Buyback

Upexi authorized a $50 million share buyback after its stock plunged 47% and holds roughly 2 million SOL on the balance sheet. Institutional Solana treasuries have largely maintained positions even as many crypto-backed stocks trade below their Solana-backed net asset value.

dYdX’s governance has approved a proposal to raise the protocol’s DYDX buyback allocation from 25% to 75% of net revenue. The change directs a much larger share of earnings into token repurchases, potentially tightening supply and supporting price discovery.

Upexi, tied to the Solana ecosystem, unveiled a $50 million share buyback plan after its stock plunged more than 50% over the past month. The company says the move is intended to bolster shareholder value amid heightened market volatility and regulatory uncertainty.

dYdX governance voters approved allocating 75% of protocol revenue to DYDX token repurchases, enabling up to 5% of the total supply to be bought back annually. The move tightens tokenomics and may provide longer-term price support.

Nasdaq-listed Upexi (UPXI) said its board authorized repurchases of up to $50 million of its common stock on Thursday, signaling active capital management from a Solana-focused digital asset treasury. The move reflects a broader shift of crypto treasuries toward buybacks to return capital and potentially support share prices.

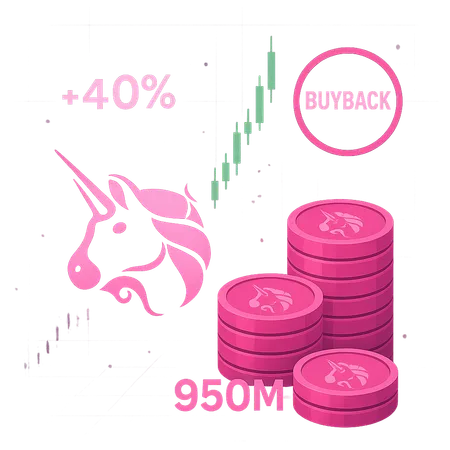

Uniswap (UNI) surged about 40% after the protocol unveiled a fresh buyback plan, with on‑chain accumulation now surpassing 950 million UNI. Market participants are weighing supply compression against execution risks as volatility spikes.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility