What Pacifica’s Rise Means for Solana Perps: Order Flow, Liquidity and SOL Price Support

Summary

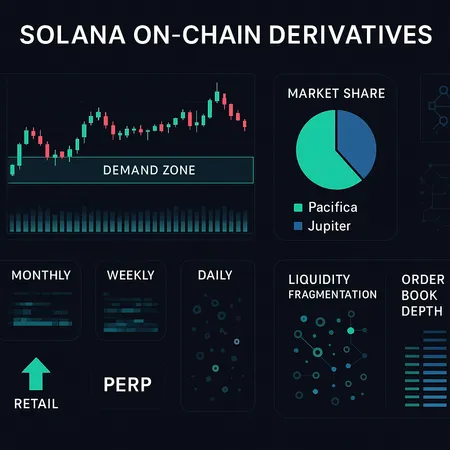

Executive snapshot

Pacifica has recently surpassed Jupiter to become the top perpetual DEX on Solana. For derivatives traders and market-structure analysts, that’s not just a leaderboard change — it can alter where order flow concentrates, how liquidity fragments across books, and ultimately how SOL finds support or capitulates around key technical zones (notably the $145–$155 demand area). This piece breaks down volume rhythms (daily, weekly, monthly), the differing roles perps play for retail versus institutions, the microstructure effects of centralization, and scenario planning if perps continue to centralize on Pacifica.

Why a venue shift matters: order flow and liquidity mechanics

A venue’s leadership matters because it captures the lion’s share of order flow. When traders funnel market and limit orders to one DEX, two things happen: deeper visible liquidity at tight spreads, and faster transmission of price signals (funding, liquidations, and large block trades) through that venue’s book.

- Order flow centralization improves execution quality: concentrated taker flow reduces cross-venue arbitrage frictions; the dominant book often becomes the price leader. That lowers slippage for large takers and improves fill predictability.

- Liquidity fragmentation declines, on-paper: fewer venues mean a bigger consolidated book and lower aggregate slippage for a given order size — but not necessarily lower systemic fragility.

However, centralization also creates single-point concentration risks: technical outages, exploitable matching-engine nuances, or incentive changes (maker rebates, fee schedules) on Pacifica will have outsized market effects.

Volume dynamics: daily, weekly, monthly patterns

Understanding timescale rhythms helps forecast where leverage will amplify moves.

Daily (intraday)

Retail-driven volume spikes around news, airdrops, or token listings. Intraday often sees shallow but noisy liquidity: many small taker orders and higher cancellations. When Pacifica consolidates this retail flow, you typically see:

- compressed spreads at peak hours, lower per-trade slippage for small-to-medium orders;

- faster propagation of price moves across the Solana ecosystem (DEX swaps, lending liquidations).

Weekly

Weekly dynamics smooth intraday noise and reveal directional conviction. Macro threads (earnings, macro risk-on/off, SOL staking announcements) push sustained directional perps flows. If Pacifica controls the weekly flow, it becomes the venue where directional positions are established and where funding rate imbalances first materialize.

Monthly

Monthly figures show where institutional-sized open interest accumulates. Institutions prefer stable books and predictable custody/settlement — they chase venues with depth, predictable funding, and audited risk controls. If Pacifica proves its infrastructure at monthly cadence, expect higher open interest concentration, meaning larger eventual liquidation webs and stronger feedback loops between funding and spot.

Retail vs institution: how perps behave differently

Perpetuals serve two overlapping but distinct user bases.

- Retail: short-term, high-frequency directional bets or leverage hunting. Retail flow spikes are episodic, sensitive to UI/UX, token integrations, and incentive programs (maker rebates, trading comps). Retail often provides top-of-book liquidity via many small limit orders, but that liquidity is fickle.

- Institutional: seeks predictable execution, deep hidden liquidity or TWAP/VWAP algorithms, and stable counterparty rules. Institutions create persistent open interest and often use larger notional sizes with bespoke settlement or custody.

If Pacifica’s rise attracts institutional desks (higher monthly OI, formal integrations), the net result is more durable price support for SOL during sideways markets. Conversely, if its dominance is driven primarily by retail incentives, support may be shallower and prone to fast unwind.

Liquidity fragmentation: why it matters for SOL

Liquidity fragmentation means the same notional sits in multiple smaller books instead of one deep book. Fragmentation increases aggregate slippage, creates arbitrage opportunities, and impairs large-fill execution. Pacifica’s ascendancy reduces fragmentation — but only if market participants actually migrate.

- Pro: greater aggregated depth — deeper top-of-book liquidity can absorb larger flows without violent price impact, which can strengthen on-chain price support around demand zones.

- Con: correlated liquidation risk — if the largest open interest pool sits on Pacifica, a single cascade (e.g., sudden drop in funding rates, cascading liquidations) amplifies down moves across the Solana ecosystem.

Technical levels and the $145–$155 demand zone

Many traders are watching a clustered demand zone around $145–$155 for SOL. Why this band matters:

- it’s a previous multi-week consolidation band where both spot and perp liquidity accumulated;

- it coincides with large limit order clusters historically visible on Solana DEX order books and off-chain OTC data;

- liquidations below this band could trigger stop runs and rapid funding shifts.

If perps centralize on Pacifica, expect two effects on the $145–$155 area:

- Stronger immediate defense: deeper books mean larger market buys absorb downside pressure, making the zone a firmer support in intraday to weekly horizons.

- Faster, more synchronized break: if that support fails, concentrated open interest can cause synchronized liquidations that accelerate the break and widen realized volatility.

Traders should watch order book depth (top 5–10 levels) and on-chain limit order clusters on Pacifica against residual depth on other venues like Jupiter to gauge whether the zone will hold.

Scenario planning: perps keep centralizing on Pacifica

Below are three realistic scenarios and the likely market-structure outcomes.

Scenario A — Smooth centralization (benign)

- Pacifica captures >50% market share, improves matching engine performance, and attracts institutional flow.

- Liquidity fragmentation falls; daily spreads compress and VWAP slippage declines.

- SOL price support around $145–$155 becomes more reliable; funding rates reflect true directional consensus.

What to watch: rising Pacifica open interest, narrower PAC/other DEX spread, increasing average trade size.

Scenario B — Centralized but retail-dominant (fragile)

- Pacifica leads by volume, but open interest remains retail-skewed and incentive-driven.

- Apparent depth is shallow under stress; off-book liquidity is limited.

- SOL prints false support — the $145–$155 zone holds superficially but fails under sustained macro shock.

What to watch: sudden funding spikes, quick order-book thinning during drawdowns, large proportion of small-sized trades.

Scenario C — Centralization creates systemic risk (adverse)

- Pacifica holds critical mass; a technical or governance issue triggers cascading liquidations.

- The market experiences amplified drawdowns as correlated perps positions unwind simultaneously.

- Price discovery gets impaired short-term; counterparties demand higher collateral or widen spreads.

What to watch: rising realized correlation between SOL and broader crypto declines, negative skew in funding rates, increased cancellation rates at top-of-book.

Practical checklist for derivatives traders and analysts

- Track Pacifica’s market share (volume and open interest) versus JUP and other Solana venues.

- Monitor funding rates across venues — widening divergences signal arbitrage and potential stress points.

- Watch order book depth at $145–$155 on Pacifica specifically (top 5–10 levels) and compare against residual liquidity on JUP and others.

- Observe trade-size distribution: rising median trade size suggests institutional adoption; many microtrades point to retail concentration.

- Keep an eye on liquidation clusters and on-chain event timelines: large, simultaneous liquidations concentrated on one DEX spell danger.

Tactical implications for traders

- For long risk near $145–$155: prefer venues with the deepest visible liquidity and lower historical fill slippage; partial fills and staged scaling in are prudent.

- For short or spread trades: watch funding-rate asymmetries. If Pacifica leads funding directionally, basis trades may be temporarily unprofitable unless hedged cross-venue.

- For execution algorithms: prefer TWAP/VWAP across multiple venues until the centralization proves stable. If Pacifica proves reliable, routing to its book can reduce market impact.

Broader nodal effects and policy questions

Centralizing perps raises governance and risk-management questions: how does Pacifica handle emergency halts, oracle failures, or margin model tweaks? The ecosystem will pressure Pacifica for transparency. Market participants — from retail bots to institutional desks — will recalibrate counterparty risk and required collateral accordingly.

Also note the usability landscape: user-friendly UIs, integrations with custodians, and incentives will determine whether centralization is durable. Platforms such as Bitlet.app that offer derivatives and custody-informed services will watch these flows closely as well.

Conclusion — measured watchfulness

Pacifica overtaking Jupiter is an inflection point for Solana perps and the broader DEX competition. Concentration can improve execution and reduce superficial fragmentation, which may firm up SOL support around the $145–$155 demand zone — but it brings new systemic and market-power risks. Traders and analysts should monitor Pacifica’s market share, open interest, funding dynamics, and order-book health to adapt strategies. In short: centralization can be both stabilizing and brittle. Prepare for both outcomes.