Scaramucci’s $100M Bet: Political Capital and the Future of U.S. Bitcoin Mining

Summary

A $100M moment: why this deal matters beyond dollars

The report that Solari Capital — led by AJ Scaramucci — committed more than $100 million to American Bitcoin, a mining firm tied to the Trump family, is consequential for reasons that go beyond simple capital flows. On one level it’s a classic growth capital story: miners need large, lumpy capex for rigs and power contracts. On another, it is a political signal: private mining capital is now visibly aligned with domestic political actors, which changes incentives for financiers, regulators, and industry peers.

According to Cointelegraph, the investment exceeds $100M and positions American Bitcoin to accelerate its U.S. expansion reporting on the Solari deal. Follow-up coverage emphasized the political optics and the potential for regulatory scrutiny around a politically connected mining strategy (Cryptopolitan).

American Bitcoin: strategy, footprint, and stated aims

American Bitcoin (company) has pitched itself as a domestic-first miner aiming to scale quickly in the U.S. market through site-by-site buildouts and power deals. The company’s model is traditional for industrial miners: secure long-term low-cost energy, deploy large batches of ASICs, and optimize for uptime. Where it differs is in the explicit linking of political capital and high-profile backers to the rollout.

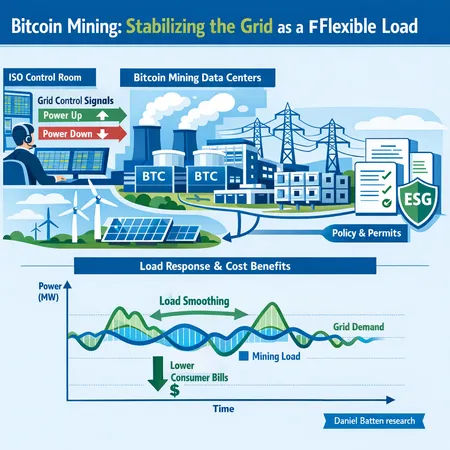

That strategy matters because mining is as much about infrastructure as it is about algorithms. Access to substations, transmission upgrades, and rapid permitting can be a bottleneck. A well-capitalized firm with political patrons can move faster on those fronts—but speed comes with attention.

Capital access: cheaper money, faster scale, and network effects

One immediate effect of politically connected funding is improved capital access. A $100M commitment from a high-profile vehicle lowers perceived execution risk for other creditors and equity partners; it functions as a signaling device. For miners, the implications are tangible:

- Lowered cost of capital for large build-outs, enabling more ASIC purchases and site activations.

- Faster ability to secure power contracts and lease sites, compressing time-to-hash.

- Attraction of secondary investors who prefer to co-invest alongside a known sponsor.

Those dynamics can accelerate the U.S. hash rate growth. More rigs come online sooner, which typically increases total network hash rate and raises difficulty adjustments for BTC. That reduces short-term rewards per miner but reinforces the barrier to entry—forcing smaller operations to compete on efficiency or niche opportunities.

Regulatory risk: scrutiny, politicization, and the downside of fame

Political backing is a double-edged sword. While it can grease access to resources, it also invites oversight. A politically connected miner is more likely to attract:

- Congressional attention on permitting and grid use, especially if local communities raise environmental or tax concerns.

- State-level scrutiny of power allocation and interconnection priorities.

- ESG-driven investor reviews and potential shareholder activism if environmental claims are weak.

The Cryptopolitan piece highlights how optics around a Trump-linked mining operation could amplify political criticism and invite hearings or PR campaigns. That matters for investors: regulatory delays or adverse rulings can turn a growth story into a stranded-capex problem.

ESG narratives: greenwashing risks and the race to prove sustainability

ESG has been both a sword and a shield in mining discourse. Miners increasingly tout renewables, curtailed energy arbitrage, or carbon-offset programs to neutralize criticism. But politically visible firms face elevated skepticism: claims are scrutinized not only for accuracy but for political motivation.

Investors and stakeholders will push for independent verification of emissions footprints, clear power sourcing contracts, and transparent disclosures. If American Bitcoin’s scale comes at the cost of opaque power arrangements or heavy reliance on fossil gas peakers, traditional ESG investors (and even some institutional allocators) may balk—whereas partisan supporters might not.

This is a reputational calculus: political capital can substitute for market trust in some circles, but it cannot easily neutralize independent ESG audits, local community opposition, or insurer underwriting standards.

Miner concentration, hash rate, and network health

An inflow of capital that enables rapid deployment can concentrate mining capacity in fewer hands or in clustered geographic footprints. That has several technical and market implications:

- Hash rate concentration: if American Bitcoin and similar well-capitalized firms command a large share of U.S. hash power, geographic and operator concentration increases. That elevates counterparty and operational risks.

- Network resilience: more hash rate is generally good for Bitcoin security, but concentration undermines censorship-resistance if coordination risks arise among dominant miners.

- Market dynamics: larger miners can influence spot power prices in local load pockets, negotiate privileged transmission upgrades, or wield economies of scale in maintenance and hedging.

Importantly, investor worries about BTC supply are often overstated: Bitcoin’s issuance schedule (block rewards) is fixed. This investment does not change BTC supply. It can, however, reduce effective decentralization and change the competitive environment for mining rewards, pushing marginal miners to consolidate or exit.

Does this signal a broader geopolitical shift in mining?

The U.S. has been vying for a larger share of the global mining pie since policy and enforcement changes in China in 2021. The Solari–American Bitcoin story fits a pattern: capital flows to jurisdictions seen as politically stable and aligned with Western infrastructure. But there are caveats:

- Concentration of politically backed capital in the U.S. may accelerate domestic growth, but it is not guaranteed to displace diversified global mining across Canada, Kazakhstan, or other energy-rich regions.

- Political investment can be episodic; it may ebb with election cycles or policy shifts that alter incentives.

- State-level energy markets and permitting frameworks remain the real gating factors; capital cannot buy a transmission line overnight.

Seen another way, this could be the beginning of a more overtly geopolitical phase in mining where national champions, aligned private capital, and energy policy converge—similar to how strategic industries like semiconductors attracted government attention.

What this means for investors and industry observers

For policy-aware investors and institutional allocators, the American Bitcoin case suggests several practical steps:

- Conduct political-risk due diligence: analyze potential regulatory actions, local permitting timelines, and reputational exposure tied to backers.

- Stress-test scenarios: model delays in interconnection, curtailment risk, or forced divestitures under adverse political outcomes.

- Demand transparent ESG disclosures: independent audits of carbon intensity, power contracts, and community impact are now table stakes.

- Watch concentration metrics: monitor major miners’ share of U.S. and global hash rate, plus geographic clustering of facilities.

Platforms such as Bitlet.app and token research outlets can be useful starting points for gathering operational data, but investors should supplement platform intel with independent grid- and permitting checks.

Watchlist: indicators to follow in the next 12–24 months

- Hash rate growth and difficulty trajectory: rising hash rate will confirm capital is being deployed at scale.

- Permitting and interconnection timelines for American Bitcoin projects: delays or denials are early red flags.

- ESG audit releases and third-party verification of power sources.

- Congressional inquiries or state regulatory filings referencing politically affiliated miners.

- Secondary financing rounds or institutional co-investments that either validate or dilute the initial political signal.

Bottom line

The Solari Capital investment into American Bitcoin is more than a $100M growth round; it is a case study in how political capital can reshape mining capital flows, regulatory risk profiles, ESG narratives, and miner concentration. For investors, the upside is faster scale and potentially outsized returns from early mover advantage. The downside is heightened scrutiny, reputational risk, and the long-term threat to network decentralization if concentration rises unchecked.

Policy-aware investors should balance the opportunities against scenario-based risks, demand transparency around power sourcing and governance, and track indicators that reveal whether this transaction is an isolated headline or part of a deeper geopolitical pivot in Bitcoin mining.