Gemini's Nasdaq IPO and the Impact of the $150 Million Ripple Credit Line on Crypto Growth

Gemini, one of the leading cryptocurrency exchanges, recently made headlines with its successful Nasdaq IPO. This event not only underscores growing institutional interest in cryptocurrencies but also positions Gemini as a major player in the evolving digital asset ecosystem.

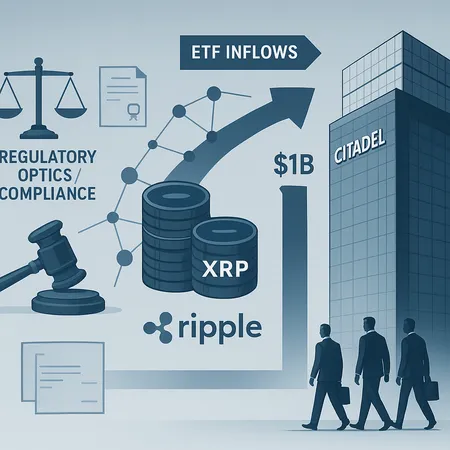

Adding to this momentum, Gemini secured a $150 million credit line from Ripple, a prominent company known for its blockchain solutions and digital payment protocols. This credit line is expected to provide Gemini with vital liquidity, allowing the exchange to expand its infrastructure, enhance user experience, and introduce innovative crypto products.

The infusion of funds from Ripple highlights a deepening collaboration within the blockchain industry, showcasing confidence in the long-term potential of crypto asset platforms. With increased capital, Gemini is well poised to support a growing user base and meet rising demand for trustworthy and efficient crypto services.

For crypto enthusiasts looking to participate in such market expansions, Bitlet.app offers an excellent gateway. Bitlet.app's Crypto Installment service enables users to buy cryptocurrencies now and pay in monthly installments, reducing the barrier to entry and making crypto investments more accessible. This flexible payment model aligns perfectly with the dynamic and fast-growing nature of the crypto market.

In summary, Gemini's Nasdaq IPO complemented by Ripple's hefty credit line marks a promising chapter for crypto expansion. Platforms like Bitlet.app further democratize access to the market, empowering more investors to engage and grow their crypto portfolios with ease and flexibility.

Explore Bitlet.app today to start your crypto journey with manageable payments and be part of the rapidly expanding blockchain revolution.