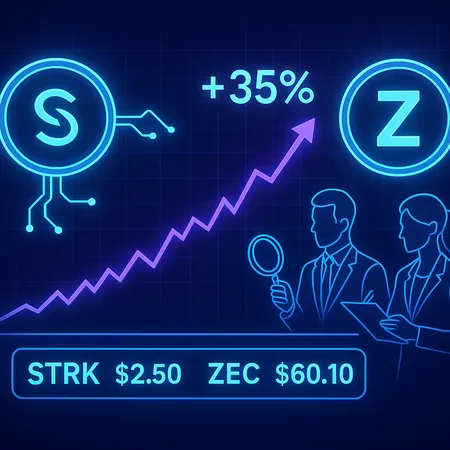

Why Zcash Comparisons Are Fueling STRK’s Latest Rally

Summary

Short-term surge and why analysts noticed Zcash

Starknet’s native token STRK jumped 35% on Monday, according to CoinGecko, igniting fresh analyst comparisons with Zcash (ZEC). The link isn’t about identical use cases — one is a layer‑2 scaling solution and the other a privacy-focused layer‑1 — but both are anchored in zero-knowledge proof technology, which has become a powerful narrative for investors betting on next-generation crypto infrastructure.

The spike has pushed market participants to reassess where capital flows next in the evolving zk landscape. As traders rotate into projects that promise scalability, privacy and lower fees, tokens like STRK find themselves in the spotlight, particularly as zk-rollups move from theoretical promise to real-world adoption.

Why the ZEC parallel matters for STRK’s story

Zcash’s earlier runups were driven by renewed interest in privacy features and the underlying zk-SNARKs research that first proved practical zk proofs at scale. Analysts drawing parallels point to three shared themes:

- Technology narrative: Both projects showcase zero-knowledge proofs — a concept now moving from niche research into mainstream adoption. That narrative attracts speculative and strategic capital alike.

- Ecosystem momentum: Renewed developer activity and integrations can turn technical advantages into token demand. For Starknet, growing dApp deployments and tooling increases utility for STRK.

- Market sentiment: When one zk-focused asset moves strongly, it can lift related tokens as funds search for the next beneficiary of the trend.

These are not guarantees of a sustained rally, but they explain why investors see a logical link between ZEC’s historical moves and STRK’s recent price action.

On-chain signals and market drivers to watch

Beyond headlines, on-chain indicators and macro drivers will determine whether STRK’s rally persists. Watch for: network activity growth, fee and gas dynamics, developer contributions, and token distribution changes that could impact supply pressure. Additionally, liquidity flows between centralized exchanges, DEXs and staking/lockup mechanisms will influence volatility.

The broader rotation into zk infrastructure is also tied to growth across the blockchain stack and renewed interest in scaling solutions that support DeFi and NFT platforms. If Starknet captures more real-world throughput and developer mindshare, STRK’s use-case narrative strengthens — but rising expectations can also amplify corrections.

Practical takeaways for traders and builders

For traders: the 35% intraday move signals momentum but also greater short-term risk. Consider monitoring order book depth, open interest in derivatives, and on-chain metrics rather than relying solely on headlines. For builders and long-term holders: increased attention to Starknet can translate into lasting ecosystem growth if developer activity and composability continue to improve.

Platforms that support flexible crypto access, including installment and P2P features, may see increased user interest as demand for zk assets grows — a trend services like Bitlet.app are positioned to observe and serve.

Conclusion

STRK’s surge reflects more than a single pump: it’s part of a broader rotation into zero-knowledge technologies where both scalability and privacy themes are converging. While parallels to Zcash help explain investor psychology, the sustainability of STRK’s run will depend on measurable on-chain adoption, liquidity dynamics and how quickly Starknet’s ecosystem matures. As always, investors should balance the upside of a compelling tech narrative with the reality of market volatility and do their own research before allocating capital.