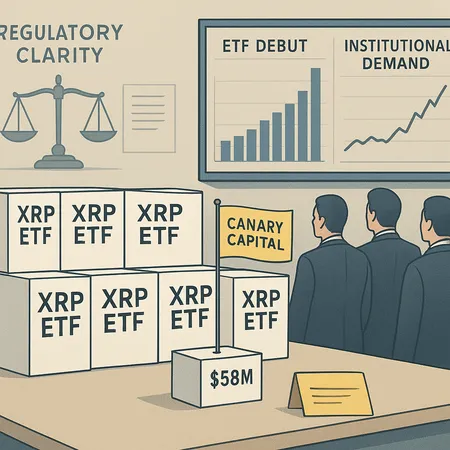

XRP Spot ETFs: Nine Launches, Canary Capital’s $58M Debut, and What Comes Next

Summary

Quick primer: what happened and why it matters

In the span of days, the market saw a cluster launch of nine spot XRP ETFs — a product wave that matters not just for trading flows, but for how XRP’s price discovery and institutional access will evolve. Issuers rushed to list as filings cleared and market windows opened; Coinpedia documented the coordinated timetable that put nine ETFs into the race within ten days. That compression changes incentives: early flows, index licensing, and AP capacity will determine winners and losers in short order.

Why nine ETFs are launching now

There are three practical reasons issuers piled into spot XRP products at once.

- Regulatory runway and product timing. Once a path to approval became viable for spot crypto products, issuers who had prepared filings accelerated listings to capture early demand and brand positioning.

- Race for market share and index exposure. Launching early lets issuers accumulate AUM and lock in AP relationships that underpin long‑term secondary market liquidity.

- Channeling institutional demand. Asset managers see potential to convert spot‑trading appetite into fee‑bearing AUM — a classic first‑mover opportunity in ETF markets.

These forces are the same ones that powered prior ETF waves for other tokens. The Coinpedia overview that flagged the nine‑ETF timetable frames this as a deliberate industry push rather than isolated launches.

Canary Capital’s $58M ETF debut — signal or noise?

Canary Capital’s XRP ETF posted a $58 million first‑day showing, which one coverage called the strongest U.S. exchange‑traded product debut of 2025. That number is meaningful: for institutional allocators watching ETF debut metrics, $58M on day one is large enough to confirm dealer support and AP engagement, but small relative to the multi‑billion dollar cohorts seen in mature ETF categories like equities or even earlier Bitcoin ETFs.

What to read into it:

- Affirmation of institutional demand: A multi‑tens‑of‑millions opening day suggests real allocation interest beyond retail curiosity. Institutional allocators often seed new ETFs through block trades and familiar PMs.

- Not yet a saturation point: $58M is substantial for a new crypto ETP but not systemic. It signals product viability rather than dominance.

See the coverage of Canary Capital’s debut for the initial numbers and market color.

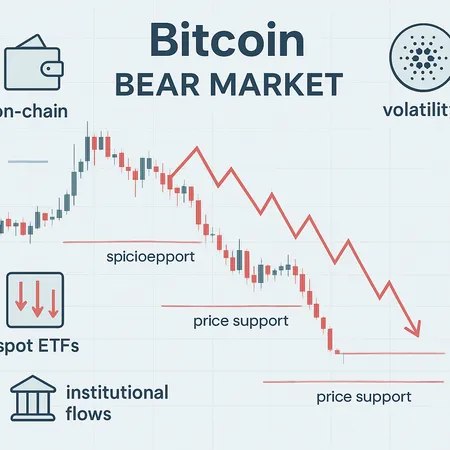

Early flow dynamics: hot starts then settling liquidity

Initial debut spikes are common; what matters is the follow‑through. Live updates documented that day‑two trading volume for one of the tickers slipped materially after the opening surge, illustrating a two‑phase pattern: an opening tranche of allocations followed by a settling period as APs and market‑makers calibrate spreads and creation tiers. Day‑two volume normalization is not a failure — it's a market finding its footing.

That cadence suggests the market is currently in a price‑discovery transition: some investors use ETFs to express directional exposure immediately, while liquidity providers work to knit ETF price to the underlying XRP order books. Watch for the pace at which creation/redemption activity transitions from bespoke block trades to more routine AP operations; that's the clearest sign of healthy secondary liquidity.

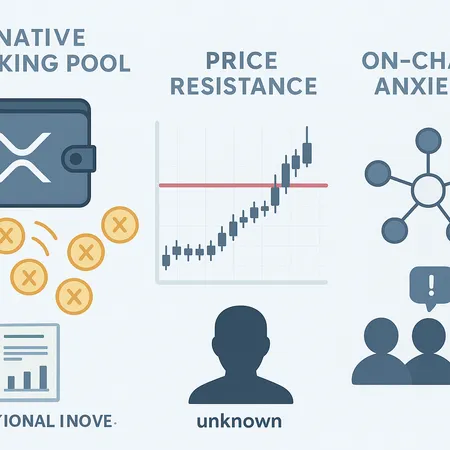

The utility debate: product demand vs. protocol fundamentals

Product launches do not erase fundamental questions. Some institutional research voices remain skeptical about XRP’s medium‑term utility, even as ETFs open distribution channels. For example, a VanEck research head publicly questioned XRP’s on‑chain value proposition, arguing that ETF demand can co‑exist with unresolved utility narratives.

This critique matters for allocators for two reasons:

- Duration risk: If institutional allocations are trading‑oriented (shorter duration) rather than conviction bets on protocol utility, flows can reverse quickly on macro or regulatory shifts.

- Valuation anchoring: ETFs can create a new demand floor by funneling capital into centralized custody, but long‑term price requires on‑chain usage, developer activity, and broader ecosystem adoption.

The Bitcoin‑era playbook showed that ETFs and utility narratives can diverge for long periods. Allocators should treat ETF entry as a market‑access event distinct from fundamental thesis validation.

Market structure implications: liquidity, arbitrage, and concentration

A rapid multi‑issuer rollout reshapes several structural levers:

- Arbitrage plumbing: Effective price alignment between ETF NAV and spot XRP depends on robust AP activity, low-cost custody, and tight spreads in both the ETF and XRP spot markets. Expect market‑makers to expand capacity quickly if spreads are tradable.

- Fragmentation vs. consolidation: Multiple ETFs fragment order flow across tickers, which can depress immediate liquidity in each product. Over time, winner‑take‑most dynamics (fee, distribution partnerships) tend to consolidate AUM into a few leaders.

- Authorized participant concentration: If a small set of APs dominates creations, liquidity risk rises. Institutional allocators should monitor the AP roster and whether redemptions can be executed without moving markets.

- On‑chain vs. off‑chain liquidity: ETF demand is settled through custodians and APs — not on‑chain activity. For true price formation resilience, underlying XRP exchange depth and OTC desks must absorb large flows.

These mechanics are why institutional allocators should watch both ETF tape and on‑chain/off‑exchange liquidity metrics simultaneously.

Practical checklist for allocators deciding whether to allocate

If you manage institutional capital and are weighing allocation to an XRP ETF, use this checklist before sizing positions:

- Confirm the AP list and custody partner names; prefer ETFs with multiple, reputable APs and insured custody.

- Monitor creation/redemption frequency and size for signal of natural liquidity.

- Track ETF premium/discount and intraday NAV deviations — persistent dislocations indicate market‑making stress.

- Compare XRP spot order‑book depth and OTC desk capacity to the ETF’s average daily volume.

- Review the issuer’s operational playbook for corporate actions, cold storage, and insurance terms.

- Account for regulatory continuity risk: continued clarity is needed to avoid binary outcomes.

Tools and dashboards that correlate ETF flows with on‑chain liquidity can accelerate decision‑making — platforms like Bitlet.app can be used to triangulate these signals in real time.

Likely next steps and scenarios for price formation

Short term (weeks): expect debut spikes, day‑to‑day volume normalization, and fee/marketing competition between issuers. Some ETFs will attract distribution from broker‑dealers and platforms; others will lag.

Medium term (months): consolidation around a handful of leaders is probable as institutions favor ETFs with reliable APs and low tracking error. If AP systems work smoothly, ETF NAV should increasingly anchor price discovery for large passive allocations.

Long term (12+ months): two divergent outcomes are plausible. If on‑chain usage and developer activity pick up, ETFs become one leg of a broader adoption story and contribute to sustained liquidity. If protocol utility remains contested and allocations are largely speculative, prices may become more sensitive to macro risk and ETF flows — a higher‑volatility regime.

Bottom line for allocators

Canary Capital’s $58M debut and the nine‑ETF launch window prove that institutional channels for XRP exposure exist and will be actively used. But product availability is not the same as protocol endorsement. Allocators should treat early inflows as a signal of access demand while rigorously monitoring creation/redemption mechanics, AP diversity, custody terms, and the unfolding fundamental debate raised by institutional research. In other words: the ETFs make it easier to trade XRP at scale — they don't, by themselves, resolve the long‑term utility question.

For managers building allocation frameworks, the practical approach is to start small, watch the operational metrics, and scale only as NAV alignment and liquidity profiles stabilize. Keep an eye on market updates and live volume tracking; early day‑one excitement will give way to the slow work of price formation.