Institutional Moves in the Recent Bitcoin Sell‑Off: Mt. Gox, ETFs, El Salvador, Tether and the Liquidity Picture

Summary

Executive snapshot: what this roundup covers

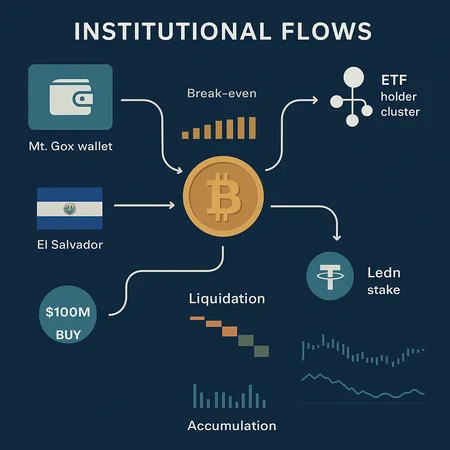

The recent Bitcoin sell‑off was not a retail story alone. It involved a stack of institutional maneuvers — on‑chain transfers, futures liquidations, sovereign buying and private corporate positioning — all interacting in a compact time window. This piece tracks the most consequential moves (Mt. Gox, ETF holder behavior, liquidation imbalances), highlights sovereign and corporate accumulation (El Salvador, Tether), and interprets what those signals mean for near‑term BTC volatility and institutional conviction. For many traders, Bitcoin remains the primary market bellwether; for allocators, the question is whether these flows represent redistribution or re‑allocation.

On‑chain spotlight: Mt. Gox and the large custodial flow

A headline move that caught market attention was the near‑$1 billion transfer tied to the Mt. Gox trustee. The event, analyzed in detail by CryptoTicker, involved significant BTC movement between trustee‑controlled wallets and external custodial addresses. At face value, such transfers are ambiguous: they can be preparatory (reorganizing assets across custody providers) or precursor to sales.

The market reaction depended on timing and context. In a stressed market, a large transfer can be interpreted as an imminent sale and trigger defensive positioning. But on‑chain heuristics matter: whether funds move to known exchange deposit addresses, to cold‑storage multisigs, or to OTC counterparties changes the implication. CryptoTicker’s write‑up suggests caution before assuming an immediate dump: large custodial shifts can simply reflect trustee logistics. Still, the psychological effect is real — watch the destination clusters and subsequent on‑exchange inflows as a confirmation signal.

ETF holders and break‑even dynamics: sticky flows amid a slump

Institutional ETF holders are not monolithic. Cointelegraph’s coverage of institutions “leaning into crypto” even during a price slump captures an important tension: some allocators view dips as accumulation windows, while others — particularly short‑dated, performance‑sensitive funds — face break‑even constraints that force rebalancing.

ETF break‑even dynamics matter because they determine marginal selling pressure. If a meaningful tranche of ETF creation happened near recent highs, those holders have a long runway and may sit through volatility if mandates and risk budgets allow. Conversely, near‑term entrants or funds with strict drawdown rules can create outsized selling as they hit stop thresholds. For analysts, layering ETF position vintage analysis (when shares were created, at what NAV) on top of daily flow data gives a clearer read on who might sell next.

Futures stress: liquidation imbalances and the mechanics of market pain

Liquidation events amplify price moves. A striking datapoint reported recently was a pronounced liquidation imbalance that produced a large gap — on the order of hundreds of millions in concentrated long/short squeezes — feeding momentum in one direction. The U.Today piece documenting a 1,364% liquidation imbalance and a $187 million gap illustrates how derivatives plumbing can magnify fundamental news into outsized price moves.

Mechanically, the combination of concentrated stop orders, funding rate swings, and thin order books at key levels can turn a directional move into cascading liquidations. For market makers and institutional desks, that means temporary spikes in both realized volatility and slippage. Watching perp funding rates, Open Interest across exchanges, and short/long concentration metrics provides early warning for potential cascade points.

Sovereign accumulation: El Salvador’s $100M purchase and the political buy signal

Sovereign buys are a different animal. El Salvador’s announced $100 million BTC purchase — expanding national reserves — is a structural demand signal that echoes beyond the backyard of that country. The Crypto‑Economy report shows that sovereign accumulation can act as a long‑term bid, changing the narrative from purely speculative flows to state‑backed reserve policy.

That said, sovereign purchases carry nuance: timing, tranche size, and transparency matter. A sovereign with ongoing dollar needs might sell in stress scenarios, and concentrated state holdings can magnify counterparty perceptions of centralization risk. Still, when states accumulate publicly, the message to markets is commitment — and for some institutional allocators that reduces behavioral barriers to adding exposure.

Strategic corporate plays: Tether’s stake in Ledn and the collateralization story

Tether’s strategic investment in Ledn — a move into Bitcoin‑backed lending — signals a pivot from pure stablecoin operations toward providing structured credit against BTC collateral. Reporting on this by Bitcoin.com highlights the evolving corporate landscape where firms that issue USDT (the dominant stablecoin) also look to deepen BTC‑linked financial services.

Why this matters: if major liquidity providers and stablecoin issuers become active lenders or custodial lenders against BTC, they increase institutional capacity to take leveraged bets or to provide financing for spot accumulation. That can compress spreads in OTC and lend markets, but it also introduces counterparty and liquidation risk chains that propagate stress if collateral values fall sharply.

Moreover, Tether’s move suggests the stablecoin‑to‑Bitcoin nexus will be more important than ever. Watch USDT issuance/redemption activity alongside on‑chain transfers as a proxy for latent buying or deleveraging pressure.

Putting the pieces together: how these flows interact

When you overlay custodial transfers (Mt. Gox), ETF holder heterogeneity, futures liquidation imbalances, sovereign buys, and corporate positioning, a few themes emerge:

Asymmetric time horizons. Sovereigns and long‑term institutional allocators operate on multi‑year horizons. ETFs and short‑dated funds are more sensitive to near‑term NAVs and performance windows. These differing clocks create both a deep base of demand and episodic selling pressure.

Derivatives as an amplifier. Even modest directional news can trigger outsized moves if liquidation imbalances and concentrated open interest coincide at thin order‑book levels.

Stablecoin plumbing matters. Moves by USDT issuers into lending and credit change the supply of leverage and margin capacity available to the market, affecting both the amplitude and duration of sell‑offs.

Narrative vs. execution. Public announcements (sovereign buys, corporate stakes) shape sentiment; execution‑level data (exchange inflows, OTC prints, wallet clustering) decide whether that sentiment translates into realized price support.

Near‑term implications for price stability and institutional conviction

For the next few weeks, expect elevated volatility as institutions reassess exposures. Specific tactical implications:

Short squeezes and cascading liquidations remain a tail risk. Watch funding rates and open interest concentration for early signals.

Custodial outflows to exchange deposit addresses are the clearest signal of imminent selling; large trustee or cold‑wallet transfers are ambiguous until destination patterns emerge. Monitor known exchange labels and OTC gateway addresses.

Sovereign and strategic buys provide structural support but are not a panacea. They lower long‑run risk premia but can coexist with sharp interim drawdowns.

USDT flow metrics are increasingly predictive. Rapid minting or redemption, plus flows into margin desks, often precede directional moves.

Analysts should triangulate across on‑chain heuristics, exchange flow data, and derivatives metrics rather than relying on any single indicator.

Practical watchlist for institutional desks and allocators

If you manage institutional exposure or advise funds, prioritize these controls and signals:

- Monitor exchange inflows/outflows for labeled Mt. Gox/trustee addresses and known custodians. A transfer into exchange hot wallets is materially different from a move to multisig cold storage.

- Track ETF creation/redemption vintages and NAV break‑even windows — older, low‑cost basis holders are less likely to sell on short volatility.

- Keep an eye on perp funding spreads, open interest across centralized venues, and liquidation imbalance reports such as the recent U.Today analysis for early squeeze risk.

- Watch USDT issuance/redemption and major stablecoin flows; they show where liquidity is coming from or leaving the system.

- Follow sovereign disclosures and corporate strategic moves as signaling events that can change narrative and mandate alignment.

Final reading and sources

This synthesis draws on contemporaneous reporting and on‑chain analysis. For further context, see the reporting on the Mt. Gox transfer and market implications (CryptoTicker), institutional buying patterns amid price weakness (Cointelegraph), El Salvador’s purchase (Crypto‑Economy), Tether’s strategic stake in Ledn (Bitcoin.com), and a detailed read on liquidation imbalances (U.Today).

This is an evolving picture — institutions change tack quickly, and on‑chain signals often lead price. Tools that combine exchange flow telemetry with derivatives and stablecoin metrics (many desks and platforms, including Bitlet.app, now surface these indicators) will be invaluable for navigating the coming weeks.