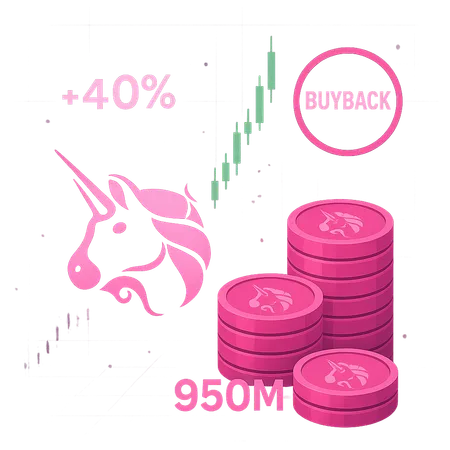

Uniswap Soars 40% After Revealing New Buyback Plan — What Traders Need to Know

Summary

Market reaction and immediate price impact

Uniswap's announcement of a new buyback plan sent UNI sharply higher, producing an intraday rally of about 40% as traders rushed to price in potential reductions in circulating supply. The market's response was swift: higher volume, elevated open interest in derivatives, and visible liquidity shifts on major exchanges. This surge reflects both speculative momentum and genuine demand from holders who see buybacks as a mechanism to support long‑term token value.

On‑chain accumulation: a major signal

Throughout 2025, UNI accumulation has been steadily rising — the protocol and its associated entities now hold over 950 million UNI tokens on‑chain. That level of accumulation is significant because it represents a large pool that can be deployed for buybacks, grants, or other treasury actions. On‑chain observers view this as a tangible resource that can materially affect supply dynamics if the protocol executes sustained repurchases or burns.

Why accumulation matters for tokenomics

Large treasury balances alter the game: they give governance and core contributors optionality. A committed buyback program funded by existing holdings can compress floating supply without requiring new revenue streams. However, the effectiveness depends on execution cadence, transparency, and market timing. The announcement triggered immediate optimism, but markets will want to see clear mechanics — whether the protocol will buy on open markets, execute timed auctions, or use swaps through liquidity pools.

What this means for UNI holders and traders

For long‑term holders, a credible buyback plan can be a bullish structural feature: it signals active treasury management and aligns incentives with token appreciation. Short‑term traders should expect increased volatility as buyback flow interacts with market liquidity; derivative desks may widen spreads or adjust hedges in response. Institutional participants and market makers will watch for on‑chain signals and governance proposals to determine how committed the team is to ongoing repurchases.

Risks, open questions, and governance considerations

While the headline move is positive, several caveats remain. Key questions include the funding source for the buybacks, the governance approval process, reporting cadence, and whether repurchases will be permanent (burns) or temporary (reserving tokens). Execution risk is real: poorly timed buybacks can overpay during rallies, and opaque operations can erode trust. Additionally, broader market conditions — including macro volatility and shifts in blockchain liquidity — will influence outcomes.

Broader market context and final takeaways

Uniswap’s buyback plan is part of a larger trend where decentralized protocols actively manage token supply to influence price dynamics. This movement intersects with other sectors like NFTs and memecoins, where supply actions often generate outsized market responses. Platforms such as Bitlet.app that offer installment and P2P services may see increased activity as users reposition portfolios around headline events.

In short: the 40% jump reflects market enthusiasm and the weight of 950 million+ UNI in protocol control, but the long‑term impact hinges on transparent, disciplined execution. Traders should monitor governance updates, on‑chain flows, and official disclosures before assuming sustained bullishness.