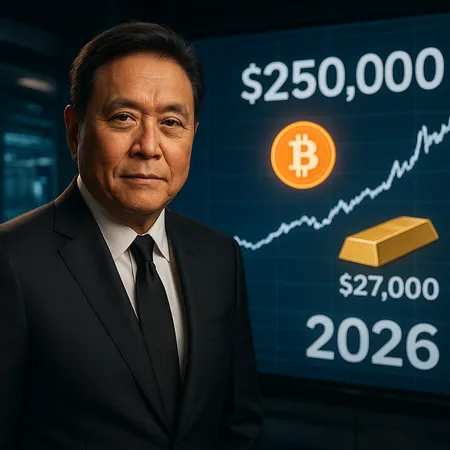

Robert Kiyosaki Predicts $250K Bitcoin and $27K Gold by 2026

Summary

Kiyosaki's bold forecast for Bitcoin and gold

Robert Kiyosaki, author of Rich Dad Poor Dad, has again grabbed headlines with a striking market prediction: Bitcoin (BTC) to reach $250,000 and gold to trade at $27,000 by 2026. His statement blends calls about monetary policy, inflation hedges, and increased adoption of digital assets. Whether you treat this as a bold outlier or a credible scenario, it refocuses attention on the drivers shaping the crypto market and traditional safe havens.

Key arguments behind the $250K Bitcoin target

Kiyosaki’s bullish thesis rests on several familiar pillars. First, continued institutional adoption and ETF inflows could materially increase demand for BTC. Second, monetary policy — namely prolonged loose liquidity or delayed rate normalization — may push investors toward scarce assets. Third, narratives around Bitcoin as a digital store of value are strengthening.

Market catalysts worth watching

- Bitcoin halving cycles and the supply shock they create. Historically, halvings have preceded strong multi-year rallies.

- ETF and institutional flows: large-scale buying from exchange-traded products can compress available market supply.

- On-chain adoption and infrastructure: greater custody solutions, DeFi integrations, and clearer compliance frameworks can lower barriers for big money.

Kiyosaki’s view sits alongside other bullish scenarios, but it’s important to contextualize: price moves of the magnitude he suggests would likely require sustained capital inflows, stronger retail and institutional adoption, and limited regulatory disruption.

Gold, inflation and the safe-haven argument

Kiyosaki also expects gold to climb to $27,000, a reflection of persistent inflation concerns and the metals’ role as a hedge. This stance positions gold and Bitcoin as complementary hedges in some portfolios: gold against currency debasement and Bitcoin for digital scarcity and growth exposure.

Risks, counterarguments and market implications

While the bullish case lists plausible catalysts, several risks could derail such an outcome: tighter monetary policy, stricter regulation, macro shocks, or a loss of retail interest driven by memecoins or speculative cycles. On the flip side, developments in the blockchain ecosystem, DeFi adoption, and ETF product launches could accelerate upside.

What investors should consider

Kiyosaki’s forecast is a reminder to balance conviction with risk management. Investors should: diversify across assets (including gold and crypto), set clear position-sizing rules, and stay informed on macro indicators. Platforms like Bitlet.app can help users track market movements and access installment or earn options for broader exposure.

In short, a $250K Bitcoin remains within the realm of possibility but is far from certain. Traders and long-term investors should treat bold predictions as scenarios — useful for planning but not substitutes for disciplined portfolio strategy.