XRP ETFs: Utility vs. Speculation — Can ETFs Outspeed On‑Chain Reality?

Summary

The renewed utility vs. speculation debate

The arrival of XRP exchange‑traded funds has compressed a complex conversation into a single headline: did the market just re‑price XRP because of real ledger use, or because ETFs and institutional flows change the mechanics of demand? That dichotomy — utility versus market‑structure — matters because it changes how investors should size positions, set time horizons, and measure success.

On one hand, some institutional voices remain skeptical of XRP’s real‑world payments role. On the other, on‑chain indicators like daily active addresses (DAAs) and transaction counts are surging, and ETFs recorded a noteworthy first‑day intake. Both sides have data; the job for analysts is to reconcile competing signals and to decide which set of evidence should matter more for different investment horizons.

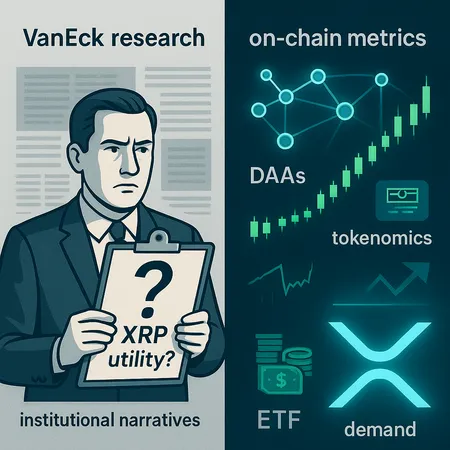

VanEck’s critique: substance and implications

VanEck’s head of research publicly raised hard questions about XRP’s utility, framing a skeptical institutional narrative that sometimes undercuts retail enthusiasm. That critique isn’t merely rhetorical: institutional allocators care about use case clarity, regulatory durability, and whether a ledger’s activity translates into durable cash flows or real economic value. Read the original piece that captured the quote and context here: VanEck executive questioning XRP’s utility.

The core of VanEck’s position is twofold. First, token utility must be demonstrable — the protocol should enable distinct, recurring economic activity that depends on the token. Second, that activity has to be resistant to narrative swings: payments, settlement, or commercial integration should show persistence beyond speculative runs. VanEck’s skepticism forces a stricter lens: high‑level metrics like ‘volume’ or headline partnerships are insufficient without durable, token‑specific demand.

The on‑chain counterpoint: DAAs and transaction growth

If the skeptics are looking for demonstrable use, the on‑chain data makes a case. Recent coverage highlights a surge in daily active addresses and increased ledger throughput on the XRP Ledger — classic on‑chain metrics that analysts track when judging adoption. See reporting on the uptick in network activity here: activity on the XRP Ledger soars.

DAAs are a blunt instrument but a useful barometer: rising DAAs typically mean more unique entities are interacting with the ledger, which can stem from real use (payments, remittances, on‑chain services) or speculative behaviors (wallet churn, trading bots). Transaction count and average transaction value add nuance — are we seeing many tiny value transfers or fewer, larger settlement transactions? Tokenomics matters here: because XRP has a fixed supply and low on‑chain fees, network activity doesn’t always translate into token velocity in a way that benefits holders the same way as fee‑capture tokens.

ETF demand: market structure changes the game

Market structure can amplify or mute fundamental signals. The recent U.S. ETF debuts for XRP recorded strong initial demand, with one report noting roughly $58 million traded in the first day — a concrete sign that institutional channels are willing to allocate. See coverage of the ETF’s U.S. debut here: XRP ETF records strongest U.S. debut of 2025.

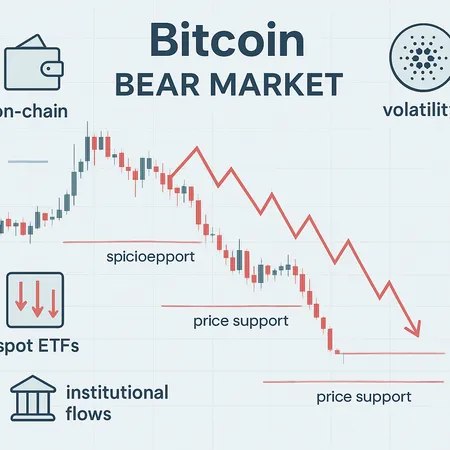

Why does ETF presence matter? ETFs change how demand reaches the asset: instead of buying spot through exchanges, institutional flows may be routed into managed instruments, which create persistent, predictable demand patterns (cash inflows, market‑making across APs, secondary market liquidity). That structural demand can lift prices irrespective of short‑term ledger activity.

For many traders, Bitcoin remains the market bellwether; but institutional products in altcoins can create their own momentum dynamics. The risk: if ETF inflows are the dominant buyer, price becomes more sensitive to macro and allocation flows and less to incremental improvements in on‑chain utility.

Can ETFs decouple price from utility? Mechanisms and precedents

Yes — but not always forever. Demand via ETFs can separate price action from on‑chain fundamentals in several ways:

- Swap and creation mechanics: ETF issuers can create shares by pooling spot XRP, tightening or loosening supply on exchanges.

- Flow persistence: steady inflows support valuation until flows stop or reverse.

- Indexing and passive allocation: ETFs standardize exposure, attracting less due diligence and more momentum capital.

Historical precedents in crypto show both outcomes. Products can prop up prices long after network activity cools, but when flows reverse or regulatory headlines hit, the reversion to fundamental valuations can be abrupt. Critics warn of this exact path: if price runs far ahead of sustainable use, the narrative risks becoming detached or even ridiculous. For that critique, see the cautionary tone here: XRP could become a joke.

A practical framework to evaluate rallies

When faced with a rally that mixes on‑chain growth and ETF flows, use a layered framework. Below are actionable lenses analysts can apply.

Tokenomics first: who benefits from activity?

Tokenomics asks whether ledger use translates into value capture for holders. Key questions: Is XRP required for settlement in a way that creates recurring demand? Do protocol fees or burns provide a mechanism for scarcity? On XRP, low fees and a fixed supply mean ledger traffic doesn’t automatically funnel revenue to holders the way native fee models do on some other chains. That doesn’t negate utility, but it limits the strength of the causal link between activity and token price.

On‑chain metrics: signal vs. noise

DAAs, transaction counts, and median fees are useful but noisy. Combine metrics:

- Trend and persistence: is DAA growth sustained over weeks/months or a short lived spike?

- Composition: are addresses custodial exchanges or unique retail wallets? Are transactions internal token movements or real economic transfers?

- Value per transaction: rising transaction counts with falling median value can indicate speculative wallet churn rather than meaningful settlement.

Pair these metrics with external validation: partner integrations, real payments settled on‑ledger, and counterparty adoption.

Market structure and flow analytics

ETF inflows, AP behavior, and custodial flows matter. Track:

- Net creation/redemption volumes for the ETF (when public).

- Exchange reserve changes: are spot exchange holdings falling as ETF APs pull inventory?

- Flow correlations with macro risk assets.

If price appreciation is tightly correlated with ETF inflows and exchange reserves decline, the move is more structure‑driven. Conversely, if exchange balances remain stable while DAAs and real economic activity rise, the case for utility strengthens.

Narrative, regulation, and path dependency

Institutional narratives (payments rails, cross‑border settlement, or fintech partnerships) can attract capital quickly. But narratives are fragile: adverse commentary from influential institutions or regulators can shift flows. VanEck’s public questioning is an example of a narrative counterweight — it can slow institutional adoption or force deeper scrutiny.

Regulatory clarity also changes the risk premium. ETFs reduce custody and compliance friction for some allocators, but they don’t immunize the underlying token from regulatory or legal shocks.

What this means for long‑term investors

Long‑term investors should bifurcate positions and expectations. A two‑bucket approach helps:

- Core (fundamental) bucket: sized for conviction that ledger use will grow into token‑dependent economic activity. These investors demand sustained on‑chain signals, partner integrations, and tokenomics that align incentives.

- Accretion (market‑structure) bucket: tactical exposure to ETF‑driven flows and momentum, sized smaller and managed actively — stop losses, profit‑taking rules, and monitoring of ETF creation/redemption and exchange balances.

Platforms and execution matter: dollar‑cost averaging into a long‑term core position via regulated products can reduce timing risk. For traders who want regulated exposure, services like Bitlet.app (used here only as an example of a platform that aggregates crypto financial products) can help manage execution, but the investment framework should still be driven by the analysis above.

Tradeable signals and monitoring checklist

If you’re actively assessing whether the rally is utility‑driven or structure‑driven, monitor weekly:

- DAAs and active wallet growth (trend and composition)

- Exchange reserve changes and ETF creation patterns

- Real‑world integrations and counterparty settlement use cases

- Narrative shifts from institutional research and regulatory headlines

A convergence of rising DAAs, increasing value per transaction, steady partner use, and positive tokenomics would indicate a utility‑led move. Conversely, strong ETF inflows with stagnant or noisy on‑chain signals point to a structure‑driven rally.

Conclusion: nuance over binaries

The arrival of XRP ETFs complicates the old utility vs. speculation debate. VanEck’s critique is a healthy reminder that narratives need substantiation; rising DAAs and ETF demand both provide measurable signals, but they speak to different mechanisms. For analysts and seasoned retail investors, the right response is not shouting down one side; it’s building a disciplined framework that separates tokenomics and on‑chain fundamentals from market‑structure flows — then sizing positions and risk accordingly.

XRP’s path will depend on the interplay of these forces. Short‑term price action may be governed by ETF mechanics and allocation decisions. Long‑term value, however, will track whether ledger activity matures into token‑dependent economic utility that withstands the next cycle of flows and headlines.