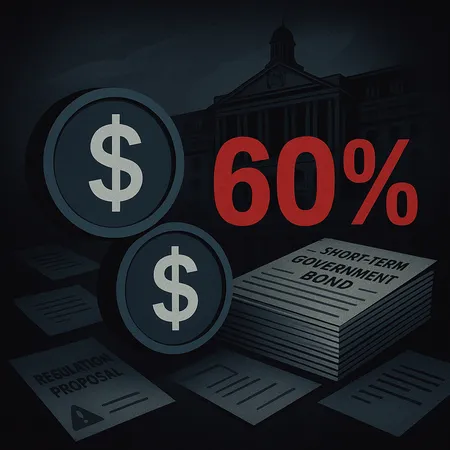

Bank of England Proposes 60% Government Bond Cap for Major Stablecoins — What It Means for Crypto Markets

New BoE proposal: government bonds take center stage for stablecoin reserves

On Monday the Bank of England proposed new rules for major stablecoin issuers that would allow them to invest up to 60% of the assets backing their tokens in short-term government bonds. The measure is framed as a move to strengthen the safety and transparency of stablecoins, but it also reshapes how issuers manage liquidity, yield, and counterparty risk.

This proposal arrives amid broader global regulatory scrutiny of digital assets and comes with trade-offs that could influence the wider crypto ecosystem, from centralized exchanges to stablecoins used across DeFi flows.

Why the BoE is pushing this change

The BoE’s stated aim is to reduce the overall risk profile of major stablecoins by steering reserves toward highly liquid, sovereign-backed instruments. Short-term government bonds are seen as low credit-risk assets that can shore up confidence in a peg during periods of market stress. In that light, the rule is intended to:

- Improve transparency and public trust in backing assets.

- Reduce exposure to volatile commercial paper, corporate deposits, or complex repo positions.

- Align crypto reserve practices more closely with traditional financial stability norms.

However, the choice to cap non-government assets at 40% (implicit after the 60% government allocation) creates consequential shifts for issuers and markets.

Market implications and potential downsides

Liquidity and redemption risk

Holding a larger share of reserves in government bonds increases safety on paper but may reduce instantaneous liquidity in stress scenarios. Short-term sovereign debt is generally liquid in normal conditions, but under extreme market distress or if multiple large stablecoin issuers sell simultaneously, liquidity can evaporate and prices can gap.

Yield and issuer economics

Government bills typically yield less than corporate or repo alternatives. That means issuers could see lower returns on reserves, squeezing margins or forcing higher fees for users. Smaller issuers with tight capital may struggle to adapt, potentially accelerating consolidation in the stablecoin sector.

Concentration and market crowding

If major issuers all move assets into short-term government bonds, demand could push yields down further and amplify concentration risk in sovereign debt markets. This creates a form of systemic coupling between the crypto sector and government funding markets.

Impact on DeFi and market plumbing

A shift in reserve composition could ripple into DeFi where stablecoins are heavily used as collateral and medium of exchange. Lower yield on reserves might reduce incentive for issuers to provide liquidity incentives or rewards, affecting yields across lending markets and AMMs. Moreover, compliance-driven fragmentation could create jurisdictional stablecoins with differing reserve rules — complicating liquidity routing for protocols and traders.

Regulatory and operational costs

The BoE proposal will likely increase compliance burdens: auditors, proof-of-reserve frameworks, and tighter custody standards. Smaller issuers could face higher operational costs, further entrenching large players. It also raises questions around central bank coordination — will the EU, US, or other major regulators mirror this stance, or diverge? Cross-border harmonization remains uncertain and could produce arbitrage opportunities.

Possible benefits despite the downside

Not all effects are negative. The framework could enhance public confidence, reduce instances of opaque or risky backing, and make major stablecoins more acceptable for institutional counterparties and payment infrastructures. Greater clarity may also attract banks and regulated entities to integrate stablecoins into payments rails — a long-term positive for mainstream adoption.

What issuers, investors, and platforms should watch

- Issuers: model reserve yield scenarios under the 60% limit and assess funding, fee, and product adjustments.

- Investors/users: monitor liquidity plans and redemption processes; prefer issuers with clear proof-of-reserves and robust contingency plans.

- Platforms/Exchanges: prepare for compliance complexities and potential liquidity fragmentation when listing different jurisdictional stablecoins.

Platforms that offer trading, custody, or yield products — including services like Bitlet.app — will need to adapt onboarding and risk assessments to this evolving landscape.

Takeaways and next steps

The BoE’s proposal to allow up to 60% of stablecoin reserves in short-term government bonds is a significant regulatory nudge toward safety and transparency. But it is not a panacea: the measure introduces liquidity, yield, and concentration trade-offs that could reshape issuer economics and the broader crypto market.

Watch for consultation responses from industry groups, possible alignment (or divergence) from other regulators, and issuer announcements on reserve rebalancing. For users and DeFi participants, the key questions will be: who can maintain liquidity under stress, and which tokens remain most usable across trading and lending ecosystems.

As regulators tighten the rules, the stablecoin market will continue to evolve — and market participants should be proactive in assessing both the near-term frictions and the long-term stability gains.