Gate Ventures and ADEN Integration: Boosting Decentralized Perpetual Trading on Gate Layer Chain

Gate Ventures has officially announced its integration with ADEN to expand decentralized perpetual trading capabilities on the Gate Layer Chain. This strategic partnership aims to bring enhanced decentralized financial services, particularly perpetual contract trading, to users with better speed, security, and scalability.

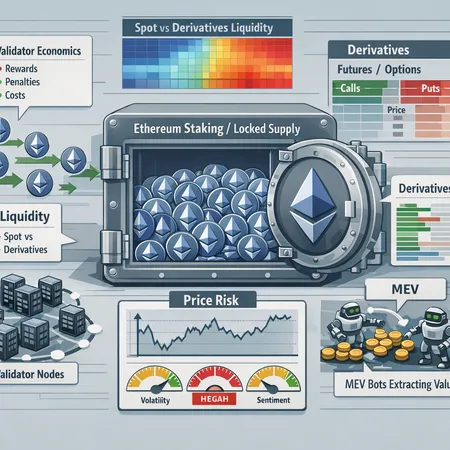

The Gate Layer Chain serves as a robust blockchain infrastructure that supports fast and secure transactions, making it ideal for decentralized trading applications. With ADEN's integration, users can expect more innovative trading products and improved liquidity options, boosting the overall trading experience.

This development marks a significant step towards broadening decentralized finance (DeFi) accessibility, allowing traders to engage in perpetual contracts with increased efficiency and reduced costs.

For those interested in purchasing cryptocurrencies to take advantage of such opportunities, Bitlet.app offers a flexible Crypto Installment service. This unique feature lets users buy cryptos now and pay monthly, reducing upfront financial pressure and enabling more traders to participate in emerging DeFi platforms like the Gate Layer Chain.

Stay tuned to Bitlet.ai for the latest updates on crypto innovations and how integrated platforms like Gate Ventures and ADEN redefine the trading landscape.