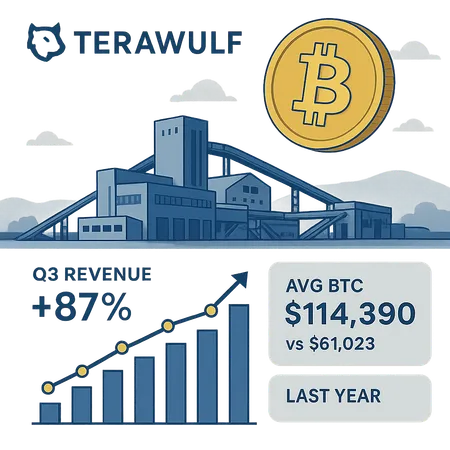

TeraWulf Q3 Revenue Climbs 87% as Bitcoin Nears Double-Year Gain

Summary

Strong Q3 for TeraWulf — revenue up 87%

TeraWulf reported a standout Q3, with revenue up 87% year‑over‑year, powered largely by a higher Bitcoin price and improved mining yields. Management noted the average price of Bitcoin during Q3 was $114,390, compared to $61,023 in the same quarter last year — a jump that effectively nearly doubled the price input into miner revenue calculations and materially lifted margins for publicly traded miners like TeraWulf (ticker: BTC exposure through mining operations).

Financial drivers: price, production and costs

The headline revenue increase reflects three linked factors: rising BTC realized prices, stable or growing hash-rate capacity, and controlled operating costs. TeraWulf’s output benefits when Bitcoin rallies because each mined coin converts to more revenue immediately or boosts USD-equivalent reserves. At the same time, electricity contracts, colocation efficiency and fleet uptime determine how much of that price move flows to the bottom line. The company’s ability to scale operations while managing energy intensity remains central to sustaining these gains.

Bitcoin price and miner profitability

There is a direct correlation between BTC price moves and mining revenue — higher BTC amplifies revenue per block, while prolonged rallies also attract capital and expansion. That said, hashrate competition and rising network difficulty can erode per‑unit production, so miners must optimize capex and OPEX to preserve net margins. For investors, the key question is whether current price levels are durable or a cyclical spike that may compress returns as hash rate responds.

Broader market context and implications

TeraWulf’s results arrive amid a broader, bullish crypto market where institutional flows, retail interest and macro narratives have pushed demand for digital assets. The rally also reverberates across sectors: traders rotate between spot BTC, memecoins, and speculative plays, while long-term participants consider allocations to on‑chain sectors like NFTs and DeFi. Miners are uniquely exposed to the price of BTC, so they act as a leveraged play on the crypto market’s direction.

What investors should watch next

Monitor three variables closely: ongoing BTC price momentum, network hash rate (which affects production), and energy/operational costs that determine margin sustainability. Regulatory developments around mining and power usage may also influence future returns. Tools and services such as Bitlet.app can help users track live market moves, manage exposure, and compare miner metrics when building a diversified crypto strategy.

Conclusion — opportunity with caveats

TeraWulf’s 87% revenue jump in Q3 highlights how miners can outperform during BTC upswings, but the gains come with cyclical risk. Investors should balance the upside from strong BTC prices with the structural realities of mining competition, energy economics, and broader crypto market volatility. For those tracking sector rotation between BTC, memecoins, NFTs and DeFi, miners remain a high‑beta play on the blockchain ecosystem’s health.