: consider batching, relayer models, and L2-first deployments to make shared liquidity economically meaningful.

- Partner on compliance rails: work with regulated FI partners for on/off ramps, but preserve composability via clear API contracts and attestation layers.

- Run small, auditable pilot programs: pilot insured liquidity vaults feeding an Aqua-style pool, and measure slippage, fee comp splits, and user retention before scaling.

Where this goes next

Aqua-style liquidity layering and Aave App–style retail rails are complementary. One reduces fragmentation and squeezes more utility from on‑chain capital; the other brings more retail money through simpler, insured on‑ramps. Together they can materially improve DeFi usability — but only if teams solve the UX, gas, and regulatory puzzles.

For DeFi product leads and advanced engineers, the near-term opportunity is ripe: build bridge primitives (position receipts, standardized attestation), test L2 integrations, and iterate on insurance models that can be externally verified. As more users flow in through better stablecoin rails, liquidity layers like Aqua will have the chance to prove their capital efficiency in real markets.

For technical reference and to follow these developments closely, read 1inch’s Aqua announcement and Aave App’s product notes: see the 1inch piece on Aqua and the Aave App coverage for the savings and rails integration.

If you’re prototyping, remember to keep user clarity front and center — and to measure whether improved capital efficiency actually translates into better retail experiences, not just prettier TVL metrics.

Further reading

- 1inch Aqua overview: 1inch unveils Aqua, a liquidity layer to optimize capital across DeFi and enable new strategies

- Aave App launch coverage: Aave App launches high-yield savings with bank/debit card support and unlimited stablecoin transfers

For hands-on product iterations, keep an eye on cross-protocol composability discussions inside the broader DeFi and Blockchain communities — and consider how Bitlet.app and similar platforms can simplify on‑ramps while preserving composability.