Bank of England

A House of Lords inquiry has opened into stablecoins amid regulator warnings they could drain bank deposits and reshape payments. The Bank of England is simultaneously finalizing rules to treat large stablecoin issuers as systemically important.

Cross-party MPs and peers have urged Chancellor Rachel Reeves to rein in the Bank of England’s proposed regime for systemic stablecoins, warning the plans risk pushing crypto innovation and investment out of the UK. They argue the measures could be disproportionate and harm the domestic fintech ecosystem.

Bank of England Deputy Governor Sarah Breeden warned that easing the UK’s proposed stablecoin regulations could hurt financial stability, citing the Silicon Valley Bank collapse and Circle’s USDC briefly losing its dollar peg as cautionary examples. Her remarks highlight regulatory risk for the broader crypto market and DeFi ecosystem.

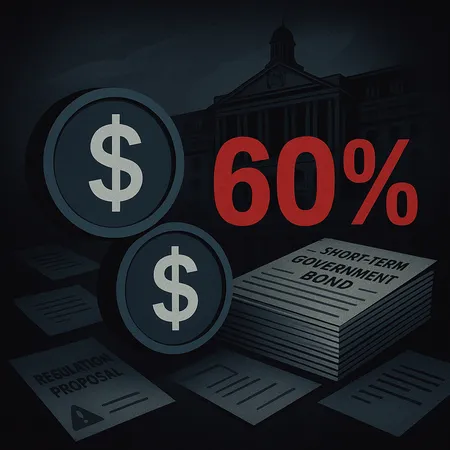

The Bank of England has proposed that issuers of major stablecoins may hold up to 60% of reserves in short-term government bonds, a move that tightens rules but raises concerns about liquidity, yield pressure, and market concentration. Industry participants should prepare for higher compliance costs and possible ripple effects across DeFi and exchanges.

Coinbase and the UK crypto industry oppose Bank of England's proposed stablecoin caps, arguing they are stricter than US and EU regulations. The Bank of England aims to protect traditional banks but sees these caps as possibly transitional. This situation highlights the UK's challenge in balancing crypto innovation with financial stability.