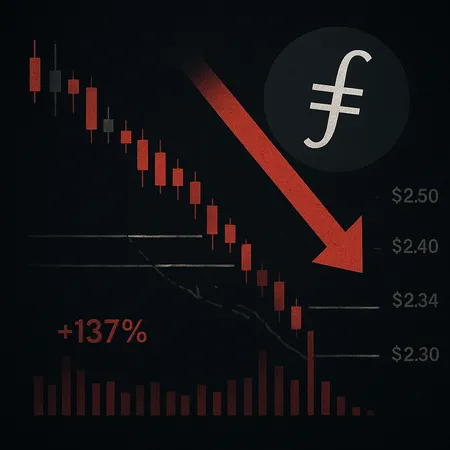

Filecoin Plunges 10% After Technical Breakdown; $2.30 Now in Sight

Summary

Quick overview

Filecoin (FIL) suffered a sharp sell-off over the past 24 hours, sliding roughly 10% to trade around $2.34 after losing the $2.50 and $2.40 support zones. The move was accompanied by a dramatic increase in activity — volume spiked 137% above its average — which strengthens the case that this is a genuine technical breakdown rather than a shallow flush. Across the broader crypto market, altcoins and memecoins showed weakness, amplifying downside pressure on FIL as traders rotated out of risk-on plays.

Market snapshot and context

The volume surge alongside price weakness is a classic confirmation signal: heavy selling met lower prices instead of absorbing the move. That behavior often signals continuation rather than an immediate rebound. On-chain metrics show increased distribution from short- to medium-term holders, and macro risk sentiment (tightening correlation with equities and Bitcoin) has nudged liquidity out of speculative buckets like storage tokens.

Filecoin remains tied to broader blockchain and infrastructure narratives, but short-term technical damage can outpace fundamentals. Traders watching the crypto market should also note sector flows: when DeFi and NFT rotations stall, infrastructure tokens like FIL often lose their bid.

Technical levels to watch

- Immediate resistance: $2.40 then $2.50 — these recently flipped to supply zones after the breakdown.

- Immediate support: $2.30 is the next logical bearish target; a clean break below that could open a move toward lower structural supports.

- Momentum reads: RSI has moved into weaker territory and moving averages are beginning to slope down, signaling the trend favors sellers until proven otherwise.

If price manages to reclaim $2.50 with volume, that would reduce the odds of extended downside. Until then, expect choppy lower-highs and tests of lower supports.

Trader playbook and risk management

For active traders: consider keeping position sizes conservative and use tight, predefined stops. Short bias is reasonable while price stays below $2.40–$2.50, but look for confirmation (volume-backed moves or reversal candlestick structure) before adding exposure. For longer-term investors, dollar-cost averaging into clear fundamental catalysts — not during panic-driven breakdowns — tends to reduce entry risk.

For users managing orders or exploring P2P liquidity, platforms like Bitlet.app can be useful for executing trades with flexible settlement options; however, protocol choice should never replace sound risk controls. Also monitor sector rotation: if DeFi or NFT activity revives, that could restore demand for infrastructure tokens.

Bottom line

Filecoin's abrupt drop and 137% volume surge make this a technical breakdown that merits respect. $2.30 is the near-term level to watch — a failure there would increase odds of deeper losses, while a reclaim of $2.50–$2.40 would be the first sign of stabilization. Keep an eye on volume and on-chain flows, and avoid conviction bets until a clear trend reversal appears. For continual coverage of infrastructure tokens and sector trends, watch related stories on DeFi and stay disciplined with risk.