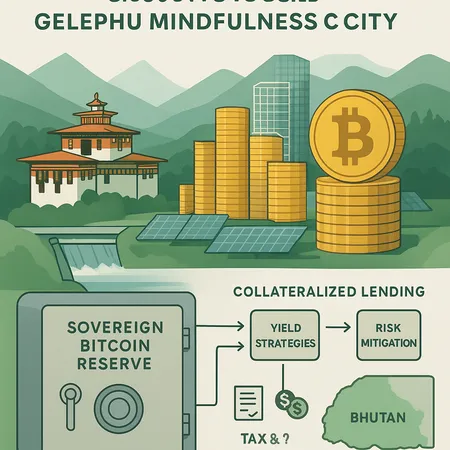

How Bhutan Plans to Use 10,000 BTC for Gelephu Mindfulness City — Mechanics, Risks, and Global Implications

Summary

What Bhutan announced and why it matters

In December 2025 Bhutan announced a pledge of up to 10,000 BTC to support the development of the Gelephu Mindfulness City — a sustainability- and mindfulness-focused economic hub. The core announcement and national framing were covered by major outlets, including Coindesk and News.Bitcoin.com, which describe the pledge as a national commitment intended to fund infrastructure and long-term development without immediately liquidating reserves (Coindesk, News.Bitcoin.com).

That combination — a large sovereign BTC position and an ambitious domestic project — is unusually bold. It raises immediate questions for policy analysts and macro investors: how can a government generate project funding from BTC without selling reserves, how are energy and sustainability goals folded into the plan, and what precedent does this set for other states considering a crypto-denominated reserve?

The financing model: extracting liquidity without selling BTC

Bhutan's stated aim is to avoid draining its strategic BTC holdings. Practically, that pushes the design toward collateralized financing, structured credit, and yield-generation strategies that unlock fiat or working capital while leaving a net BTC position intact.

Collateralized lending and repo-style facilities

The simplest, lowest-friction route is to pledge BTC as collateral in secured lending markets. Institutional counterparties (banks, crypto-lending desks, or regulated custodian-backed facilities) can extend loans in fiat or stablecoins against BTC collateral at negotiated loan-to-value (LTV) ratios. For example, at a 50% LTV a 10,000 BTC pool yields immediate liquidity equal to half the on-chain value while the nation retains ownership of the coins. Such structures resemble repos or margin-backed loans and have precedents in institutional crypto finance.

Benefits: immediate liquidity without sale, potential for multi-year terming, and familiar legal frameworks (secured lending). Drawbacks: counterparty and custody risk, margin calls during volatility, and the need for robust collateral governance.

Securitization and tokenized bonds

Another route is to securitize the income streams or future economic value of the Gelephu project into a tokenized instrument backed indirectly by BTC reserves. The sovereign could issue BTC-backed development bonds — essentially stablecoin or fiat-denominated debt where repayment originates from project revenues and the sovereign's BTC collateral. Tokenized bonds can attract global crypto-native capital and institutional investors seeking exposure to sovereign credit with crypto backing.

Yield strategies and revenue stacking

To augment financing and reduce borrowing costs, Bhutan could direct a portion of collateralized BTC into yield strategies: lending wrapped BTC to institutional borrowers, participating in over-the-counter liquidity pools, or partnering with regulated market-makers that provide structured yield. Because BTC lacks native staking, most yield must come from lending markets, derivatives market-making, or real-world-asset (RWA) structures that lend against tokenized project revenue.

Each yield strategy increases counterparty exposure and complexity, so the careful sovereign playbook will prioritize collateral prudence, short-duration counterparties, and clear legal recourse.

Preserving reserve positions through hedging and structural design

A central design objective is preserving net BTC exposure. Several tools can achieve that:

- Options collars and swaps: The sovereign can sell covered calls and buy protective puts (a collar) to monetize volatility while capping downside risk. Alternatively, total-return swaps can synthetically transfer economic exposure while keeping on-chain custody intact.

- Overcollateralized lending with buffers: Setting conservative LTVs and automatic deleverage rules reduces the risk of forced sales during drawdowns.

- Time-boxed tranches: Finance the project in tranches, releasing BTC collateral only as project milestones are met and only against new capital providers who assume risk incrementally.

Together, these measures let a government extract near-term purchasing power while maintaining long-term BTC holdings in expectation of appreciation.

Custody, governance, and legal considerations

Collateralized sovereign BTC operations require best-in-class custody arrangements and precise legal agreements. Questions that must be answered include: who holds the private keys during the term of the loan? Does the state retain beneficial ownership? How are margin calls handled under sovereign immunity? Without clean custodial and contract law frameworks, counterparties will demand steep haircuts or refuse exposure.

Transparency and independent auditability are also essential for market trust. Institutional lenders and international rating agencies will want robust, verifiable attestations of holdings and enforceable collateral remedies.

Energy, renewables, and the local development angle

Gelephu's stated focus on mindfulness and sustainability means energy strategy will be central. Coverage from Blockonomi and Invezz highlights Bhutan's stated emphasis on renewables and innovation in implementation (Blockonomi, Invezz).

Practical integrations include using BTC-backed financing to accelerate local hydroelectric capacity, microgrids, or green data centers. That accomplishes two goals simultaneously: powering local economic growth and creating infrastructure that could, in theory, host energy-intensive digital operations with a positive sustainability narrative.

However, skeptics will press on the footprint of any crypto-associated activity. The government will need to show that BTC-backed financing supports renewables and local jobs rather than incentivizing carbon-intensive mining outside of national standards. Framing the project around sustainability—rather than raw mining—helps manage public opinion and international scrutiny.

Tax, regulatory, and currency-risk considerations

Navigating tax and regulatory regimes is one of the trickiest operational challenges.

- Tax treatment of yields: If BTC collateral earns yield (via lending or derivatives), those returns may be taxable under domestic law. The sovereign will need to determine whether revenue is recognized in BTC or a fiat equivalent and how that interacts with corporate and VAT regimes.

- Regulatory compliance: AML/KYC, FATF guidance, and cross-border payment rules affect counterparties and capital inflows. Sovereign operations cannot be opaque; banks and custodians must satisfy regulators when taking BTC as collateral.

- Currency and balance-sheet risk: Borrowing fiat against BTC introduces FX risk. If repayments are in local currency, depreciation could magnify debt burdens; if in USD, the sovereign must secure hard-currency inflows. Managing this requires hedging policies, possibly using FX forwards or currency swaps — which themselves add complexity and counterparty risk.

From a macro perspective, reserve accounting and IMF engagement will matter. How do reserve managers report BTC-backed liabilities? Will rating agencies view the pledged BTC as encumbered? These questions influence future sovereign access to traditional credit markets.

Geopolitical and market implications for sovereign BTC holdings

Bhutan's pledge is more than a domestic financing innovation; it signals a new class of sovereign balance-sheet engineering. Possible implications:

- A template for monetizing crypto reserves: Other small or mid-sized states with BTC exposures could replicate the model: use collateralized lending and structured instruments to fund strategic projects without immediate sales.

- Pressure on global liquidity and custody markets: Demand for institutional custody, repo desks, and structured credit that can accept sovereign-grade BTC collateral will grow. That creates opportunities for custodians, clearing houses, and regulated lending desks.

- Sovereign competition and signaling: Holding BTC can be both economic and political signaling — a hedge against fiat volatility and a bet on crypto-native capital inflows. As more countries experiment, markets will watch for correlation between sovereign activity and BTC volatility.

But there are downsides. Encumbering large BTC reserves can weaken a nation's perceived unencumbered reserve cushion, possibly affecting sovereign credit metrics. Worse-case scenarios — rapid price declines forcing margin calls, or counterparty disputes over collateral enforcement — could create systemic stress for the nation and its lenders.

What this precedent means for other nation-states

Policy analysts should treat Bhutan's move as a prototype rather than a playbook. Its success depends on careful legal scaffolding, conservative LTVs, diversified counterparties, and transparent governance. A few considerations for other states:

- Scale matters: smaller economies can benefit more from creative monetization without destabilizing markets, while larger economies could cause market dislocations.

- Legal clarity is essential: enforceable custody and bankruptcy rules that respect sovereign prerogatives will determine counterparties' willingness to lend.

- Energy and social policy must align: projects must credibly deliver local public goods to avoid political backlash.

For crypto macro investors, Bhutan's approach offers new collateral sources and potential credit instruments to underwrite, but it also raises counterparty and political risks that must be priced into any exposure.

Practical checklist for policymakers considering BTC-backed development financing

- Establish institutional custody with independent attestations and legal clarity over rights in stress scenarios.

- Use conservative LTVs and tranche financing tied to project milestones.

- Build hedging programs (options, collars, FX swaps) to protect net reserve exposures.

- Prioritize renewable energy and transparent procurement to align growth and sustainability goals.

- Engage international institutions early to clarify reserve accounting, tax treatment, and rating implications.

Conclusion — a cautious, innovative step with outsized implications

Bhutan's 10,000 BTC pledge for the Gelephu Mindfulness City is a consequential experiment in sovereign crypto finance. If structured with conservative collateral terms, strong custody, and clear governance, it offers a path for countries to mobilize crypto capital for real-world development without wiping out strategic reserve exposure. Yet the model materially raises legal, regulatory, and macro-financial questions about encumbrance, counterparty risk, and accounting treatment.

Observers should watch the implementation details: LTVs, counterparties, hedging programs, and the transparency of contracts. That is where the difference between a repeatable, responsible template and a cautionary tale will be written.

For market participants interested in sovereign crypto operations or decentralized yields, platforms across the ecosystem — and services such as Bitlet.app that intersect with installments and on-ramping — will likely see increased demand for custody, compliance, and treasury tooling.

Sources

- Coindesk: Bhutan commits up to 10,000 Bitcoin to back new mindfulness-based economic hub — https://www.coindesk.com/policy/2025/12/17/bhutan-commits-up-to-10-000-bitcoin-to-back-new-mindfulness-based-economic-hub

- News.Bitcoin.com: Bhutan launches 10,000 BTC development pledge for Gelephu Mindfulness City — https://news.bitcoin.com/bhutan-launches-10000-btc-bitcoin-development-pledge-for-gelephu-mindfulness-city/

- Blockonomi: Bhutan pledges up to 10,000 Bitcoin for Gelephu development — https://blockonomi.com/bhutan-pledges-up-to-10000-bitcoin-for-gelephu-mindfulness-city-development/

- Invezz: Bhutan pledges 10,000 Bitcoin to develop Gelephu Mindfulness City — https://invezz.com/news/2025/12/17/bhutan-pledges-10000-bitcoin-to-develop-gelephu-mindfulness-city/?utm_source=snapi

For background reading on how institutional BTC collateral markets work, see resources on institutional custody and repo markets, and for market context refer to broader reporting on Bitcoin and emerging DeFi credit primitives.