The Challenges Facing Ethereum: A Deep Dive into Its Recent Decline

Ethereum, one of the leading platforms in the blockchain and cryptocurrency space, has recently faced several challenges that have contributed to its decline. As the second-largest cryptocurrency by market capitalization, fluctuations in its value have significant implications for the broader market. Various factors such as increased competition from other blockchain platforms, scalability issues, and regulatory scrutiny are salient points in understanding Ethereum's current predicament.

Increased Competition: Newer blockchains are emerging with innovative technologies that promise faster transaction times and lower fees. This increased competition may draw developers and users away from Ethereum, leading to a decline in its adoption and usage.

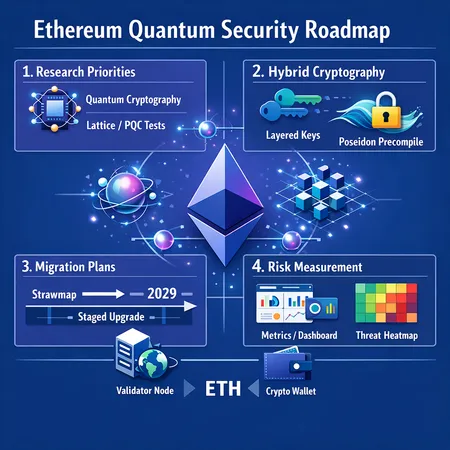

Scalability Issues: Ethereum has long struggled with scalability, particularly during periods of high transaction volume, which leads to network congestion and skyrocketing gas fees. Although the transition to Ethereum 2.0 seeks to address these issues, delays and technical hurdles have hindered the overall effectiveness of this upgrade.

Regulatory Challenges: As governments worldwide tighten regulations surrounding cryptocurrencies, Ethereum has faced scrutiny regarding its governance and the operational models of projects built on its platform. This uncertainty can deter investors and developers, impacting market sentiment.

Market Sentiment: Investor sentiment plays a crucial role in the cryptocurrency market, and negative news or downward trends often lead to panic selling. Ethereum's price decline may be exacerbated by broader market trends, including shifts in investor confidence.

In this context, users looking to invest in or utilize Ethereum can consider diversifying their crypto portfolio. Platforms like Bitlet.app offer unique services, such as Crypto Installment, which allows users to buy cryptocurrencies, including Ethereum, and pay monthly instead of upfront. This can provide an accessible option for investors looking to optimize their crypto investment strategies amid market uncertainty.

As Ethereum works to overcome these hurdles, it remains to be seen how its future will unfold in the ever-evolving world of digital currencies.