Crypto Market Trends in Q2 2025: Impact of 59% Drop in Venture Capital and What It Means for Investors

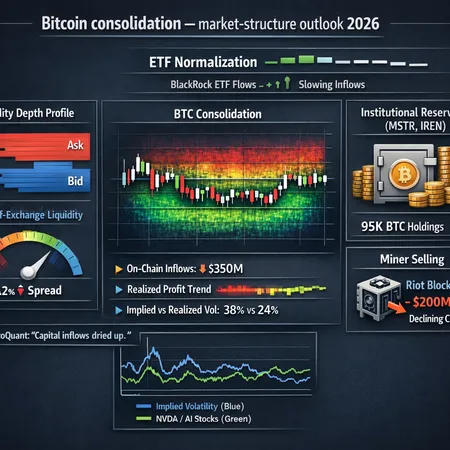

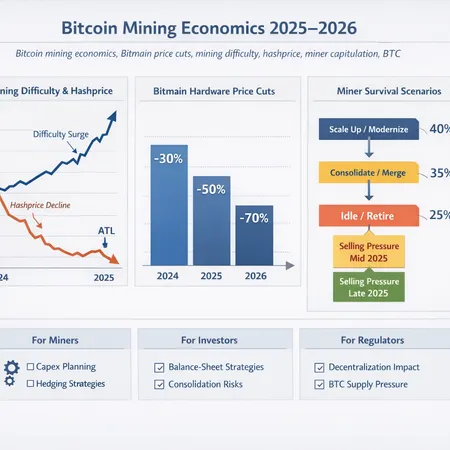

The second quarter of 2025 saw a substantial 59% decline in venture capital funding flowing into the cryptocurrency space. This sharp downturn signals a shift in investor sentiment and has notable implications for both startups and retail investors alike.

For investors, this contraction means increased caution around new projects, leading to a more selective funding environment. While this may limit some innovation, it also encourages maturity and focus within crypto ventures.

Amidst these market challenges, platforms like Bitlet.app provide a valuable service for investors. Bitlet.app offers a Crypto Installment service, allowing users to buy cryptocurrencies now and pay monthly instead of paying in full upfront. This flexibility is especially helpful during times of market uncertainty, enabling investors to build their crypto portfolios gradually without heavy immediate capital outlay.

Investors should stay informed on market trends, consider diversified strategies, and leverage tools like Bitlet.app to manage risk effectively. The dip in venture capital funding suggests a market undergoing consolidation but also opens opportunities for long-term holders and strategic participants.

In summary, the 59% drop in venture capital in Q2 2025 presents challenges but also pushes the industry toward greater resilience. Using innovative platforms such as Bitlet.app and maintaining a disciplined investment approach can position investors to thrive even in a more cautious environment.