Why Cash App and Other Payment Providers Route Stablecoin Payments on Solana, Not Bitcoin

Summary

Executive snapshot

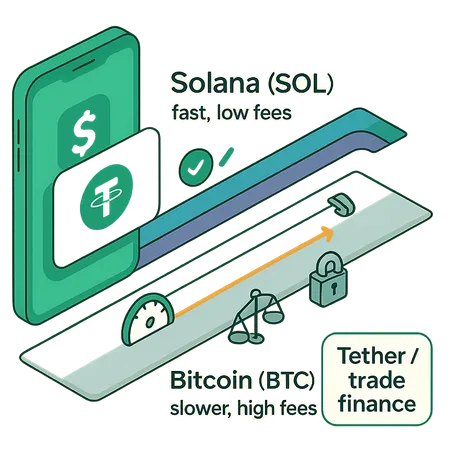

Payment apps that need to move fiat-like value at scale are increasingly routing stablecoin payments on Solana rather than on Bitcoin. The decision comes down to three product-level priorities: scalability, latency, and per-transaction cost — all of which directly shape wallet UX, reconciliation flows, and merchant settlement guarantees. This article explains the engineering tradeoffs behind that choice, grounds the discussion in Cash App’s rationale, and explains why Tether’s push into trade finance also matters for product and risk teams integrating USDT rails.

Why mainstream payment apps choose Solana for stablecoin payments

Cash App’s decision to run stablecoin payments on Solana (rather than attempting to route everything via Bitcoin) is emblematic. The reasoning is pragmatic: high throughput, predictable and tiny fees, and very low confirmation latency let mainstream products deliver a frictionless payment experience. AmbCrypto lays out this logic from a product lens — that Cash App prioritized Solana for stablecoin payments because it matches the speed and fee profile required for an app-scale payments UX (analysis of Cash App’s choice).

From a product manager’s standpoint, the consequences are immediate:

- Faster on-chain confirmations mean users see near-instant success states, reducing support tickets and chargeback disputes.

- Lower and predictable fees mean price framing is simpler — you can hide blockchain costs behind a micro-fee or absorb them as cost of goods.

- High throughput enables batching and multi-recipient transactions, which matter for payroll, remittance, and P2P flows.

These advantages feed directly into wallet UX: short waiting times, rarely visible gas configuration screens, and fewer “retry” flows.

Solana’s technical advantages for stablecoin rails

Solana’s design choices make it attractive for payment rails. Architecturally, its Proof of History (PoH) mechanism and parallelized runtime let validators order and process many transactions quickly, lowering both latency and per-transaction compute costs. Practically this means SOL-based networks can sustain high transactions-per-second with fees that are a tiny fraction of legacy layer-1s.

Operationally, payment engineers can exploit Solana’s strengths:

- Batching and bundling: High throughput and low fees mean providers can combine many micro-payments into single settlement operations, reducing on-chain hit rate and simplifying accounting.

- Near-instant UX: Sub-second to few-second finality (in practice) enables apps to show completed transfers immediately, which is critical for consumer expectations around “instant” payments.

- Lower infrastructure cost per tx: Validators and indexers face lower per-transaction compute, letting payment providers scale wallets and hot-wallets more economically.

For product teams, the result is clear: Solana enables consumer-grade payment interactions that are hard to deliver on BTC without expensive L2s or custodial compromises.

The tradeoffs: security, reorgs, and settlement finality (vs Bitcoin)

Speed and cost do not come for free. The primary tradeoffs are different failure modes and finality semantics compared to Bitcoin.

Bitcoin (BTC) is optimized around robust, slow-moving settlement and long-term immutability. For large-value settlement, this is a feature: deep PoW security, widely distributed mining, and conservative confirmation policies give firms confidence in finality. If your product’s highest priority is maximal censorship-resistance and the strongest possible 51% attack resistance, Bitcoin’s properties matter.

Solana optimizes for low latency and high throughput. That introduces risks engineers must explicitly manage:

- Shorter-but-not-absolute finality: Solana’s confirmations are fast, but the network has experienced transient forks and occasional extended recovery operations. Payment systems should adopt pragmatic confirmation thresholds (e.g., wait additional blocks for high-value transfers) and design idempotent reconciliation.

- Reorg handling and rollbacks: Wallet and backend logic must tolerate rare reorgs — detect and reconcile state changes, avoid double-crediting customer accounts, and implement robust replay-protection.

- Centralization vectors: Faster chains often rely on tuned validator hardware and smaller effective validator sets for performance, which can raise governance and censorship considerations for high-risk flows.

A hybrid operational model is common: use Solana for fast customer-facing UX and perform periodic settlement to stronger security anchors (e.g., BTC or audited custodial ledgers) for large-net positions. That pattern preserves UX while mitigating systemic settlement risk.

For context, product teams should not treat on-chain confirmation as a single authority for settlement. Instead, think of on-chain events as one input into a broader reconciliation pipeline that includes off-chain proof-of-reserve, custodial confirmations, and AML/compliance checks.

Wallet UX and gas fee implications

One of the biggest wins with Solana rails is simplified wallet UX. Lower fees and predictable costs let designers hide gas complexity from users in ways that make crypto payments behave like debit-card transfers:

- Gas abstraction becomes practical: Service providers can subsidize or absorb minimal fees without risk of large unexpected spikes.

- Fewer user decisions: No need for users to set gas price or select fee tiers; fewer failure states reduce support overhead.

- Smoother merchant integrations: Merchants receive predictable settlement times and can automate payouts without manual gas management.

However, engineers must still design for edge cases: sudden fee pressure, token rent-exemption, or temporary network congestion. Instrumentation, rate limiting, and graceful degradation (e.g., queueing transfers and providing UX feedback) are essential.

Tether, trade finance, and changing trust assumptions for USDT

Stablecoins are not just protocol rails; issuers are economic actors. Tether’s announcement that it is expanding into trade finance and aims to fund commodity trades signals a shift in issuer behavior and business model (Tether expansion into trade finance).

Why this matters for product and risk teams:

- Issuer risk expands beyond redemption mechanics: If USDT issuers participate more in trade finance, counterparty exposures and balance-sheet interdependencies become relevant when modeling redemption risk and operational liquidity.

- Settlement expectations change: Payment rails that assumed simple peg maintenance may now need to account for funds being used in longer-duration commercial transactions.

- Due diligence matters more: Integrators must monitor not only smart contract and network health, but also issuer transparency (reserves, counterparties) and regulatory posture.

Practically, this means custodial and non-custodial wallet providers should tighten their monitoring of on-chain flows, issuers’ public disclosures, and prepare contractual mechanisms to handle issuer-driven liquidity stress.

Engineering and product recommendations for teams integrating stablecoin rails

For fintech PMs and blockchain engineers, here are concrete patterns and decisions to consider:

Define UX SLAs and map them to chain choices: If 1–3 second user feedback is a requirement, Solana is a natural fit. If multi-day final settlement is acceptable and you prioritize maximum decentralization, BTC or anchored solutions may be better.

Use hybrid settlement: Keep customer-level UX on Solana for speed; periodically aggregate net positions and settle to more conservative anchors or custodial ledgers for long-term risk reduction.

Design robust reconciliation: Implement idempotent crediting, ledger replay protection, and automated reorg detection. Assume on-chain events are eventually consistent.

Abstract gas for users: Build fee-pay or meta-transaction layers so wallets can provide gasless UX while maintaining antifraud controls and rate limits.

Monitor issuer risk metrics: For USDT rails, track issuer disclosures and market signals; maintain contingency plans if Tether’s commercial activities affect redeemability.

Instrument for observability: Log mempool behavior, confirmation latencies, and chain health. Surface this data in ops dashboards tied to UX metrics (e.g., time-to-confirm, failed-tx-rate).

Consider custody tradeoffs: Custodial wallets simplify UX and reconciliation but concentrate counterparty risk. Non-custodial gives users control but complicates onboarding, recovery, and dispute resolution.

Bitlet.app and similar platforms that bridge fiat and crypto rails already implement many of these patterns: UX-first chains for customer flows, plus heavier settlement and reconciliation logic behind the scenes.

Conclusion — pragmatic rails for product viability

Routing stablecoin payments on Solana is a pragmatic choice for mainstream payment apps: it aligns chain-level properties with the product-level needs of instant feedback, low fees, and simple UX. But product and engineering teams must design for the tradeoffs — implement hybrid settlement, reconciliation, and issuer monitoring to manage security and liquidity risk. With issuers like Tether moving into trade finance, the lines between on-chain rails and off-chain commercial risk blur; teams that treat stablecoins purely as rails without modeling issuer behavior will be exposed.

For fintech teams building payment rails, the takeaway is straightforward: pick the chain that maps to your UX and risk profile, instrument aggressively, and treat stablecoins as both technical rails and economic actors when building resilient payment products.