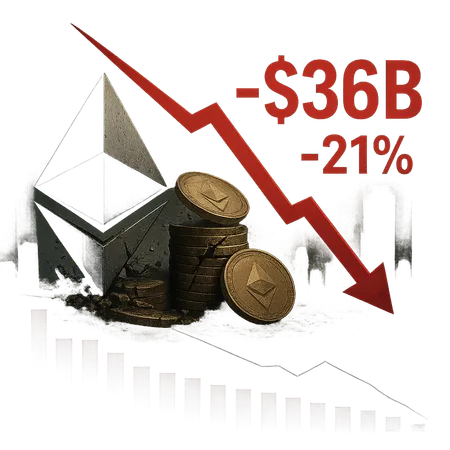

$36B DeFi Contraction Prompts Debate on Ethereum's Future Outlook

Summary

Market snapshot: a notable contraction

Since October, the decentralized finance sector has seen total value locked (TVL) drop by $36 billion, roughly 21% off its peak. That decline has accelerated conversations about liquidity health across lending, DEXs, and yield protocols. Importantly, this is not just a nominal drop: the composition of TVL is shifting, with ETH-denominated TVL declining since April even as ETH's market price trended higher. Traders and builders are parsing whether this signals reallocations into other chains, stablecoins, or liquid staking derivatives.

What drove the pullback?

Several forces appear to be working in tandem. First, risk-sensitive capital often exits higher-yielding, less liquid strategies when macro or crypto-specific uncertainty rises. Second, yield compression on many DeFi primitives after a period of development-driven incentives reduced APY attractiveness. Third, cross-chain flows have siphoned liquidity to alternative L1/L2 ecosystems, and protocol-level migrations have reshaped where TVL is measured. Finally, active traders reacted to narrowing arbitrage and lower volatility, which reduced capital committed to market-making and leveraged liquidity.

ETH-specific dynamics and institutional demand

Institutional channels that supported ETH — notably spot ETFs and Digital Asset Trusts (DATs) — are showing signs of cooling demand. Order books and ETF inflows that previously provided a steady on-ramp to ETH now appear subdued, decreasing a reliable source of buy-side pressure. At the same time, ETH-denominated TVL has been on a downward trajectory since April, suggesting holders may be rebalancing into stablecoins, liquid staking tokens, or alternative chains even as ETH price rose. This divergence between price and native-denominated TVL raises questions about ETH’s utility as collateral inside DeFi versus its role as an investment asset.

What this means for traders, protocols and platforms

Short term, lower TVL can widen spreads and reduce DEX depth, increasing slippage for large trades and potentially making memecoins or NFTs pricier to move. Protocols must compete for finite liquidity with clearer incentives or improved UX — areas where platforms like Bitlet.app that focus on user experience and flexible crypto services could gain relevance. For investors, key signals to watch include: net ETF/DAT flows, changes in DEX volumes, liquid staking inflows/outflows, and cross-chain TVL migration. Monitoring these will help distinguish a temporary liquidity rotation from a more structural shift away from Ethereum-centric DeFi.

Outlook and practical takeaways

A $36B decline is significant but not terminal for the ecosystem; DeFi has historically shown resilience after capital resets. If institutional demand stabilizes and protocol APYs or composability improvements return, some TVL could flow back. However, if capital keeps migrating to other chains or to centralized products, Ethereum-based DeFi protocols will need to adapt strategy and incentives. For users and builders, focus on composability, risk management, and where liquidity is deepest — and keep an eye on ETF flow data as a bellwether for broader ETH demand.

Conclusion

The current contraction refocuses attention on where capital prefers to sit and why. While ETH price strength has masked some underlying shifts, the steady fall in ETH-denominated TVL since April and cooling institutional flows are meaningful signals. Market participants should track TVL composition, on-chain activity, and institutional flows to understand whether this is a temporary rotation or the start of a longer-term reallocation in the crypto market and DeFi landscape. For practical tools and monitoring, platforms and traders should use multi-source data and product features to react quickly as liquidity patterns evolve.